Looking For Growth? First, Define The Market

There’s a common adage that you need at least a billion-dollar market to make an exciting business. That is not necessarily true for all businesses—it’s totally fine to own and run a small, cash flow-positive company. However, the sentiment is definitely true if you are looking to be a venture capital-based business or any business that has “scaled” long-term growth prospects—which typically means a business with the potential to be at or over $100 million. This is because you need to ensure that you have enough clearance in your market to grow market share and support long-term growth. If you are looking for capital with investors, they are going to want to ensure the market is large enough to support your valuation so that they can get a reasonable return.

So, to reiterate, a $1-billion-plus total addressable market (TAM) is important because you need a high enough ceiling in a marketplace to operate. If your market is small and crowded, you’re going to have compression. The market may be attractive, but that compression inevitably means that you will have new and existing entrants all competing for your customers, suppliers, leads, etc. For instance, if you are relying on paid installs or paid traffic for customer acquisition, the competition will continually drive up your costs as activity intensifies. I have seen this time and time again, from shopping marketplaces to travel. I once ran a gaming business and there we saw that having size and scale ensured that our company had better margins and could outprice the competition.

In all these matters, the situation gets worse with a smaller market. Your upside is capped (because it’s small), and the market becomes inefficient over time. It’s a lot easier to operate in a larger market with several different types of serviceable, addressable markets—a subject we will get into in the next chapter.

Big TAM but Where Are You Servicing It?

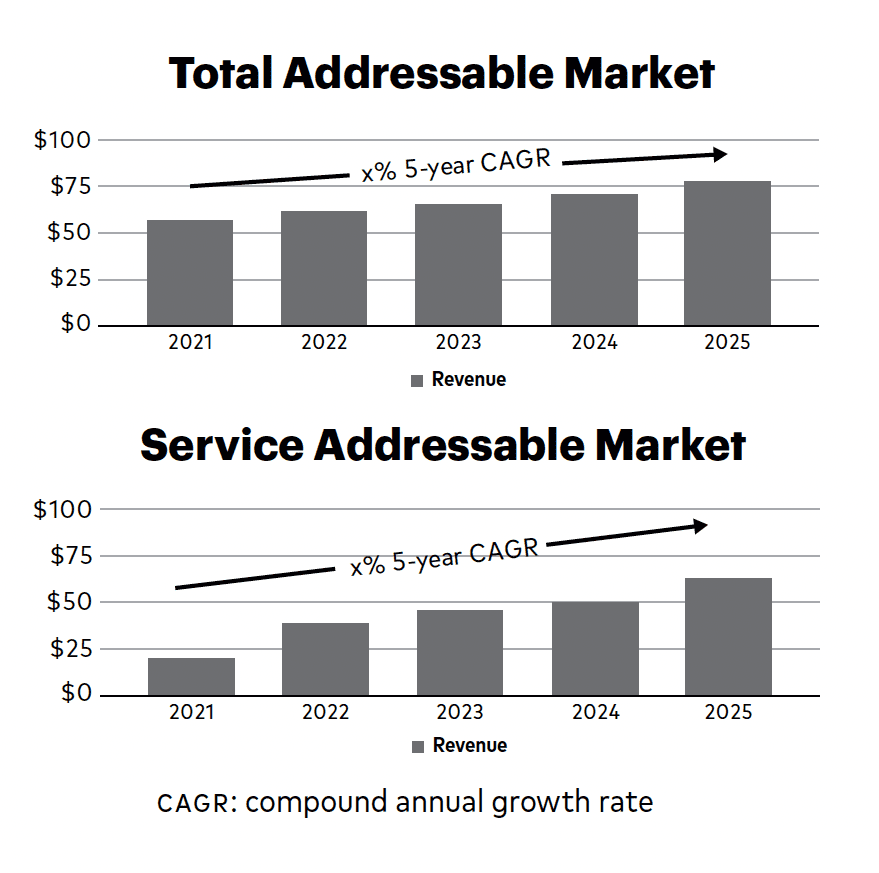

So you need a big total addressable market, but you also need a large and growing serviceable market. The SAM—serviceable addressable market—is where your company or products address a set of customers. It’s rare to have a SAM that is as large as your TAM. Identifying an addressable market where you can have some competitive advantage is important, especially if you can find a SAM that is growing faster than the overall market. This is a great opportunity to get an edge in the marketplace. It’s a good place to knock down your first proverbial bowling pin.

