The Covid-19 pandemic has wrought havoc worldwide and ushered in a new era of uncertainty, leaving almost no sector of the economy untouched. In addition to the immediate negative impact on valuations, many companies are having difficulties preparing reliable, if any, projections because of the unknown impact that Covid-19 may have during Q3 and Q4 of 2020 and beyond.

The Covid-19 pandemic has wrought havoc worldwide and ushered in a new era of uncertainty, leaving almost no sector of the economy untouched. In addition to the immediate negative impact on valuations, many companies are having difficulties preparing reliable, if any, projections because of the unknown impact that Covid-19 may have during Q3 and Q4 of 2020 and beyond.

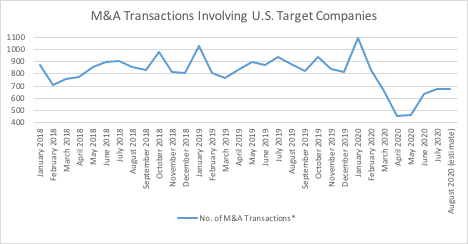

While some businesses have bucked the trend (e.g., technology companies), most public companies experienced a steep drop in valuation in February and March. Concurrently, as the impact of Covid-19 and related lockdowns hit globally with full force, M&A activity involving U.S. targets significantly decreased in a manner reminiscent of downturns following the dot-com crash in the early 2000s and the 2008 financial crisis. It took until 2014 for M&A activity to return to 2007 levels, but there is room for optimism this time around, as equity markets generally, and the valuation of many public companies, have quickly rebounded, with the S&P 500 closing at a record high on August 18. M&A activity has followed suit, although at a slower pace, and companies with stockpiles of cash or valuable stock are seeking target assets and are increasingly jumpstarting transaction discussions and negotiations.

*Source: FactSet

*Source: FactSet

With activity re-escalating, CEOs and management teams of acquirers and targets—willing or unwilling—would be well advised to familiarize themselves with best practices for M&A in this new age. Short-term swings in valuation affect public companies more meaningfully than private companies and while privately held companies may not see eye-to-eye with buyers with respect to valuation, most can bide their time and avoid being acquired by relying on governmental and private credit market funds. For public companies that are held to account on a quarterly basis and subject to attack by activist shareholders, institutional investors and competitors, that’s much more challenging.

CEOs of public companies, especially those who have not seen their share prices recover, should evaluate potential vulnerabilities and responses to unsolicited takeover proposals, including establishing a committee (typically including the chair and CEO), to run point on these issues. Management should also consider the reactions of key shareholders in case of a takeover offer; maintaining clear lines of communication and trust with them could make the difference between a successful or failed takeover attempt. Management should also assess structural takeover defenses, including charter and bylaws provisions, state antitakeover laws, board classification and having a “poison pill,” while also considering how such measures might be received by shareholders and proxy advisory firms.

At the other end of the spectrum, management of public companies may want to contemplate using their stock as currency instead of, or to supplement, cash. Under current circumstances, receiving stock may also be an attractive proposition for target shareholders (who usually prefer cash), allowing them to share in potential synergies down the road. It could also help bridge valuation gaps and, unlike cash deals, has the added advantage of permitting shareholders to defer taxes on gains.

Another tool to consider when a valuation gap seems insurmountable is an earn-out (or, for pubic target companies, contingent value rights). Historically used infrequently and only in certain industries (primarily life sciences), the current environment is ripe for increased and broader use of these mechanisms. Although earn-outs might enable deals to be struck when there would otherwise be none, they entail uncertainty, additional negotiation complexity, fiduciary considerations when approving them and increased litigation risk down the road.

In this new era, companies should anticipate protracted deal negotiations, in part because of the quasi-elimination of in-person meetings, which not only create potential deal opportunities but often prevent transactions from falling apart and expedite alignment on terms.

Also, Covid-19 has brought certain contractual terms to the forefront—for example, earn-outs, representations and warranties (including regarding legal and contractual compliance, operations, value of inventory) ordinary course of business covenants, special indemnities and material adverse change (“MAC”) provisions), requiring additional negotiation time. MACs and ordinary course of business covenants—which, if triggered or breached, respectively, could allow a buyer to walk away from a signed, but not closed, transaction— have been at the forefront of the M&A news cycle since March, putting billions of dollars of deal value at risk.

For example, Advent International invoked the occurrence of a MAC to back out of purchasing Forescout Technologies for $1.9 billion and the Simon Property Group sought to terminate a $3.6 billion acquisition of Taubman Centers for similar reasons. Also, a special committee of WeWork sued SoftBank following the termination of a $3 billion tender offer for WeWork shares for failure to comply with various covenants. In complex M&A negotiations, where millions or billions of dollars can hinge on a single word, careful drafting is paramount. Even as belts tighten, it has never been more crucial to enlist the help of experienced advisors.

Parties should expect delays at other stages of the deal cycle too, including a protracted due diligence phase, leading buyers to request longer exclusivity periods. Representations and warranties insurance, increasingly popular in recent years, remains available, but coverage will be less robust (excluding, for example, Covid-19). As with receiving approvals from governmental bodies and private parties and obtaining debt or equity financing, it will be more time consuming to obtain a policy than has traditionally been the case.

So, the following are key considerations for CEOs and top management:

• Be ready: solidify lines of communications with key shareholders and assess corporate preparedness;

• Bridging value gaps is a key impediment to deals; evaluate stock consideration and earn-outs/CVRs;

• Protracted deal cycle:

Is there a “new normal” for M&A or are we back to business? The answer is probably somewhere in between, provided that Covid-19 does not strike again in full force, with accompanying lockdowns.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.