Over time, however, perceptions of QVC as a low-end retail channel have been disabused by the caliber of both its celebrity hosts and the products they hawk. For example, the network regularly features upscale offerings, including fashions from high-end designers (Isaac Mizrahi, Diane von Furstenberg), upscale cosmetics (Bobbi Brown, Clinique) and state-of-the-art kitchen tools (a $529 Vitamix).

This coupling of high-profile brands and engaging, interactive programming has long been what distinguishes QVC from competitors, explains Mike George, CEO of QVC, which does $8.6 billion in sales annually and is a wholly owned unit of Liberty Interactive. “We have always felt that it is our mission to be the editor and the curator of great product selection,” he says. “Amazon can be the universal product catalog. That’s not our business. Our business is to present to you these great items every day that we’ve carefully gone out and selected and curated.”

The Drive to Digital

However, in recent years, that model has been morphing to accommodate what can only be described as a massive consumer shift toward digital retail platforms. During the 2013 holiday shopping season, U.S. brick-and-mortar retailers saw about half the foot traffic they experienced three years prior, according to ShopperTrak. Meanwhile, online retailer Amazon claimed to have had its best holiday season ever, citing 36.8 million items ordered worldwide on Cyber Monday alone.

QVC, which launched its first website in 1996, is well-positioned to continue to benefit from consumers’ migration to Internet shopping. Already, 43 percent of its current business is on e-commerce, with mobile sales accounting for about 40 percent of e-commerce revenues. QVC’s performance against peers will be easier to track going forward thanks to a tracking stock Liberty introduced for the division in October (QVC Group, trading as QVCA and QVCB). The move will allow the market to distinguish QVC’s performance from that of the rest of the company’s Internet businesses (Backcountry.com, Evite, CommerceHub, Bodybuilding.com, Provide Commerce).

“We’ve found that the tracking stock approach gives you most of the benefits of a full spinoff at less cost and complexity,” explains George, who notes that to maintain its growth trajectory QVC will need to continue to evolve to meet changing consumer shopping habits. “Our customer keeps evolving, and how she wants to engage with us has moved from a passive, linear television experience to a very immersive, multi-channeled experience. She is ordering product from her mobile phone while watching her kids’ soccer games, engaging with us on Facebook and commenting on her iPad while watching her favorite cooking program.

Our view is that if we can stay at the forefront of moving with her to where she’s going, this business can continue to grow and expand over time.” Toward that end, QVC is developing second-screen experiences geared toward fans of its most popular programs, such as the “In the Kitchen with David” cooking show. An iPad application allows viewers watching the show to receive real-time communication synced with events on the show, such as opportunities to submit questions, details about the products being featured or recipes for the dishes being prepared.

Going for Global Growth

Going for Global Growth

Given the favorable headwinds driving domestic sales, George remains optimistic about QVC’s growth prospects at home. At the same time, however, he plans to continue to break into new markets as part of an international expansion strategy launched in 2010. In addition to the U.S., the company currently sells in the UK, Italy, Japan and Germany.

“About one-third of our business is outside the U.S. and we want to keep growing that number,” he says. “We will open in France next year and our goal is to keep opening a new market every 18 to 24 months. These markets take many years to grow to a certain scale, so it’s not a short-term proposition; but history will show that these are great 10-year and 20-year plays for the company.”

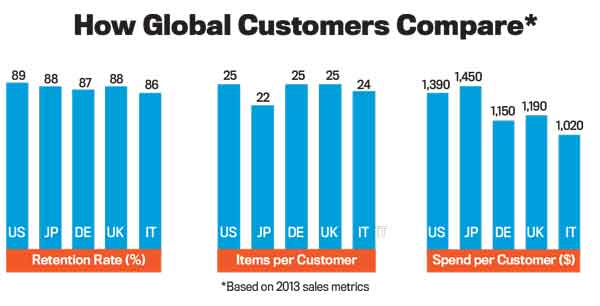

Thus far, QVC has found that its model translates well overseas and that sales and buying patterns are relatively consistent across borders (see chart, above). For example, the average spend per year, number of items bought and the retention rate for consumers is similar across country markets.

“Obviously we’re tailoring the product mix to the market and the programming reflects the local culture, but the core of what we are doing is amazingly consistent around the world,” notes George, who states that international growth will be a major focus going forward. “Global expansion will look different over time. We’ll be expanding into more emerging markets, where we will need a leaner model and which may involve acquisition activity in addition to ground-up building. That’s the next horizon.”

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.