Peter Drucker, whose tenure as a renowned management guru began in the 1940s and continued through the next 70 years, advised that the “make versus buy” decision was perhaps the most fundamental strategic choice of corporations. CEOs and boards consider this tradeoff not only with sourcing and manufacturing and M&A decision-making, but also in top-level staffing—especially when choosing between new, celebrated saviors from the outside or trusted insiders with a proven track record as candidates for CEO succession.

In CEO transitions, a messianic quest for an external savior can overlook and disparage the in-house stars. Most recently, the wise choice of a well-regarded insider to take the reins as the CEO of Target led some misguided analysts to complain that an outsider should have been selected, in spite of the glistening track records of many internally hired CEOs. Consider Andy Jassy of Amazon, Arvind Krishna of IBM, Dave Ricks of Eli Lilly, Brian Moynihan of Bank of America, Joaquin Duato of Johnson & Johnson, Indra Nooyi of PepsiCo, Bob Iger of Disney, Mary Barra of GM and others across sectors. Are these triumphant insiders flukes? No, the internal candidate path is often the right answer in successions unmarred by scandal or a strategic missteps.

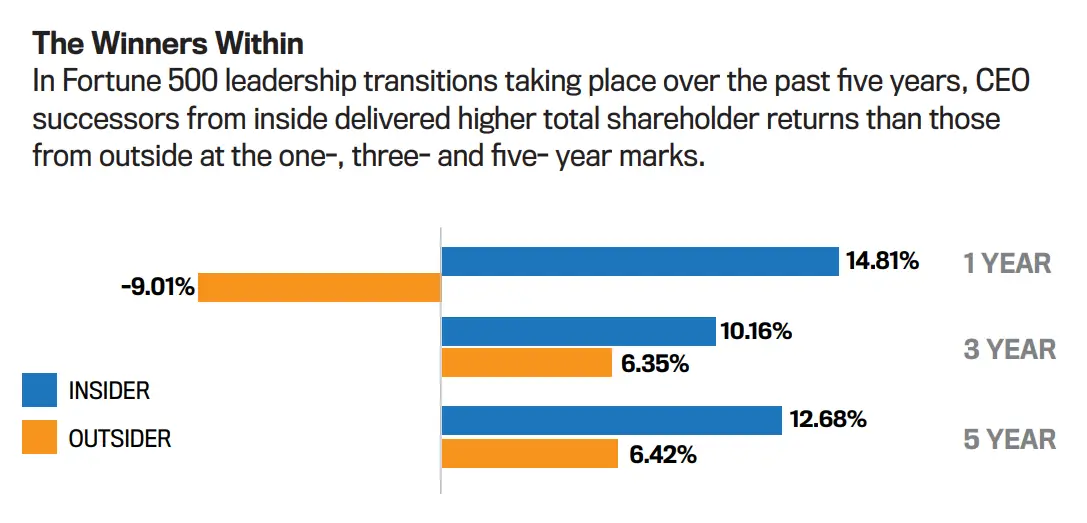

Our new, original analysis of CEO transitions taking place at Fortune 500 companies in the past five years suggests that, surprisingly, internal CEOs have consistently outperformed external CEOs in recent years, with dramatic outperformance in total shareholder return (TSR).

Among the 61 CEO transitions that took place over the past year, the 39 CEOs elevated from within generated an average TSR of 14.81 percent on an annualized basis, as compared with the average TSR of -9.01 percent generated by the 22 CEOs selected from outside.

Amazingly, the trend holds true over a longer period. Of the 93 Fortune 500 CEO transitions that took place over the past one to three years, the 71 internal CEOs generated a 10.16 percent average annualized return, while the 22 external CEOs generated a 6.35 percent average annualized return. Similarly, of the 84 CEO transitions that took place over the past three to five years, the 70 internal CEOs generated a 12.68 percent average annualized return while the 13 external CEOs generated a 6.42 percent average annualized return.

The data is clear: There has been dramatic stock outperformance by internal CEOs far surpassing external hires across recent Fortune 500 CEO successions.

The advantages of insiders include:

- Avoids coattail attributions of success. It is hard to determine from outsiders if they were merely part of a successful enterprise benefiting from the halo of that business or supported by less visible, superb team members who deserved the credit.

- Presents a verifiable track record of performance. The board has firsthand experience with the candidate’s achievements, strengths and leadership, while only indirect ways to evaluate an outside candidate’s likelihood of success.

- Can hit the ground running, knows where the bodies are buried; less likely to be fooled by sycophants sucking up to the new boss.

- Has trusted relationships with the board, management colleagues and key stakeholders—customers, suppliers, regulators, communities, etc.

- Reinforces morale in a company where loyalty is celebrated rather than undermined. Supports a culture of contribution with mentors and protégés seeing that investments in management development are valued.