THE CHALLENGE

THE CHALLENGE

You’re leading the U.S. operations of an Irish company where you’ve worked for 15 years when a headhunter comes calling about your dream job: the CEO role at a large, public company in your industry. The hitch? The company in question is just emerging from Chapter 11 and hampered with virtually no credit, low-margin contracts and only a three-month grace period on its considerable debt. Plus, you’ll be agreeing to swap a big chunk of guaranteed comp for incentive- and equity-based pay.

THE BACKDROP

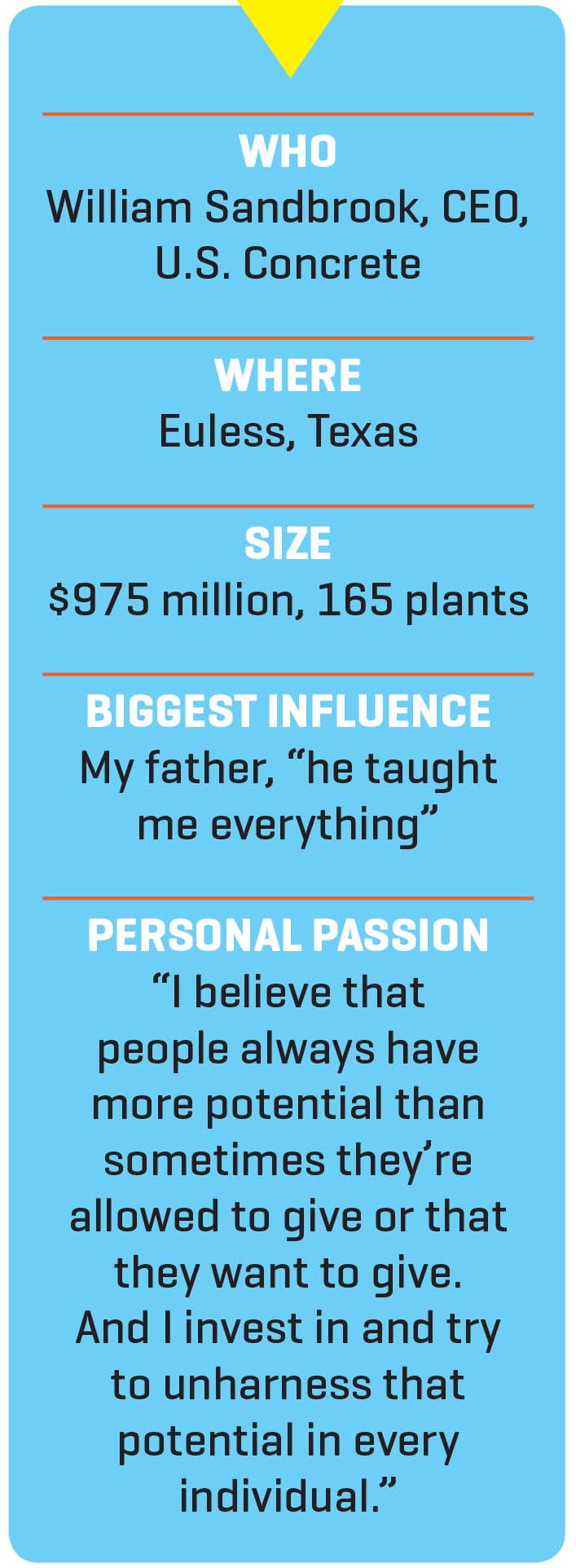

Bill Sandbrook opted to grab the opportunity to lead Euless, Texas- based U.S. Concrete, jettisoning a role leading a stable $7 billion materials company, Oldcastle’s Americas Products & Distribution. “Foreign companies are generally run by someone of local national descent and I was ready to be a public company CEO,” explains the 59-year-old, who spent 13 years in the U.S. Army before entering the private sector. “The timing was right for me from a career standpoint—and there aren’t many U.S.-domiciled public companies, even bankrupt ones, in the [building materials] industry.”

It turned out to be a bigger gamble than Sandbrook knew. Like many materials companies, U.S. Concrete had been snapping up small, local concrete companies in an effort to gain both operating efficiencies and local-market pricing power. Then the recession hit and the building business flatlined, prompting financial trouble. By 2011, recovery was gleaming on the horizon—a factor in Sandbrook’s decision to take the job. Soon, however, he discovered that a rebound in the construction market alone wouldn’t solve the company’s issues. “It had grown to the point where the dots on the map added up to an $800 million company, but they were too scattered,” he explains. “There’s no competitive advantage in a regional market [in this business] unless you’re in the No. 1 position.”

