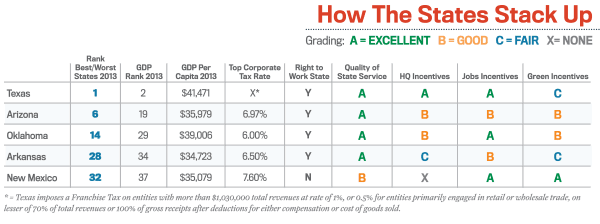

Evaluating the environment any given state offers to its business community is a complicated business, taking into account everything from the tax and regulatory climate and the quality of the workforce to the living environment. With these issues in mind, Chief Executive’s second Regional Report offers an in-depth look at the pros and cons of doing business in Texas, Arizona, Oklahoma, Arkansas and New Mexico.

Welcome to Texas, Chief Executive’s No. 1 state for Business in 2013. To say the Lone Star state dominates the world of corporate relocation is like saying Dallas gets hot in July. Texas attracts so many migratory chiefs that locals have coined a new term, “Texodus,” to describe the influx.

Texas leads the nation in job creation. With 8 percent of the nation’s population, Texas owns nearly one out of every three high-paying U.S. jobs. Last year, Texas’ real GDP grew by 3.2 percent, to $1.3 trillion, compared with 2.2 percent nationwide. Half of the private-sector jobs created in the U.S. over the past 10 years are here. For 11 consecutive years, you-know-who has led the nation in exports.

Expectations of a lower tax bite in Texas shape the nation’s site selection and corporate relocation patterns. Eliminating both corporate and personal income tax, Texas ranks eighth in lowest tax burden according to the Tax Foundation. (Caution: property taxes are high and franchise tax nibbles some profits.) Texas is home to 52 Fortune 500 companies. With a workforce nearly 13 million strong, the state boasts the second-largest labor pool in the U.S. workers’ compensation? Not required.

Strong clusters feed the state’s major industries: oil and natural gas, defense, information technology, biomedical research, fuel processing, electric power, agriculture and manufacturing. Plus, plenty of universities annually replenish the pool of professional and managerial talent. Add to that business networks and two major international airports, aggressive corporate recruitment and the trend of relocating CEOs and population growth quickly makes sense.

Led by the aggressive efforts of Governor Rick Perry, Texas courts out-of-state employers with the nation’s biggest program of financial incentives, distributing some $19 billion a year, according to a report by The New York Times . Texas rolls out the green welcome mat to a wide range of company sizes, from behemoths like Apple and Samsung to Abadak, a 30-employee tarp and tent manufacturer.

Amid the hoopla around migrating companies, homegrown success stories also abound. “For me, being in the oil and gas business, you really can’t beat Texas,” says Chris Faulkner, chief of Dallas-based Breitling Energy Companies. “This is a state with roots firmly grounded in the oil and gas industry. Our [government] representatives understand what our industry does for our people and our economy and support our industry with rational regulations and fair incentives, unlike some other states that can’t seem to get out of their own way.”

“People come to Texas because it is a meritocracy,” adds former Dallas Federal Reserve Bank chief economist and director of SMU’s O’Neil Center for Global Markets and Freedom Michael Cox, an Arkansas transplant. “We come here because we believe in an environment where we can work and be successful without big-government regulations. I believe the biggest opportunity to do this is right here in Texas.”

Arizona headline: “Job Growth Continues.” Ranked sixth this year in our CEO survey, Arizona added over 46,000 jobs in the past 12 months, outpacing the national job-creation recovery. Top recruiters were leisure and hospitality (especially restaurants and bars), construction, financial activities, healthcare, wholesale trade, professional and business services, and—libertarians, cover your eyes—state and local government. The fastest-rising sector: educational services. That’s no surprise in a state that is home to both the Apollo Group, which owns the University of Phoenix, and Arizona State, America’s largest public university.

