When Chief Executive polled its CEOs last week about their overall perceptions of business conditions, sentiments seemed to be running high. The Index, our monthly gauge of CEOs’ perceptions of overall business conditions, finally saw an uptick in optimism after a general decline over the year.

Confidence jumped 7.1 percent to 5.23 out of a possible 10, bringing confidence back to levels seen this summer. Though overall confidence has dropped 18 percent since the Index’s 2011 high of 6.39 in February, November’s jump seemed to be an indication that conditions are starting to recover.

Here are three things that happened in October that helped boost CEO confidence:

Projections for key business metrics also saw a boost. Over 69 percent of CEOs expect to see increased revenues over the next year, a 15 percent increase from October.

After five months of increased hiring hesitation, more than 40 percent of CEOs expect to increase their workforce over the next 12 months. In September, fewer than 30 percent of CEOs planned to hire, a huge drop from April’s 48.84 percent.

In addition to increased revenue and hiring projections, CEOs also are optimistic about profit projections. Over 58 percent of CEOs expect to see increased profits compared with just 46 percent one month ago.

Capital expenditures are also slowly recovering; almost 45 percent of CEOs expect to increase cap ex. Though down from February’s 54 percent, cap ex increases are still an indicator of positive business investment.

Though there is continuous CEO discontent with U.S. political leadership and a consensus that regulations are stifling a full economic recovery, there are signs that things are looking up. One CEO said, “We are seeing former clients become strong financially again and returning to us to receive our public relations/marketing/media relations services, which they discontinued at the height of the recession. Smart executives know that visibility equals market share, and market share is fairly inexpensive now. While others sit out on the sidelines, visionaries are getting back in the game.”

Another CEO noted, “U.S. based corporations are cautiously giving up some cash,” which is progress in the right direction. Another has found success in specific markets: “We have been fortunate to identify specialty niches with high demand and a limited qualified supply of service providers. So while we see the overall economy as weak, our growth has come from recognizing these niches early and positioning ourselves as early market leaders.”

These numbers and comments, however, were compiled between November 1 and November 4. Since then, there have been political and economic developments that could potentially push confidence back down:

Let’s hope the second half of November can be more like October.

CEO Confidence Index — November 2011

Respondents: 195

| October 2011 | November 2011 | Monthly Change | |

| CEO Confidence Index | 4.88 | 5.23 | 7.1% |

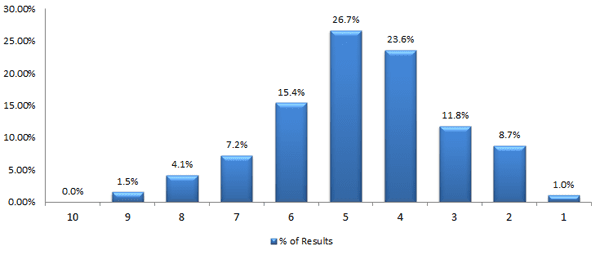

What do expect overall business conditions to be like one year from now on a 1 -10 scale? (10 = Excellent)

What is your assessment of current overall business conditions on a 1-10 scale? (10 = Excellent)

Over the next 12 months, what changes do you forecast for your firm compared to the past 12 months?

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.