In any normal year (if there is such a thing these days), business optimism would likely be frazzled by the slew of challenges, from geopolitical unrest to high interest rates to a likely rocky presidential election on the horizon.

But the 131 CEOs we polled in February don’t seem to be feeling the pressure. When asked to rate the current business conditions, they gave it a 6.3 out of 10, up from 6.2 in January—and the third consecutive increase.

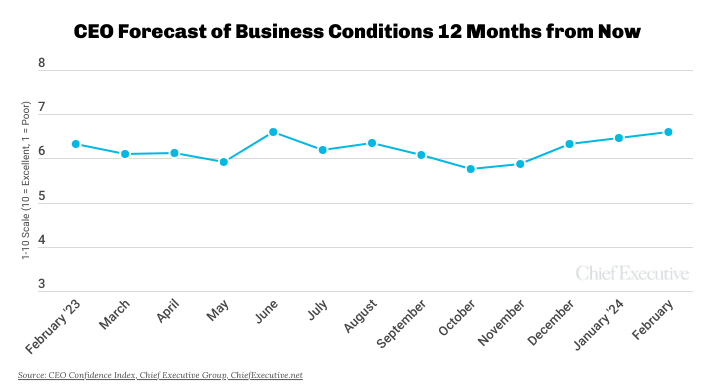

But there’s more. They also remain highly bullish on the economy over the next 12 months. In fact, CEOs’ optimism for business in the year to come climbed another 2 percent this month, compared to January. This is the fourth consecutive increase, which puts our leading indicator of CEO confidence at 6.6, measured on a 10-point scale where 10 is Excellent and 1 is Poor—the highest it has been since last June (also 6.6) and only surpassed by March 2022 before that.

CEOs say their growing optimism stems from demand starting to pick back up, the lure of interest rate cuts happening sooner rather than later and a potential correction of the labor shortages.

“Our business is strong right now, and conditions seem to have moderated a bit versus the very inflationary environment we experienced the last couple of years,” said Don Ochsenreiter, CEO of Dollamur Sport Surfaces, a middle-market manufacturer of athletic sport mats based in Texas.

Jon Kramer, president of OHM Advisors, an AEP with locations across Indiana, Kentucky, Michigan, Ohio and Tennessee, said he expects conditions to be “very good” by this time next year—at 8 out of 10. His reasoning: “solid funding for our industry, falling interest rates, strong demand for our services, and we will be past the election noise,” he said.

“There will be more certainty following the election,” agreed Steve Schiller, president of engineering firm John A. Martin & Associates Of Nevada. “The results are less important than being out of an election year.” He rates his forecast for business 12 months out a 9 out of 10.

Overall, nearly half of those polled (44 percent) in February say they forecast improving business conditions over the next 12 months. Only 27 percent expect things to deteriorate—one of the lowest levels in three years.

To put it into perspective, over the entirety of 2023, barely one third of CEOs on average reported feeling optimistic in the business environment. That proportion averaged only 29 percent in 2022. So far in 2024—though the year is young—the average is 45 percent.

An Election Year

Among those CEOs expecting conditions to worsen this year, the great majority cited the presidential election as one of the main culprits for their concern. Elections, after all, bring uncertainty—especially in our current environment.

But looking at the historical data collected from our monthly survey of CEO confidence, which we’ve been running since 2002, none of the past five election cycles show a trend as to the impact those events have on CEOs’ level of optimism (or pessimism)—at least none that could help forecast what to expect in the markets for the months ahead.

Instead, the fluctuations in CEOs’ optimism during the past five elections are mixed—ranging from a YoY jump of 25 percent in confidence in 2004 to a 40 percent drop in 2008—and a lot of other movements in between.

That’s because it’s difficult to isolate the impact of the election alone, especially if you consider everything else that happened during those years: from the Iraq war to the Great Recession to a global health pandemic.

So, it didn’t come as a surprise that despite the disruption the upcoming election may cause, most CEOs aren’t—at least for now—too concerned about its impact on business.

THE YEAR AHEAD

As optimism rises, we observe a positive correlation with the proportion of CEOs forecasting profits, revenues, hiring and capex to increase.

- Our February data found 72 percent of CEOs polled forecasting higher revenue by this time next year (from 75 percent last month and 70 percent on average in 2023).

- 65 percent said they also expect enhanced profitability (from 66 percent last month and 60 percent on average in 2023).

- 45 percent said they plan to bump up capital expenditures this year, from 43 percent last month and 43 percent on average in 2023.

- And perhaps most telling of the optimism over the resolution of the labor crunch: 56 percent said this month that they intend to increase hiring in 2024—up 18 percent from January (and a 46 percent average in 2023).

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/