The Grand Canyon State’s economy grew 2.6 percent last year, 13th nationally, as Arizona continues to recover from the recession. With government the largest employer in Arizona, the effects of sequestration and state budgetary constraints are marked. “Arizona job growth has outpaced the U.S. since hitting bottom in the fall of 2010,” says Dr. George Hammon, associate director of University of Arizona’s Economic and Business Research Center in the Eller College of Management. “The economy continues to grow and improve.” He predicts accelerating recovery through at least 2015.

This year, the state’s sales tax expires and both corporate income and property taxes fall, leading economic-development advocates to proclaim good times ahead. Arizona is still a rapidly growing state; construction companies and their suppliers, as well as real estate businesses, are posting “Help Wanted” signs. However, the boom-style gallop that characterized the ’90s and ’00s has downsized to a fast trot. Past efforts to lure companies from out-of-state were often low-key and interrupted by budgetary constraints; more recently, metro areas like Greater Phoenix have ramped up their relocation and recruitment programs with more aggressive campaigns. The main target: California CEOs.

Arizona’s extensive educational system and well-funded network of incubators and business-plan competitions help accelerate the pace of commercialization. “It’s very easy to get involved in Arizona, in terms of business, politics or both,” says Jon Pettibone, partner with Quarles & Brady, a law firm in Phoenix.

“Land prices, cost of acquisition and operating costs are very favorable in Arizona,” says Barry Halpern, a law partner with Snell & Wilmer’s Phoenix office. ”The overall tax burden is lower than in Texas, and we wipe out California from the tax perspective.” Add proximately to Phoenix’s international airport, the presence of the state college’s research divisions, the climate and what he calls Arizona’s “underappreciated workforce,” and you’ll find, he says, “a very favorable environment for business.”

When the Devon Energy Corporation’s staff began moving into their company’s new 50-story office tower last November, they raised the city’s profile in more ways than one. Occupying Oklahoma City’s tallest address, the headquarters of America’s largest independent oil company anchored the town’s economic renaissance with a reminder as to where America’s energy industry began. Roughly one in four Sooner jobs depend on energy, estimates Mickey Hepner, economist and business school dean at the University of Central Oklahoma. Dozens of thriving oil, gas and alternative-energy companies are Oklahoma-based, including OGE Energy, Continental Resources and Sandridge. Agriculture is Oklahoma’s other traditional big employer. More recently, aviation and biotech have emerged as significant industries. “Efforts are underway to diversify our economy” further, says Fred Morgan, CEO of the Oklahoma State Chamber of Commerce. “Aerospace industry growth is one benefit of that.”

Devon’s new tower caps the revival of Oklahoma City, a business-led makeover that has brought restaurants, retailers, concert venues and a sports arena to a state capitol that once ranked so low on corporate America’s list that American Airlines publicly spurned it for fear employees would quit rather than relocate there. When basketball’s New Orleans Hornets relocated here temporarily post-Katrina, they showcased the oil town to a national TV audience, leading the way to a permanent NBA franchise, says Ted Streuli, editor of the hometown Journal Record.

From an entrepreneurial standpoint, “Oklahoma has a very strong business climate,” says Jeri Koehler, director of the Innovation Center at Rogers State University. “Small businesses and startups have access to capital through the Oklahoma Center for Advancement of Science and Technology. And an organization called I2E provides access to capital to high-tech growth firms.”

Business boosters would like to see fledgling ventures get more support. Sadly, a report released this summer by the Oklahoma Employment Security Commission shows new businesses are struggling—launching with fewer employees and disappearing earlier. “The past two recessions seem to have reduced creation and survival rates” for new companies, says Monty Evans, senior economist. “Still, manufacturing is holding its own, and so are professional services, leisure-industry businesses and the hospitality industry.”

“The state has been addressing some of the tough issues” that may have deterred startups, spinoffs and relocations, says Morgan. “We completed a comprehensive overhaul of workers comp and ratcheted the income tax down from 7 percent to 4.9,” he said. “As far as our tax system, we’ll continue to work on that.”

