In a new poll of CEO optimism taken before this weekend’s assassination attempt on former President Donald Trump, many of those surveyed seemed to be anxious already that—despite recent stock market records and retreating inflation—there was an increased level of risk to the economy, even if they could not pinpoint the source of their concerns.

Perhaps it was simply a pessimistic reflex developed after more than four years of constant disruption and volatility. “Something’s gotta give,” said one of the CEOs we surveyed, echoing others.

Most of the 140 CEOs we polled in July for the Chief Executive CEO Confidence Index agree business conditions will most likely improve over the coming months—51 percent said they expect things to get better, up from 45 percent in June. But the extent of those improvements, CEOs say, may turn out to be less than hoped for or expected earlier this year.

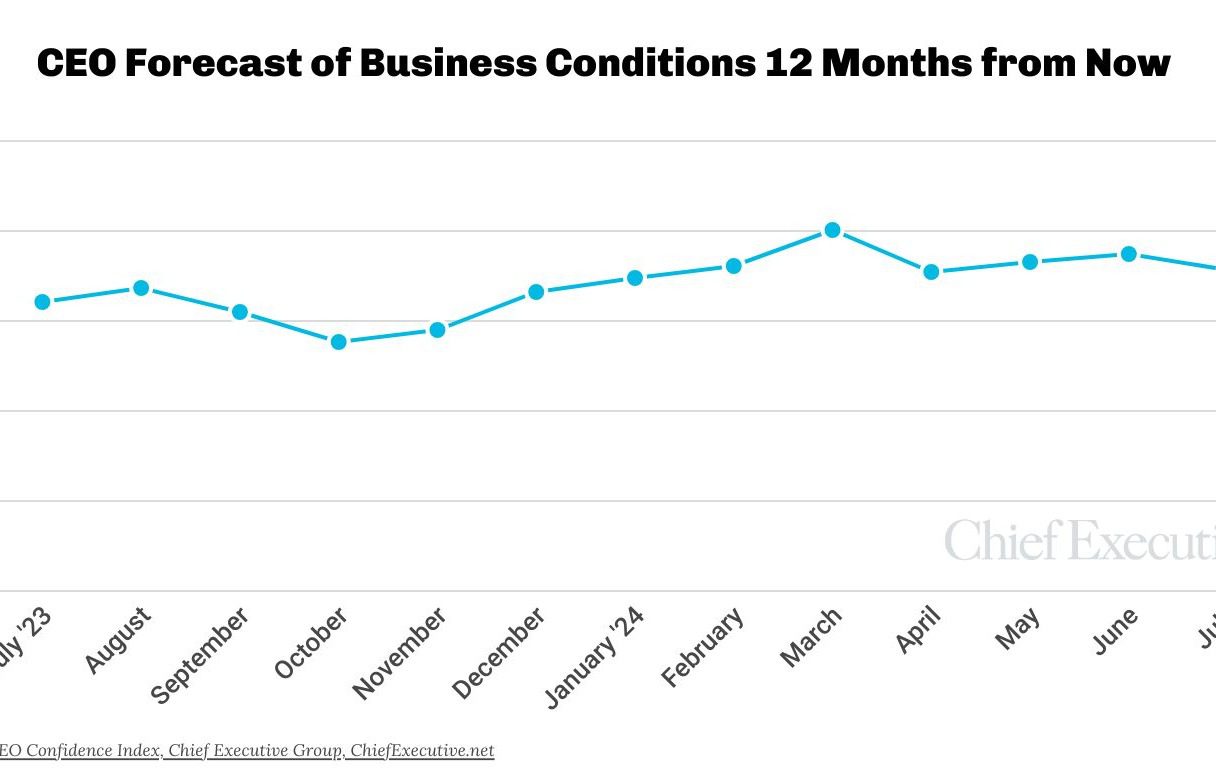

After back-to-back gains in May and June, CEO optimism slipped early July, returning to April levels. CEOs now rate the business environment in the U.S. 12 months from now at 6.6 out of 10, on a scale where 10 is Excellent and 1 is Poor—down from the 6.7/10 rating they forecasted just a month ago.

“The elements of uncertainty regarding inflation and the Fed’s management of it, the fluctuations within the labor market and the unemployment rate, the economic instability and military tensions within certain global regions, and the results of the pending U.S. presidential election all tend to bring about a little less optimism over the course of the next twelve months,” said Jim Vandegrift, president of Springfield, OH-based R&M Materials Handling, who still expects it to be a good year for business—just not as good as it is today.

That’s the general sentiment we find in our polling this month: at current levels, CEOs’ outlook for business 12 months from now remains strong—within “Good” territory according to the 10-point scale—just not as strong as it’s been in recent months.

CEOs’ assessment of current business conditions also declined 3 percent in July, to 6.1/10 from 6.3 in June. That rating is now at its lowest since November 2023.

THE YEAR AHEAD

According to our July data, a relatively high proportion of CEOs are now planning to increase capital expenditures in the year ahead, as interest rates promise to come down: 53 percent vs. 44 percent in June—an uptick of 20 percent in just one month and the highest proportion on record since the middle of 2022.

Meanwhile, in July 72 and 64 percent of the CEOs we polled now forecast increases in revenues and profits, respectively, over the coming year, compared to 76 and 71 percent in June.

In terms of hiring, July shows a slight decrease in the proportion of CEOs planning to increase headcount, 46 percent vs. 48 percent in June.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/