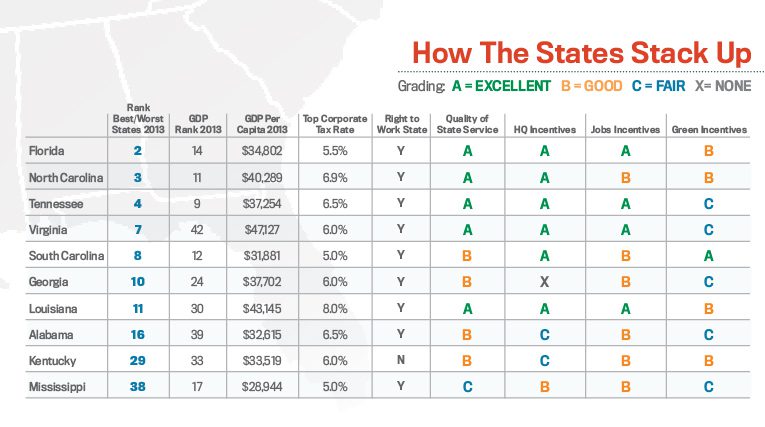

Strolling around his desk wearing a wireless headset, Governor Rick Scott of Florida cold-calls chief executives. After chatting about sunny weather, white sand beaches and lifestyle amenities, the governor launches into pitch mode, proclaiming Florida the country’s best place to operate a business. (Chief Executive’s “Best & Worst States for Business” ranks Florida first in the Southeast, and second in the country, behind Texas.)

The talk is backed by cold cash. Last year, Florida spent nearly $4 billion on incentive programs, according to the New York Times’ national database. Florida’s generosity makes it the most welcoming state in the Southeast. Sales tax waivers and job-creation tax credits are available. Several funds, including allocations to provide worker training and to reduce closing costs, are also available.

During the first two quarters of this year, the governor’s direct appeals have lured nearly 80 companies down south, from aerospace giant Northrop Grumman to a local brewery, Grayton Beer Company. Northrop Grumman opened manufacturing facilities and has hired about 1,000 workers; Grayton added about 40.

Scott likes to bring up other topics that make the case for Florida as a manufacturing state. That case includes the pipeline of young workers and managers coming out of universities and technical schools, transportation and logistics positioning with access to multiple deep-water ports, rail, truck and jet service, the absence of a personal income tax and a government’s making good on its promise to be business friendly.

Florida ranks high in other key criteria. Its corporate tax rate tops out at 5.5 percent, lower than all but three regional neighbors. A right-to-work state, Florida offers full corporate-tax rebates based on investment size, work force hiring quotas, target-industry criteria and geographic location. Add discretionary deal-closing grants, training grants and job-creation rebates and Gov. Scott’s waiting to shake your hand.

Aiming to eclipse its old hospitality-industry/retirement-living image, the Sunshine State has embraced the global economy. Business services now comprise the largest employment category, ranking second in the U.S. Jobs in transportation and logistics have boomed—in this, Florida is third-ranked—as the state leverages its location as portal into South America. Additionally, the boom in banking, insurance and credit-industry jobs establishes Florida as fourth-ranked nationally in that cluster.

Over in Louisiana, Governor Bobby Jindal is making a similar case for the Pelican State. Like Scott, Jindal has expanded the state economy’s dependence on subsidized recruitment. His economic inducements, many deployed to rebuild or lure back businesses washed away by Hurricane Katrina, represent 21 percent of state outlays. George Gsell had relocated his 80 year-old water filtration company, MECO, to Houston after Katrina destroyed its facilities and inventory in Covington. Gsell recalls being pursued by the state’s business relocation advocates, known locally as “the Fast Start boys.” Although the invitation was sweetened with at least $5 million in incentives, Gsell contends that Louisiana’s “home boy” work force was the real deal-maker. “In Houston,” he says, “we were just another company looking for engineers. The big oil and gas companies pretty much got them all.”

