CEO Optimism Falls Back To Pre-Vaccine Levels

CEO optimism in an improving business landscape continues to fade in June on concerns over soaring materials and labor costs, supply-chain snarls, inflationary pressures and increasing taxes and regulations, which they say they expect will stall the economic recovery—and growth in their businesses.

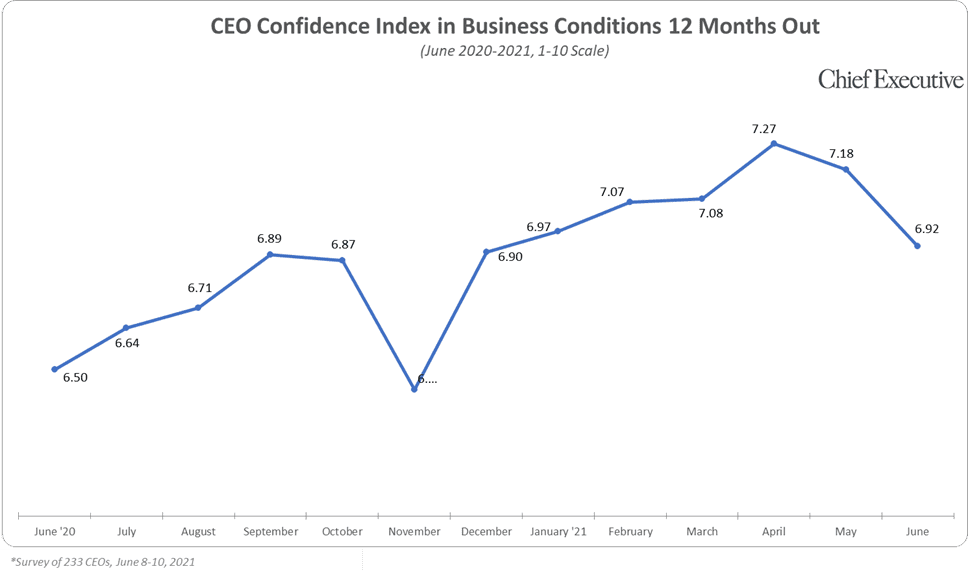

Those are the key findings from Chief Executive’s latest poll of 233 U.S. CEOs, fielded from June 8-10. After 5 months of expansion, our leading indicator of CEO confidence declined for the second month in a row in June, to 6.9 out of 10, on our 10-point scale. It is now down more than 5 percent from its April peak of 7.3 and back to December levels, before vaccination efforts began.

This rating is in-line with CEOs’ rating of current conditions (6.9/10), indicating that America’s business chiefs no longer expect conditions to improve over the coming months.

“It is clear that we will be dealing with Covid-19 for a while yet,” says Karim Chichakly, co-president of NH-based software company isee systems. While he expects the reopening of business and lifting of Covid restrictions to support growth, “If we cannot manage it, inflation may exert some strong downward pressures,” he says.

“Demand in residential new construction and repair and remodeling remains strong. However, it is being held back by the rapid increases in prices for materials coupled with shortages of product,” says Bob Merrill, CEO of Interbuild Distribution, a global manufacturer of countertops and panels. “Imports have also slowed significantly due to container shortages and slowdowns at the ports,” he says.

For Jeff Chandler, CEO and president of Hopdoddy Burger Bar, an Austin-TX-based burger joint chain with more than 20 locations across the country, “inflation, labor shortage, commodity and supply chain disruption, [and] lack of confidence in our government” justify his forecast for worsening conditions (from 7/10 to 5/10) over the coming months and why he projects his company’s revenues to be down by this time next year.

Pete Barile, president and CEO of Tennessee-based furniture manufacturer Daniel Paul Chairs, says the “uncertainty of material costs, availability and lack of labor over the next 12 months” are what’s driving his forecast for the months ahead.

Siemens chairman and former CEO Joe Kaeser agrees that inflation is a concern, to which he adds “lacking execution of the stimulus packages” as another reason why he expects muted growth this year, rating his outlook for the economy 12 months out a 6 out of 10.

Overall, only 36 percent of CEOs participating in our June poll expect conditions to improve in the next year—down from 42 percent the month prior and from 63 percent at the beginning of the year, when Covid-recovery hopes were highest.

