After a volatile 2025 where more than one-third of reforecast their revenue projections by mid-year—affecting their business plans and bottom line—it looks like things may improve in the year to come.

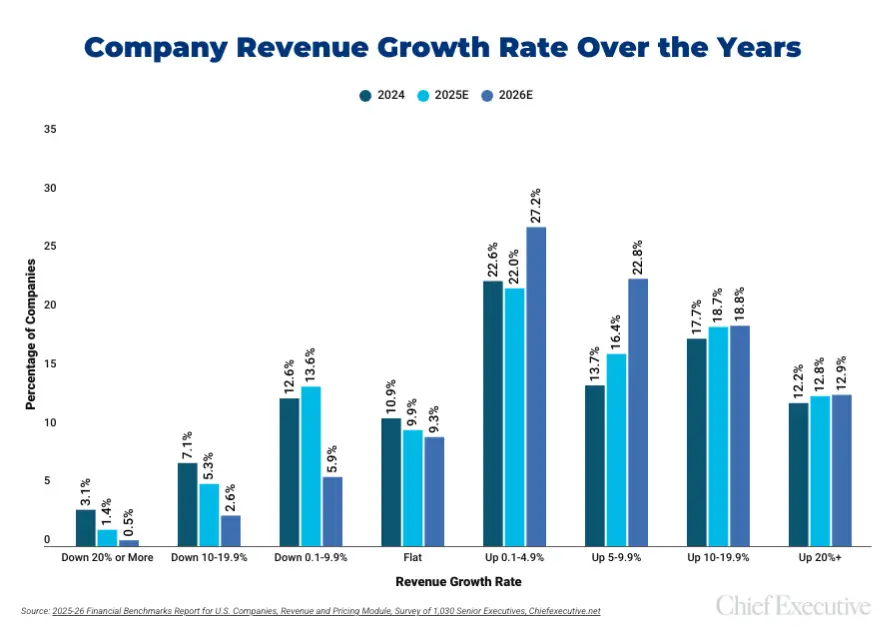

A Chief Executive Research survey of 1030 companies for our 2025-26 Financial Performance Benchmarks Report found the overall average revenue growth rate expected to climb to 7.9 percent in 2026––up from a projected 6.9 percent in 2025 and 5.6 percent (actual) in 2024.

Our annual Financial Performance Benchmarks Report is the largest survey of its kind in the U.S., charting profitability trends by company size, industry and ownership type across nearly every geography in the nation.

Revs By Company Size: Small, Shakey; Bigger, Slower

CEG Research found, once again, that small and mid-market companies expect more substantial revenue growth in 2026 than their larger peers, which tend to maintain more modest and consistent growth. Among the largest firms, a bigger proportion (14 percent) forecast no change to revenue into the new year compared to the smallest companies (8 percent).

The smallest firms suffer—understandably—the largest degrees of volatility when it comes to profit and revenue projections in our annual survey. Firms with under 100 employees expect the highest rates of decline in 2025—and largest recovery in 2026. Similarly, just 33 percent of companies with under $5 million in revenue reported a modest revenue growth rate of up to 5 percent in 2025. Now 45 percent are projecting this growth rate in 2026.

Among nearly all company sizes (except for the largest), the proportion of executives expecting no change in their revenues into the new year shrunk significantly since 2025 in light of new growth. Simultaneously, there have been significant reductions to the number of organizations expecting some kind of revenue decline in the next twelve months.

For companies valued at less than $5 million, for example, 14 percent provided a flat forecast in 2025, in comparison to 8 percent in 2026 (a decrease of 43 percent). Similar growth rates can be seen among companies of other sizes.

The Revs vs. Profit Picture

As you’d expect, revenue growth is closely correlated with profitability, and firms with the highest EBITDA values expect some of the most significant (over 10 percent) growth by this time next year.

Across the profitability scale, there are more companies expect moderate revenue growth of 5 to 9.9 percent into 2026 in comparison to 2025. For organizations with an EBITDA of 10–14.9 percent, for example, just 21 percent forecasted moderate growth in 2025, in comparison to 24 percent in 2026.

Unprofitable firms are the most likely to forecast unchanged revenues (32 percent) in comparison to 2025, although a sizeable proportion (just under 30 percent) do predict decreases.

A Look Back: Total Net Revenue in 2025

Total net revenue per employee is expected to rise just 0.3 percent (from $265,714 to $266,667) at the median in 2025, in comparison to healthier growth over 2023–2024. At the top quartile, however, net revenue per employee is forecasted to decrease by 6 percent this year––from $533,929 to just $500,000––suggesting a stagnation in productivity among firms at the median, and a measurable fall among those within the top quartile.

For a detailed breakdown of profitability trends by company size, industry and ownership type, and to benchmark your own business performance, refer to the 2025–26 Financial Benchmarks Report for U.S. Companies from Chief Executive Group.