In the latest survey by Chief Executive, CEOs are reporting a renewed sense of confidence in where the business landscape will be a year from now, registering an average confidence level of 7.07 out of 10 on our monthly CEO Confidence Index, the highest level since April.

This represents a net change of 3.21% month over month— and a gain of more than 6% from September. The rebound comes amid signs that the GOP appears to be making headway on cutting business taxes in Washington.

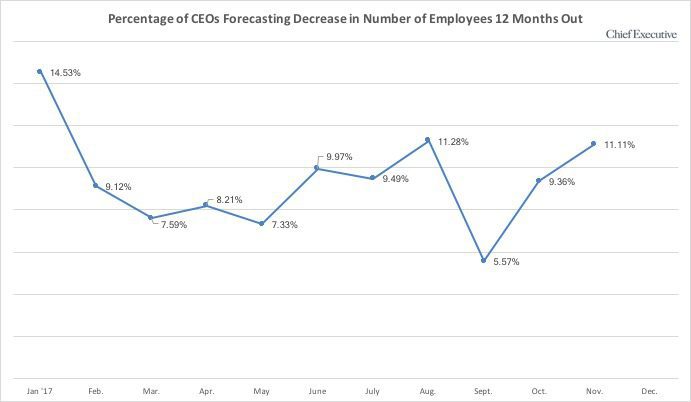

Despite overall optimism, an increasing number of CEOs are also now predicting they will see diminished profits and declines in hiring over the coming 12 months, as the pool of available workers shrinks and wages grow amid continued economic growth.

Who’s Up, Who’s Not?

Who’s Up, Who’s Not?

Financial services CEOs were the most optimistic of those surveyed, with a ranking of 8.06, 14% above the average score across all industries, and up from a January level of 7.07. The sector’s CEOs in fact reported having greater confidence in what lies ahead than in current conditions, which they nonetheless ranked positively at 7.72.

Industrial manufacturing CEOs had the biggest increase in confidence this month, showing a confidence spurt in expected business conditions 12 months from now of almost 10% since the month prior and making November the sector’s most optimistic month so far this year.

At the other end of the spectrum, after starting 2017 with an 8.25 rating, Health Care CEOs’ confidence in the future fell to 6.57 in November, a drop of 20% year to date. The battle over cost-sharing subsidies, the wavering list of participating insurers, confusion in the marketplace and uncertainty regarding the fate of Obamacare altogether are all factors likely playing a significant role in this decline.

Small Companies More Pessimistic About The Future

Looking at responses per company size (based on annual revenues), large middle-market companies share the top forward-looking confidence spot with their middle counterparts, ranking 7.29 and 7.23 respectively, ahead of the 7.07 average and reaching their highest levels since last spring.

Small companies are the only ones on a downward trend since January, having slipped 4% from 7.06 to 6.79. “Regulations and over the top food safety requirements will put most small businesses out of business,” complained the president of a small consumer goods manufacturing company who anticipates both profits and number of employees to plummet a year from now.

Mixed Picture for Revenue, Profit & Hiring

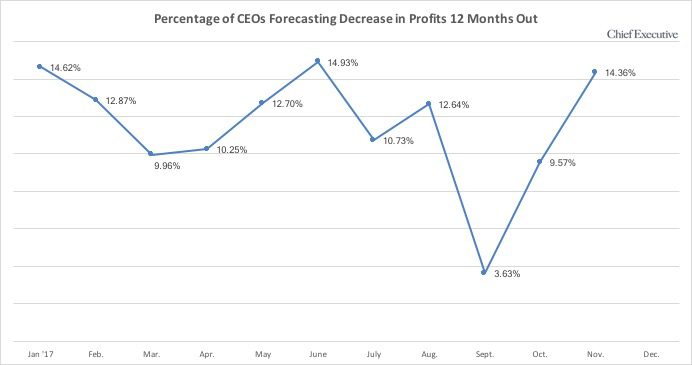

November data reveals an increasing number of CEOs anticipating profits and hiring will dwindle a year from now. Some 14% now foresee a decrease in profits this time next year, up nearly 6% since September, and closing in on one of the highest levels it’s been all year. Some 11% anticipate a similar downturn in hiring, the most since January.

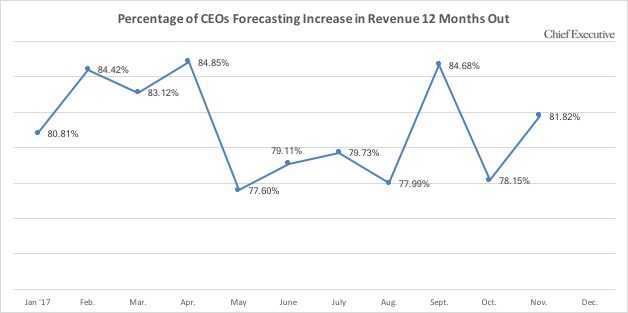

Revenue projections are up, with 82% of CEOs predicting gains 12-months from now, an increase of 4% over the prior month, and back to beginning-of-the-year levels, but still trailing early-spring enthusiasm.

Overall, despite all the volatility, America’s CEOs continue to rank current business conditions as ‘very good’ (7.03 out of 10) while remaining hopeful for a better tomorrow.

About the CEO Confidence Index

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across corporate America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The index was based on 199 responses in November.