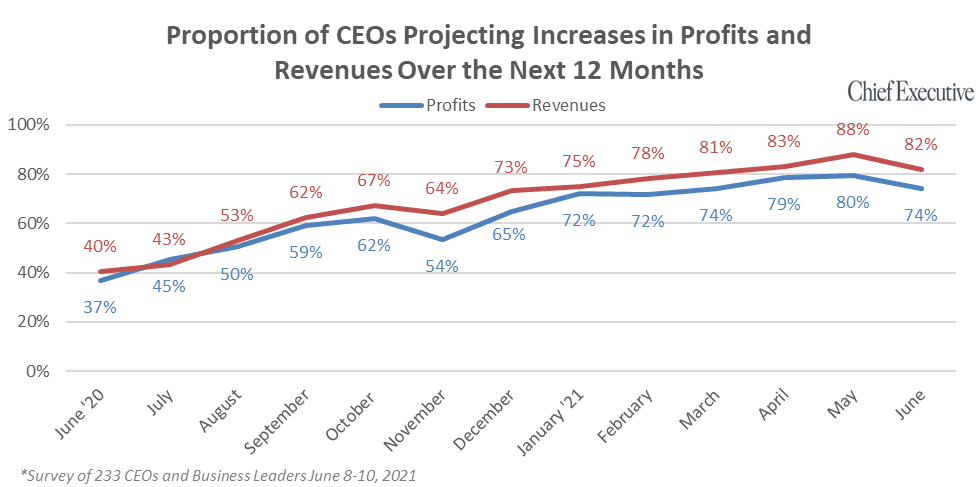

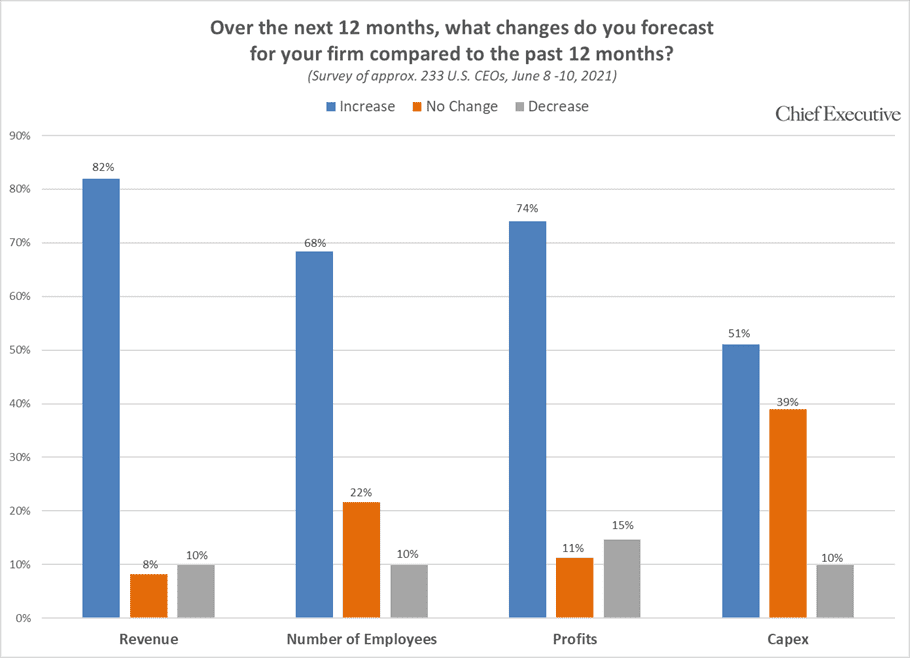

Ending a 6-month upward trend that began last November, the proportion of CEOs projecting increases in profits and revenues over the coming months dropped 7 percent in June, to 82 percent and 74 percent respectively, primarily due to the impact CEOs say inflation and increased taxes (including increasing wages) are likely to have on the bottom line.

