After slipping at the start of the year, CEO sentiment is holding steady in February.

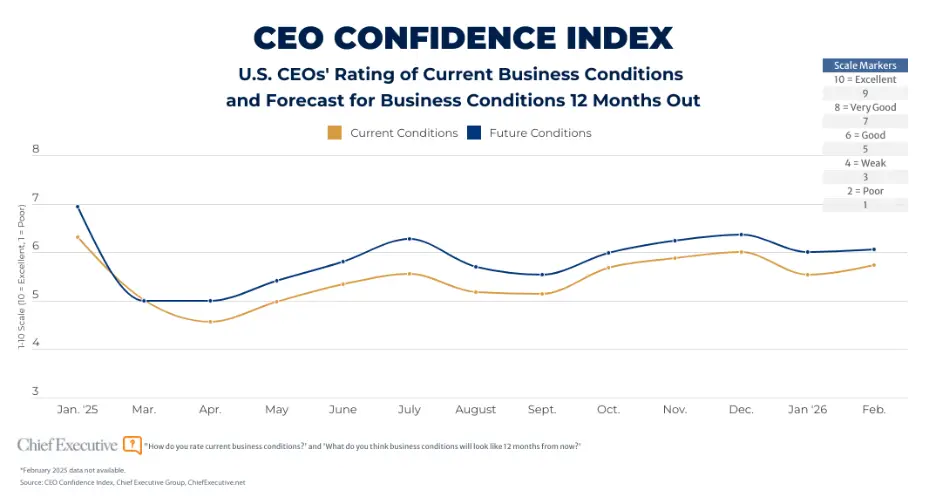

Chief Executive’s latest CEO Confidence Index—fielded among 200 U.S. CEOs February 3-4—finds business leaders rating current business conditions 3 percent higher than in January, rising to 5.8 out of 10 from 5.5.

Expectations for the year ahead remained essentially flat, with CEOs’ 12-month outlook clocking in at 6.1/10 in February from 6.0 in January.

Many respondents point to an economy that, despite near-constant disruption from the White House, continues to show resilience, with steady customer demand buoying many industries. Several also note that the effects of the Trump administration’s tariffs and “Big Beautiful Bill” are coming into sharper focus. “Economic policies will improve the economy, it just takes time,” said one healthcare CEO.

Looking ahead, nearly 1 in 5 optimistic CEOs specifically cited the midterm elections as a potential source of new predictability in Washington. “I’m hoping for split government and gridlock, which will reduce economic shocks and help people get back to growing their businesses,” said one respondent in the advertising industry.

“The political climate has the country unsettled, and until that dies down the country will continue to struggle,” added the CEO of a recruiting business, echoing others who describe the economy as fundamentally strong but vulnerable to further disruption from the White House.

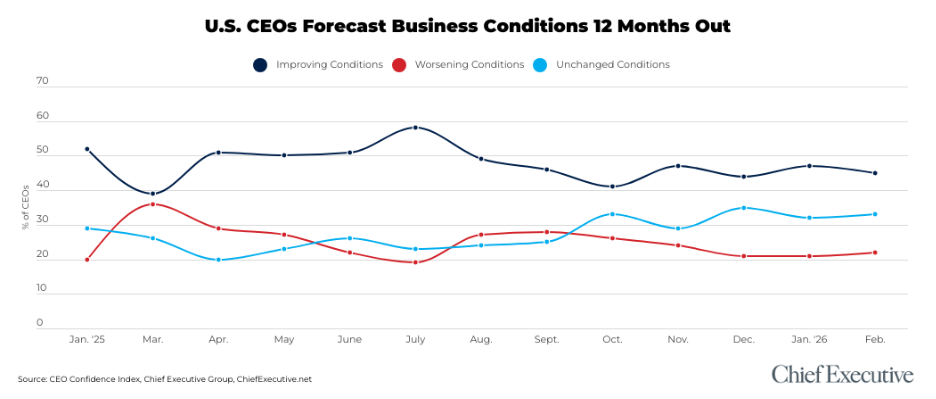

While the overall 12-month rating ticked up, the share of CEOs expecting conditions to improve declined slightly, from 47 percent in January to 45 percent in February, suggesting that optimism, though present, remains concentrated among a smaller group projecting stronger gains.

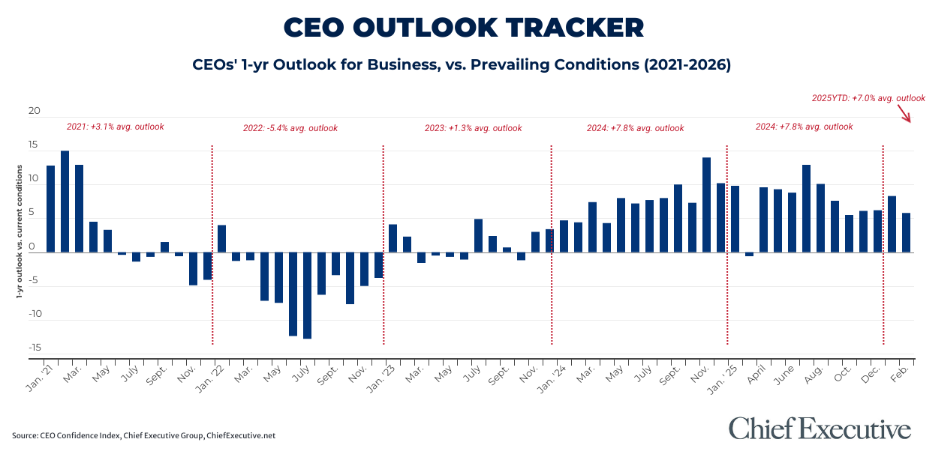

Another lens is the longer-term trend. February data indicates CEOs expect business conditions to improve by 6 percent over the next year. That is below the 8-percent average of the past two years, but above the five-year average of +3.0 percent.

