For CEOs keeping an eye on the impact that activist investors are having on large corporations, news that Trian Fund Management LP CEO Nelson Peltz is looking to force his way onto Proctor & Gamble’s board of directors clearly illustrates that the trend toward this kind of activism isn’t subsiding—and that investors aren’t shying away from taking on even the world’s biggest corporations.

While Peltz is not suggesting that P&G CEO David Taylor or the company’s directors be replaced, or that the company be broken up, the message that Trian and Peltz are sending with the preliminary proxy statement filing with the U.S. Securities and Exchange Commission disclosed on Monday is that he’s looking to shake up P&G’s organizational structure and culture, which he views as resistant to change.

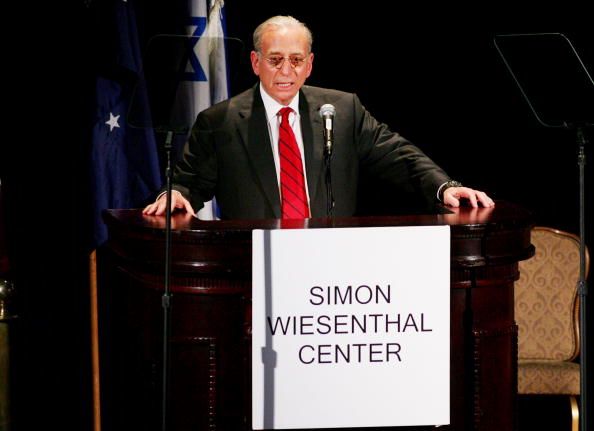

“As a member of the board, it would be my goal to help improve performance by increasing sales and profits and regaining lost market share,” Peltz said in a statement. “I also believe the board must address the company’s structure and culture. I can add far more value operating within the P&G boardroom than by merely looking in from the outside.”

For CEOs concerned about the possibility of activist investors attempting to force their will on a company, there are ways to stay on top of these situations—mainly by staying out in front of the headlines and clearly communicating to shareholders the ways in which an organization is succeeding, and why their leadership and vision will be best for the company.

“Trian has not provided any new or actionable ideas to drive additional value for P&G shareholders beyond the continued successful execution of the strategic plan in place.”

Just last month, General Motors CEO Mary Barra warded off a shareholder proposal from activist investor David Einhorn and Greenlight Capital, with 91% of stockholders voting against the plan. Einhorn and Greenlight had lobbied for months to shake up the company’s board of directors and split GM’s stock into two classes. Barra was able to communicate to stockholders that while GM’s stock was undervalued, the company was taking meaningful steps to rectify the situation and had a winning plan for the future.

Trian already owns 1.5 percent of P&G (about $3.3 billion in stock), and has been in discussions with Taylor over the past several months over ways to increase sagging share prices and the company’s strategic vision.

For its part, P&G says it has maintained an active dialogue with Trian since it became a large investor, though Peltz has not shared any detailed plans on how the company or its culture could be improved. P&G said in a statement that “while the board is always willing to consider new ideas that may help drive profitable growth and enhance shareholder value, the board notes that Trian has not provided any new or actionable ideas to drive additional value for P&G shareholders beyond the continued successful execution of the strategic plan that is in place.”

The date of the Company’s 2017 Annual Shareholder Meeting has yet to be been announced, so stay tuned to see whether Peltz is successful in his bid to join the board, or whether Taylor and company can successfully communicate to stakeholders that its current path is the one that will lead to success moving forward.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.