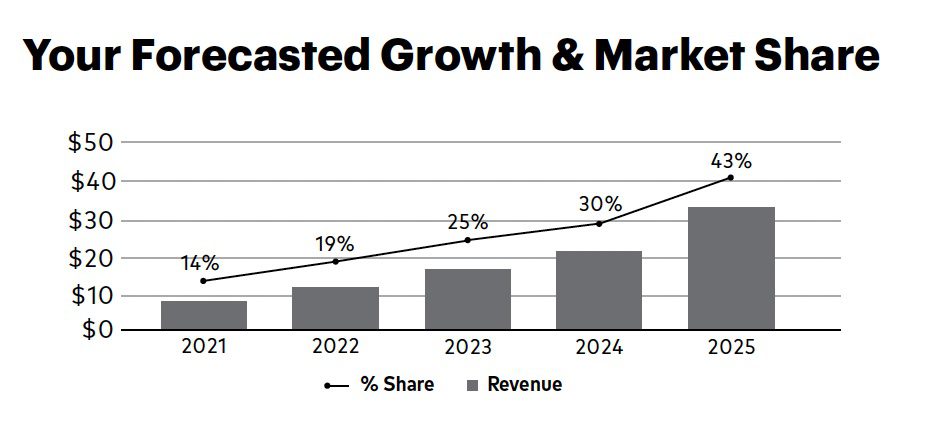

Understanding your SAM enables you to focus and get a wedge into the market. It’s a great place to start. There are several ways to look at the market. You can look at how you’re growing against the overall size of the market, which can be unit market share or as a revenue leader. Or you can compare your performance against the TAM and SAM to see how your relative performance is tracking.

I’m always surprised to see entrepreneurs talk about their total addressable market without understanding who they’re targeting within that market. In the B2B space, you are typically targeting via firmographics to slice up your TAM and SAM. In the consumer space, it is typically both demographics and psychographics for determining your target.

In fact, when I worked at IAC (InterActiveCorp, a holding company that is the mastermind of media and e-commerce mogul Barry Diller), we literally just talked to a version of the following diagram. You have to look at the TAM, the SAM, and what percentage of each market you can obtain. Those three numbers mapped over time should give you a strong sense of whether you have found a compelling business proposition with a large enough operating pond.

I really want to stress

I really want to stress

One example of looking at the TAM and SAM is my experience at Expedia. Today, Expedia is a $22-billion-plus publicly traded online travel e-commerce juggernaut. I joined the company right after September 11, 2001. I was just coming off a difficult startup experience and was looking to do something from the ground floor but at a bigger company.

Travel is one of those monster categories that never ceases to innovate. The global category is over $9 trillion, and online travel alone is over $300 billion. Just when you think there isn’t any more innovation, another new startup brings a new twist to this mongo market. It reminds me of the patent office quote that “everything that can be invented has been invented.”

I started at Expedia as the lone employee tasked with building a B2B business. Expedia was and still is primarily a consumer business. They’d had a couple of unsuccessful attempts at the corporate travel space prior to my arrival. One of these had been a partnership with American Express, which is not only one of the largest credit card companies but at the time was also the largest seller of travel (especially corporate travel) in the world.

That partnership went horribly wrong, in a way that reminded me of when Microsoft tried working with IBM. IBM wanted Microsoft to build a graphics-based operating system called OS/2. Microsoft built its own system called Windows as an upgrade to DOS. Windows became the focus, and OS/2 became a dud because of Microsoft’s focus on their own OS. That is sort of how it went down at Expedia. American Express wanted to white label Expedia for their corporate needs, but Expedia really wanted to focus its energy on a direct-to-consumer play versus a white label (where the customer doesn’t realize that Expedia is powering the experience) or OEM play (an “original equipment manufacturer,” where a company produces a product to be marketed by another company).