Gsell isn’t the only chief smitten with Louisiana’s pro-business climate; CEOs nationwide rank Louisiana 11th in the nation, a steep climb from its 47th ranking in 2006. A hiring spree in construction, oil and gas, business services and transportation and logistics helped revive an economy battered by losses in oil and gas, tourism, aerospace, financial services and apparel. Last year, KPMG’s Competitive Alternatives looked beyond the complexity of the state’s byzantine tax structure and ranked New Orleans and Baton Rouge among the most cost competitive cities for their sizes. Jindal says tax reform is his No. 1 goal.

North Carolina earned a No. 3 ranking in Chief Executive polling. With three of the state’s top traditional industries—tobacco, furniture and textiles—in decline, economic development proponents tout the Research Triangle to IP-oriented businesses seeking smart workers, good infrastructure and location to lure investment. While the Triangle and other developed areas have become choice addresses for a wide variety of service firms, research operations, financial players and IT companies of all stripes, development has largely bypassed remote areas. Major income tax reform passed this summer will reduce corporate income tax to 6 percent from 6.9 percent next year, and drop to 5 percent in 2015; lower individual income tax rates to a flat 5.75 percent in 2015; and introduce a $50,000 deduction for small business owners. Additionally, recent legislation cutting unemployment insurance, education expenditures and various entitlements has been generally hailed by business leaders, with some reservations. Says North Carolina Blue Cross and Blue Shield CEO Brad Wilson: “I don’t believe now is the time to start walking away from our investment in public education.”

Tennessee, ranked fourth by CEOs, offers a muscular and expansive transportation and logistics center, anchored by the FedEx headquarters. Tennessee incentivizes aggressively; its $554 million subsidy of Volkswagen’s Chattanooga plant set a new record for auto-industry subsidies, which backfired when the German automaker announced layoffs earlier this year. Transportation and logistics company investments have led job creation over the past decade.

Virginia, ranked No. 7, figures high in most comprehensive headquarters-relocation searches. Incentives are competitive, especially for manufacturers, although finding sites can be tough. Major grants have gone to Orbital Sciences, Canon and Rolls-Royce. The governor’s use of subsidies has become a political liability, possibly tightening the spigot for future deals. Lifestyle and infrastructure—two seaports and an international airport—garner high marks. Also, a $6 billion highway improvement program was recently announced.

South Carolina, No. 8, offers a business-friendly climate and good quality of life. Companies in manufacturing, health services and construction are hiring, reducing persistent unemployment. However, government and military sectors cast a big shadow, leaving the regional economy vulnerable to public sector belt-tightening. The state’s Chamber of Commerce is pushing for infrastructure improvement, workforce development programs, and comprehensive tax reform.

Georgia, ranked No. 10, is not just the home of the Coca-Cola Company. Hartsfield International Airport, among the world’s busiest, gives Georgia companies global connectivity. Alan Dabbiere moved his mobile-technology management company, Air Watch, from the Silicon Valley to Atlanta and found hiring people got much easier. Cluster growth in the last decade has favored chemical products, construction materials, processed foods and heavy machinery.

Alabama, ranked No. 16, continues to rebuild after experiencing significant contraction during the Great Recession. Strong gains in the automotive-manufacturing industry, rising exports and a housing market on the rebound signal a more robust business climate. Regional economists predict employment gains in professional and business services, healthcare, tourism and retail. Strong ports and a well-trained work force—plus a $158 million incentive package—have helped attract companies like Airbus.

Kentucky, No. 29, boasts two international airports, two top air-cargo hubs and third place in the country’s total air cargo shipment rankings. Extensive air, rail, maritime and roadway connections bolster the state’s position as a top transportation and logistics hub. Kentucky spends roughly $324 per capita to attract companies, and oil, gas, mining and agriculture business are top beneficiaries. Years of state and regional investments have strengthened the community-college system and other technical and workforce training, much of it supporting advanced manufacturing skills and mindsets. It is the only Southeast state without right-to-work legislation.

Mississippi, ranked No. 32, has the smallest budget in the Southeast for incentives. Recent arrivals include SiliCorr ($76 million), Stion and Virdia (both $75 million). Tax rates—both personal and corporate—cap out at 5 percent. Cluster formation in recent years include: aerospace and aviation, health care, automotive, shipbuilding, energy, agribusiness and advanced manufacturing.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.