This year, Chief Executive readers ranked Oklahoma 14th Best State for Business, up from 17th last year.

Economically, Arkansas is a state of extremes. Native son Walmart is the biggest private employer in the world. Second-ranked Tyson Foods also makes the Fortune 100, and there are four Fortune 500 companies in the state. With a state GDP approaching $100 billion, Arkansas boasts the second-lowest cost of doing business in the U.S. according to CNBC. However, personal income tax takes a bite. The Natural State finished 28th among Chief Executive readers in this year’s Best State for Business Poll.

Buffeted from the trough of the recent recession, Arkansas has lagged the national median in recovery. State GDP growth was a scant 0.3 percent from 2010 to 2011, below the 1.5 percent national average. Persistent unemployment and weak post-recession hiring shapes Arkansas’s labor market: the state’s unemployment rate seemed stuck at 7.4 percent coming into fall. The labor force shrunk by nearly 40,000 jobs from mid-2012 until this summer, a dip of almost 3 percent. Manufacturing jobs led the decline, contracting by over a third, marked by 900 jobs lost when Whirlpool closed its Fort Smith plant. On the plus side, healthcare support services, office administrative and retail positions posted job gains of 3,500 over the previous year.

Increasingly, the issue of workforce readiness is being raised by employers. Fewer than one in five Arkansans graduate college. “Simply put, we must increase the college student pipeline in science, technology, engineering and mathematics,” asserts Nicholas A. Brown, chief executive of Southwest Power Pool. Federal economists predict most of Arkansas’s future jobs will be labor-intensive; the ranks of pump operators and floor finishers will grow by nearly 50 percent.

This spring, the legislature approved the largest incentive deal in state history when it lured Big River Steel to agree to construct a $1 billion mill in Osceola; taxpayers will subsidize the deal with $125 million. Among recent economic wins are Vikon Farm’s plans to build a new facility in Arkadelphia, facility expansions completed by Remington Arm’s ammunition plant in Lonoke Bad Boy Mowers in Batesville and the relocation of Internet marketing firm Inuvo’s relocation from Manhattan, New York. Says Inuvo CEO Richard Howe: “We had to do something to control our costs, and we did. We moved to Conway.” Estimated annual operational cost reduction: 40 percent.

New Mexico passed a tax package this spring designed to make the state more competitive in recruiting new industry. Corporate income tax, currently 7.6 percent, will top out at 5.9 percent by 2018. Manufacturers will have the option of paying tax only on sales made in-state, effectively eliminating the corporate income tax for many companies. When fully implemented, manufacturers here will pay an effective tax rate of 2 percent.

Ranked 33rd Best State for Business by Chief Executive readers, New Mexico has an approximately $80 billion GDP driven largely by energy producers; the state is the country’s third-leading crude oil and natural gas producer. The federal government’s spending is also a driver, reflecting the presence of three air force bases, a military testing range and an army staging ground. Two national laboratories—Sandia and Los Alamos—plus the University of New Mexico generate an intellectual property flow that serial entrepreneurs tap through startup mentoring networks and angel funds, such as the New Mexico Angels. “We have been blessed with successes in our portfolio companies,” says Angels president John Chavez. “We’ve been having four times and five times returns the last few years.”

Aiming to hone the state’s appeal to employers, Gov. Susana Martinez has bolstered job training and hiring incentives; one new program defrays taxes for employers for six months. Last year, the state’s Business Advocacy office helped more than 200 companies overcome such bureaucratic delays as licensing hurdles. New Mexico has also made strides in international trade, joining the top export-growth states.

For many executives, a big part of New Mexico’s appeal is its low-key, Main Street vibe. “Albuquerque is a smaller city than Dallas or Houston but big enough [that] we can find talent,” says Harry Mueller, CEO of Delta Group Electronics. “Albuquerque is a great town, the weather is fantastic, and it’s a great place to raise your kids.”

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.