‘Economic Drivers’

Forecasts for the broader U.S. economy continued to strengthen in February. Sixty-five percent of CEOs expect growth, up from 57 percent in January. Just 12 percent foresee a slowdown, down from 15 percent a month earlier.

“The economic fundamentals are increasing in strength,” commented Steven A. Schneider, executive chair and CEO of SHS Group Holdings. “The tariffs restructuring of our trading partners will eventually boast business revenues and will continue to [have] a positive effect on the U.S. deficit reduction. These elements will lead continued momentum for a strong economic growth in 2026.”

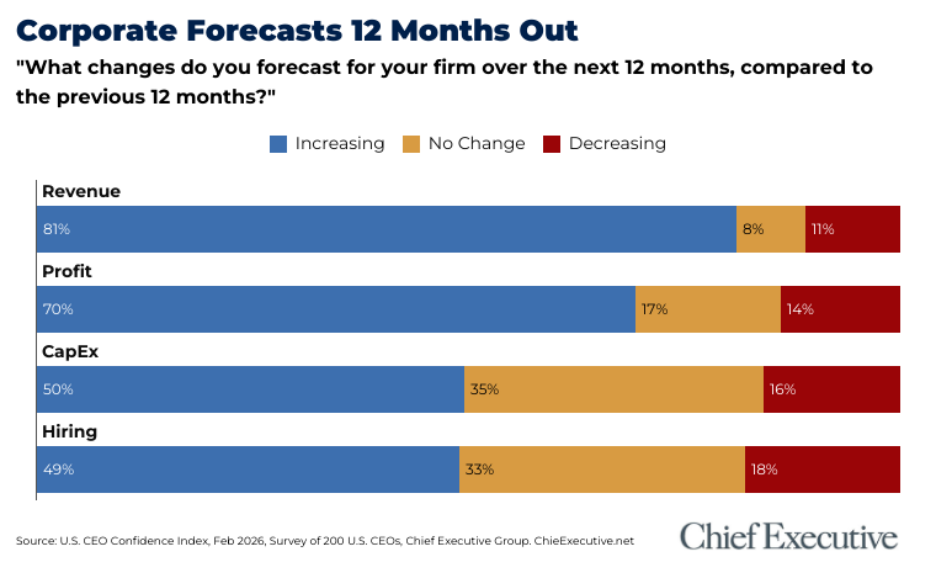

That confidence is mirrored in corporate expectations for 2026:

- 81 percent forecast higher revenues vs. 2025

- 70 percent expect profits to rise

- 50 percent plan to increase capital expenditures

All three measures are up since the start of the year, as CEOs point to a steady U.S. consumer and renewed movement of capital.

“Shaking loose of some capital, and people are moving ahead despite uncertainty. Lots in the pipeline,” said the CEO of a professional services firm in the Midwest.

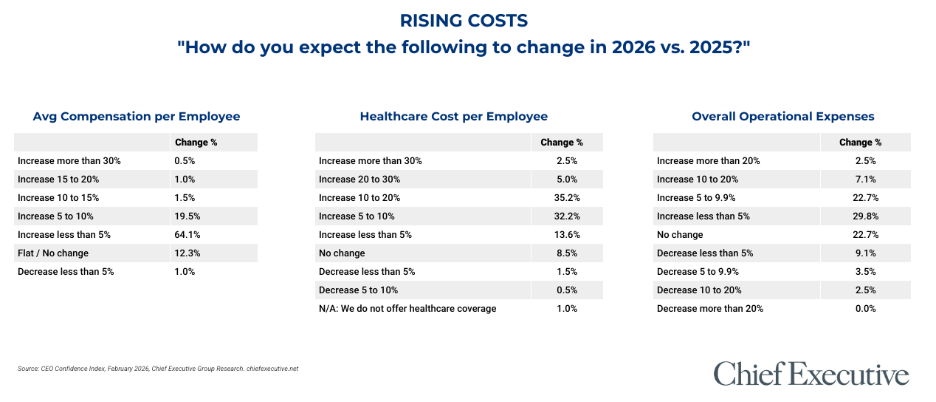

Still, inflation remains a central concern. Sixty-two percent of CEOs expect operating expenses to climb in 2026, and 88 percent anticipate healthcare costs will rise again. CEOs project the Consumer Price Index will increase by 3 percent this year.

Compensation pressures are also building. Eighty-seven percent say their organization’s average pay per employee is increasing, though most expect raises of less than 5 percent.

Rising healthcare and labor costs may help explain why hiring expectations softened in February: 49 percent plan to expand their workforce this year, down from 53 percent in January. Still, that figure remains above 2025 levels, when an average of 42 percent expected to hire.

AI may also be emerging as a key lever for cost containment. Seventy-nine percent of CEOs say they are responding to rapidly rising costs by improving operational efficiency and productivity, while 56 percent point to greater automation and increased use of technology. Just over half (55 percent) cite a more traditional strategy: passing costs through to customers.