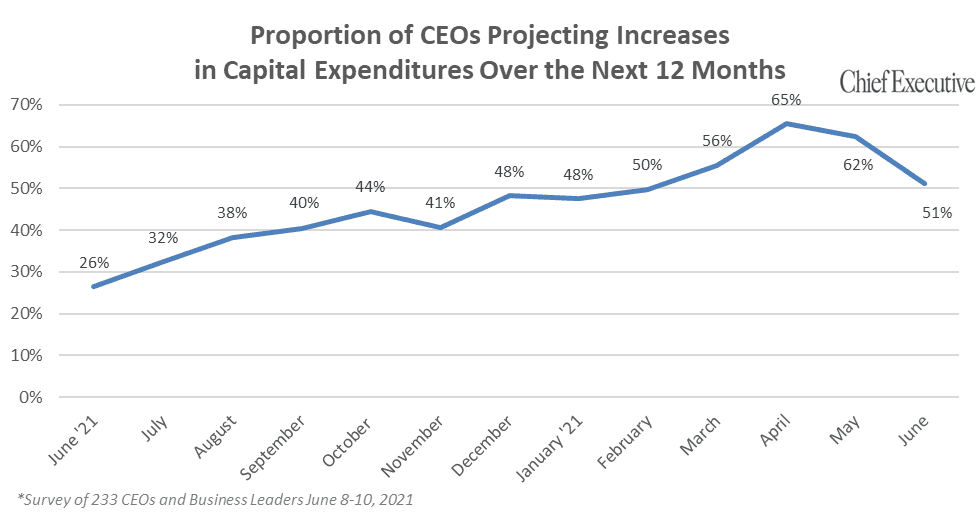

Similarly, the proportion of those anticipating to increase capex declined to 51 percent from 62 percent the month prior.

Still, 68 percent of CEOs expect to bolster their workforces in the year to come—the highest percentage since 2013—an indication of the importance of skilled labor and top talent in an increasingly challenging environment.

Still, 68 percent of CEOs expect to bolster their workforces in the year to come—the highest percentage since 2013—an indication of the importance of skilled labor and top talent in an increasingly challenging environment.

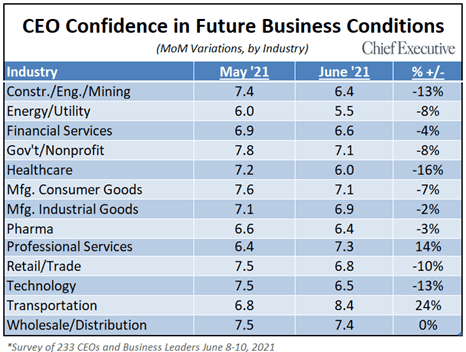

This month, 11 of the 13 sectors represented by the Index reported fading CEO optimism. Energy/Utility CEOs provided the lowest forecast across sectors, at 5.5 out of 10, which they attribute to rising inflation, regulation and government spending

“[The] current administration is pushing ESG agenda too far. Commodity prices (primarily oil and gas) will be an additional trigger for super inflation. When they figure this out, it will be too late to correct,” says the CEO of a large, Texas-based energy company, who rates his forecast for the future as “weak”, at 4/10.

“[The] current administration is pushing ESG agenda too far. Commodity prices (primarily oil and gas) will be an additional trigger for super inflation. When they figure this out, it will be too late to correct,” says the CEO of a large, Texas-based energy company, who rates his forecast for the future as “weak”, at 4/10.

At the opposite end of the range, CEOs in the transportation sector are looking to the future with much greater optimism than they did last month, rating business conditions a year from now an 8.4 out of 10—or “very good” according to our scale.

Year over year, confidence across most sectors is up—unsurprisingly given where we were in at this time in 2020. Construction CEOs and their peers in technology are the main groups not sharing in the increase in optimism. Materials costs and increasing regulations, they say, are putting a damper on their sentiment.

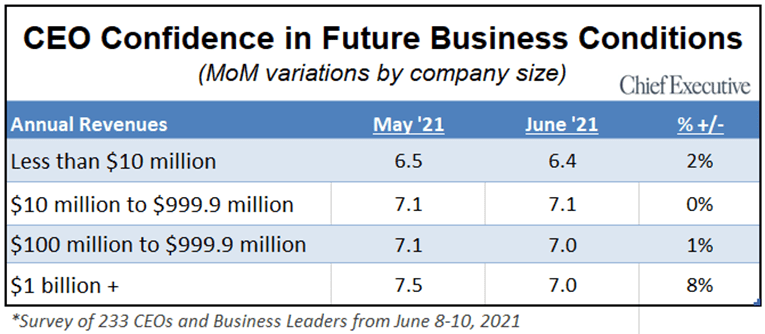

Forecasts by size remain fairly unchanged since last month, except for CEOs at companies with $1 billion+ in annual revenues, among which optimism grew by 8 percent in June. They say although they share some of their peers’ concerns, they remain confident the economy is on the mend and that activity will be buoyant enough to overcome the rest of the challenges.

Forecasts by size remain fairly unchanged since last month, except for CEOs at companies with $1 billion+ in annual revenues, among which optimism grew by 8 percent in June. They say although they share some of their peers’ concerns, they remain confident the economy is on the mend and that activity will be buoyant enough to overcome the rest of the challenges.

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.