Travel is a size and scale game. There are lots of intermediaries and lots of services: hotels, cars, air, destination services, etc. Expedia had only focused on consumers, which is about half the market. The other half is corporate travel. I helped launch the online corporate travel business, Expedia Corporate Travel, now known as Egencia.

Given that it’s half the travel business, one would expect to see more innovation in this space. The larger travel management companies control most business travel spend; when we were launching Expedia Corporate Travel twenty years ago, the top six agencies (American Express, Carlson Wagonlit Travel, etc.) controlled three-quarters of the gross bookings market. This is what the market looked like. At the time, it was around $260 billion in the U.S., and much larger worldwide.

The main features then were:

• Fortune 2000 (employee size over twenty thousand) made up approximately 35 percent of the travel spend.

• Large enterprises (employee size between fourteen thousand and twenty thousand) made up approximately 30 percent of the travel spend; this is over ten thousand companies.

• Medium-sized businesses (employee size between one hundred and two thousand) made up approximately 25 percent of the travel spend; this is about 100,000 companies.

• Small-sized businesses (employee size between one and ninety-nine) made up approximately 10 percent of the travel spend; this is about seven million companies.

It’s simple, right? Go after the top enterprises and close them just like a consumer business. Going back to our previous work on the TAM and SAM, we can break down an approach that gives us initial “successful” product/market fit. It’s too easy for a budding entrepreneur to look at a big market and say, “Why don’t we just target everyone in the marketplace?”

When you look at TAM and SAM, it’s also important to look at your entry points. For consumer businesses, it could be demographic and psychographic information. Say you want to target female health and wellness aficionados that are between 25 and 45 and have college degrees and care about social issues. You would go to market with different propositions and positioning than if you were targeting stay-at-home moms. Every market has an entry point, and every persona and firm have different wants and needs.

For this case study, we are talking about B2B. For B2B you have to think about the size of the firm (which drives the type of buyer and budget) as well as the firmographic. Firmographics are specific attributes that enable you to target companies. It can be the size of the firm (by revenue and employees), the vertical (defined by what is called a SIC (Standard Industrial Classification) code), and even geography.

Bringing it back to this example, we realized that we had a couple of hurdles. One, Expedia was known as a consumer brand, not an enterprise brand. We knew that we would not be taken too seriously by larger companies. We also knew that the larger enterprises wanted a lot of customization to their product. Online booking was also very new at the time, and most corporations were still using off-line travel agents.

Our plan was to build a product that had company-specific content (their own negotiated rates) as well as Expedia’s significant arsenal of its own content. We wanted to be the market maker with suppliers by pooling our scale to negotiate better rates on behalf of thousands of smaller businesses. We looked at all the conditions in the market and realized that the largest corporate clients would kill us with custom requirements and their low-margin-minded current customers, the traditional corporate travel companies. “Low-margin-minded” means fee-based, usage compensation—and lower profit margins.

After much analysis and testing with customers, we found that our proposition really worked for companies that were technology-centric (like technical and software companies) but not large enough to have a lot of negotiated rates. They needed Expedia’s content to supplant their own size. This enabled us to focus on several verticals in the mid-market, and we were able to get feedback on our business without having to become defocused on the wants and needs of every customer. It also enabled us to focus our efforts on having a clear value proposition while avoiding an expensive battle competing against large players that had been in the market for 30-plus years.

So our analysis went from a larger total TAM in the corporate travel space to a SAM in the mid-market, and then to a more focused strategy of zooming in on a couple of verticals. Getting this clear in your market entry enables you to define a clear product and proposition on which to focus and become successful. You can then expand into other verticals and firmographics over time. This strategy is clearly defined in one of my favorite business books, Crossing the Chasm. The author, Geoffrey A. Moore, discusses the importance of a bowling pin strategy: focusing on your initial customer and then expanding from there in order to knock down the rest of the bowling pins. That is the only way to get a strike in a marketplace. You can knock all the bowling pins down in a market by focusing only on the front row.

Adapted with permission from Unlock: 5 Questions to Unleash Your Company’s Hidden Power (Page Two, May 2022).

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.