THE SOLUTION

Soon after taking the helm, Sandbrook embarked on a more strategic strategy—buying up only those local companies that would bring the company pricing power and benefits of scale. Since the end of 2014 alone, U.S. Concrete has bought 23 local materials companies, 12 in the New York City area. “The premise is that we want to be a No. 1 supplier in very densely populated markets with barriers to entry and difficult operating conditions,” he says. In short, the company would thrive by becoming the go-to materials company in the hardest possible places to build— urban markets plagued by traffic congestion and street navigation challenges—and on the most sophisticated building projects—high rises, bridges and tunnels.

Soon after taking the helm, Sandbrook embarked on a more strategic strategy—buying up only those local companies that would bring the company pricing power and benefits of scale. Since the end of 2014 alone, U.S. Concrete has bought 23 local materials companies, 12 in the New York City area. “The premise is that we want to be a No. 1 supplier in very densely populated markets with barriers to entry and difficult operating conditions,” he says. In short, the company would thrive by becoming the go-to materials company in the hardest possible places to build— urban markets plagued by traffic congestion and street navigation challenges—and on the most sophisticated building projects—high rises, bridges and tunnels.

Customers in markets like New York City, where a building delay can be devastating, are willing to pay a premium for a reliable supplier, says Sandbrook, who is currently supplying concrete for the LaGuardia airport rebuild project and the Second Avenue subway, among others. “We have more than 200 trucks there, so while we have competitors in every borough, no single one can cover the entire buildout of the New York City metro market. The risks for a contractor to go solely on low price or solely with some small mom-and-pop supplier are significant.”

THE HURDLE

In addition to the need for a strategy overhaul, Sandbrook discovered early on that the centralized culture of previous management had squelched employee morale. “Everyone was afraid to even sneeze without asking Houston if they could spend $5,000 to fix a truck,” he recalls. “On my first listening tour, half of our equipment was broken. They were fighting with two arms behind their backs.” To address the issue, he moved the corporate headquarters from Houston to Euless and embarked on a vigorous campaign to instill more employee initiative.

In addition to the need for a strategy overhaul, Sandbrook discovered early on that the centralized culture of previous management had squelched employee morale. “Everyone was afraid to even sneeze without asking Houston if they could spend $5,000 to fix a truck,” he recalls. “On my first listening tour, half of our equipment was broken. They were fighting with two arms behind their backs.” To address the issue, he moved the corporate headquarters from Houston to Euless and embarked on a vigorous campaign to instill more employee initiative.

THE RESOLUTION

Shedding unprofitable business lines, exiting markets that didn’t fit the new strategy and strengthening the concrete company’s foundation in key geographic areas, as well as empowering employees, all paid off handsomely. Revenues, margins and cash flows have all been on the upswing, as has share performance. During Sandbrook’s tenure, U.S. Concrete’s stock price soared from less than $2 in 2011 to $49.50 (at press time).

THE OUTLOOK

Rather than set a revenue-growth target, Sandbrook is now guarding against a hiccup in the building market’s recovery. “This recovery has gone on so long that I have to be prepared for slower or even a downturn in growth—to make sure that we’re not overextended in our debt profile and that I can take costs out if necessary,” he explains. “I’m setting it up as more defensive than offensive right now, because this is a cyclical business so at some point—whether it be two years, three years or five years or next year—I need to prepare this company for that [change].”

THE LESSON

Convincing employees to tackle issues themselves takes time and communication—lots of communication. “Even experienced managers were somewhat hesitant to take responsibility so I had to teach them how to have initiative to go out and be proactive and take care of things,” reports Sandbrook, who invested time in coaching and communicating the empowerment message. “I had to say, ‘Listen, you guys have been around a long time and you know to operate. Within reason, I don’t want you to ask anybody, just go get your equipment fixed.’” Eventually the message took. “Now I’m there to help and coach and teach and motivate and hold them to high standards, but it’s very decentralized,” he reports. “I demand a huge amount of responsibility from everybody.”

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.