After rebounding in early 2019 from a weak year-end performance, CEO confidence in current business conditions eroded again in April, losing 3% month over month and 2% since the start of the year. With a rating of 7.1 out of 10, the Index is now 4% off its level at the same time last year.

After rebounding in early 2019 from a weak year-end performance, CEO confidence in current business conditions eroded again in April, losing 3% month over month and 2% since the start of the year. With a rating of 7.1 out of 10, the Index is now 4% off its level at the same time last year.

Confidence in business conditions 12 months from now also declined in April, down 1% since March and 7% year over year. At 6.7/10, the Index is up 1% since the start of the year.

Nevertheless, the confidence levels in both current and future business conditions, as measured by Chief Executive’s April poll of 379 CEOs, remain in “very good” and “good” territory, respectively.

Note: Chief Executive’s CEO Confidence Index is measured on a scale of 1-10. April poll had 379 responses.

Note: Chief Executive’s CEO Confidence Index is measured on a scale of 1-10. April poll had 379 responses.

CEOs we surveyed say their confidence stems from strong, sustained fundamentals and consumer confidence. There is increasing consensus that unemployment and interest rates will remain low, and many say that while there may be a slowdown ahead, we are now clear of a recession. CEOs also reported a growing sense of “settlement,” as trade barriers seem to be easing.

This issue of tariffs, however, remains unresolved and, paired with slowing global growth, those concerns weighed down CEO confidence in April, warranting caution and influencing companies to pause large capital projects. CEOs say adding to the uncertainty is how the 2020 campaign will impact the business climate and increase market volatility.

Dr. Teri Baydar, whose firm provides coaching and leadership development training to the C-Suite, says her clients are concerned about the amount of “unknown” in the business climate. “They express a feeling of not wanting to take risks because conditions could change at any moment,” she says. “They are behaving in a more retracted and fear-dominated state of mind compared to just a few months ago.”

The CEO of a professional services firm says he also observed this cautionary stance in his clients. “The economic uncertainty is making planning harder than ever and causing companies to hold back,” he says to explain his rating of future conditions of 7 out of 10. He nevertheless expects revenues and profits to be up by a considerable margin at this time next year.

Overall, the Fed’s decision to halt interest rate increases, continued deregulation and hopes that the U.S. will reach a trade deal with China are counterbalancing the uncertainty and bolstering sentiment at the moment. And against this backdrop, the proportion of CEOs anticipating increases in revenue, profits, capital expenditures and headcount over the next 12 months rose significantly in April, after a sharp decline in March.

Eight out of 10 CEOs anticipate revenues to be up by this time next year; 35% of which are forecasting double-digit growth. Similarly, 35% of the 71% of CEOs who expect profits to increase within a year are also forecasting double-digit growth.

In terms of investments, 54% of CEOs expect to add to their workforce over the next 12 months, and 58% are planning on increasing capital expenditures.

OPTIMISM WANES ACROSS MOST SECTORS

OPTIMISM WANES ACROSS MOST SECTORS

When examining confidence levels by sector, retail/trade CEOs reported the lowest level of confidence in the future, at 6.3 out of 10, a decline of 23% in only one month. This is, however, a reversal of trends for the industry, as its confidence is now up 5% since the same time last year. CEOs say that while they have observed an overreliance on credit and weakening demand year to date, strong job creation, low interest rates and a good stock market are boosting their optimism in the future.

Consumer manufacturing CEOs are also among the least confident of the peer groups in April, with an Index of 6.3/10. That is 14% lower than the same time last year and 10% off March levels. For them, trade is a top concern, along with the risk of a considerable economic slowdown. The challenge to find qualified talent is also an issue for the sector, as is the pressure placed on wages as a result.

On the upside, construction/engineering/mining CEOs are showing the most confidence in conditions 12 months from now, ranking the business climate a 6.9 out of 10. Despite this positive forecast when compared to other sectors, this remains 10% below last year’s confidence level and 8% lower than where it was in March.

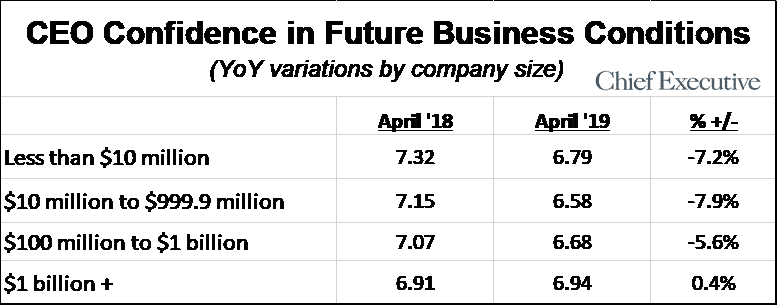

Looking at confidence from a size perspective (in terms of annual revenue), all peer groups are either down or flat in April from the same time last year—much a repeat of last month’s YoY reading.

And for a third consecutive month, small and large company CEO confidence, when examined on a month-over-month basis, continues to move counter to that of mid-market CEOs. For large company CEOs ($1 billion +), robust fundamentals and strong equity markets are more than compensating for the uncertainty pertaining to trade issues.

And for a third consecutive month, small and large company CEO confidence, when examined on a month-over-month basis, continues to move counter to that of mid-market CEOs. For large company CEOs ($1 billion +), robust fundamentals and strong equity markets are more than compensating for the uncertainty pertaining to trade issues.

Their smallest counterparts (<$10M) tell a similar story: current economic indicators, easing of regulations, consumer demand and a belief that markets will remain strong through the election cycle are supporting confidence in the next 12 months, although they say the uncertainty of what will happen next warrants some degree of caution.

About the CEO Confidence Index

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across corporate America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. The results are used as key indicators by media outlets throughout the world.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.