Few other companies—not even, say, Google—seem to excite such extreme passions. Depending on whom you’re talking to, Monsanto, the agri–biotech company, is either Satan or savior. Not bad for a B–to–B company that, apart from its commercial weed–killer Roundup, is largely unknown to the public. The observation brings a knowing expression to the face of Hugh Grant, a tall, laconic figure who speaks with the soft Glaswegian accent of his native Scotland. Since becoming chairman and CEO in 2003, he has led the $12 billion St. Louis–based company through a series of moves focused on developing products that help farmers grow more crops by using resources more efficiently. Trained as a molecular biologist and agricultural zoologist, Grant and his team have overseen the company double in size. “I seldom see leadership teams that are as collaborative as the one Hugh leads,” observes Brett Begemann, the firm’s EVP of seeds and traits, who has worked with him the longest. In 2009, the company sold $7.3 billion in seeds, biotech traits within seeds and herbicides—almost double that of its nearest competitor and 15 percent higher than the previous year. Under his leadership, total annual average return to shareholders exceeded 27 percent, with net income CAG reaching 23 percent. During this time, Grant increased the company’s R&D investment to more than $2.5 million a day.

The criticism Monsanto encountered when it transformed itself from a chemical to a biotechnology company in the late 1980s centers on its strategy of modifying the genes of corn, soybeans and cotton. The fact that civilization has been selecting for genetic traits for 6,000 years was dismissed by critics who argued that genetic modification of plant seeds would lead to “Frankenfood.”

Opposition to crop biotech has somewhat abated, as farmers around the world have voted with their plows. It’s easy to understand why. The company’s seeds contain genes that resist bugs and tolerate weed–killing pesticides. India, Brazil and Argentina have planted millions of acres of cotton and soybeans with enhanced traits. Ag–biotech continues to face resistance in Europe, but 14 million farmers in 25 countries planted 330 million acres in 2009, up 7 percent from 2008. In the U.S., about three–fourths of the corn and soybeans is grown with seeds containing Monsanto’s technology.

In fact, Monsanto now has the opposite problem, in that its success in crop biotechnology has drawn the attention of Department of Justice antitrust chief Christine Varney. Nor is the sector short of aggressive competitors such as Syngenta, DuPont, and BASF, among others. (Monsanto broadly licenses its technology, even to competitors.)

The issue of agricultural resource constraints, which promises to become more acute, lies at the core of Grant’s strategy. Currently 70 percent of fresh water in the U.S. is used for agriculture, with the rest used for drinking and personal needs. In other regions of the world, such as Africa, that figure rises to 90 to 95 percent. Add to this U.N. population projections that another 9 billion people are expected to show up on this planet over the next 40 years. How will they be fed? And this does not take into consideration that the Chinese, to cite just one group, are rapidly changing their diet to include more meat. Somehow the additional corn needed to feed beef cattle must be grown to make this possible. Recently CE’s J.P. Donlon caught up with the 2010 Chief Executive of the Year and his team in St. Louis to explore their focus on sustainable agriculture.

Helping the world feed itself seems innocuous—even admirable—but in our sustainability–obsessed world it’s become controversial. When you took this job in 2003, did you understand what you were up against?

Agriculture finds itself in the middle of discussions on global policy issues concerning food, global warming and water, among others. And because Monsanto is in the middle of the agricultural source of all this and has relevance to these larger global concerns, it is at the center of strong visceral reactions. If it were not Monsanto, it would be some other company.

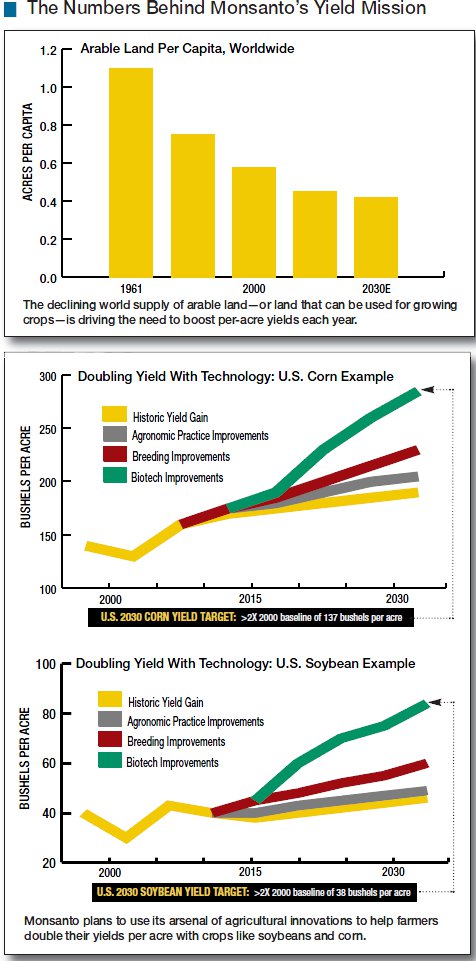

In our lifetime, certainly in your son’s lifetime, there will be another three billion people living on the planet—the equivalent of two more Chinas. There’s not much argument about this. How will we feed them and how will they have enough water? At the same time farmland is disappearing as urbanization increases. So the challenge is: How do we produce more on fewer acres of arable land?

Improving productivity is the only answer. There are those who argue for keeping everything as it is and hoping for the best, but that is not sustainable. We are among those who see a tremendous opportunity in trying to shift the slope of the productivity curve in increasing yields of key crops. That’s what our scientists—about 3,500 researchers, of which one–fourth are PhDs—wake up every morning thinking about.

How will Monsanto’s efforts move the needle on a challenge of this magnitude?

We’ve moved the needle a good bit already. We’ve improved the base seed itself. Civilization has been improving traits for thousands of years. We’re getting there quicker by improving the genetics. It’s like breeding Thoroughbred racehorses. We’ve just advanced the capacity to yieldmore.

We spend $1 billion a year on R&D, and half of that goes to improving the genetics of that seed. For example, we’re building genetic street maps of certain seeds that allow one to predict with greater accuracy what the attributes will be. It permits having better–performing, better–quality seed that’s more attuned to the environment that it gets planted into.

The other 50 cents of the R&D dollar goes to biotechnology. This may involve, for example, the fight against weeds and bugs. Further into the future, the focus will increasingly be on water usage. In North America, agriculture gargles its way through 70 percent of the area’s supply of fresh water. In Africa, that figure rises to 90 percent, and often to 95 percent. So creating crops that require less water to grow and using fertilizer more efficiently will improve yield. That’s the next chapter for the company.

So is drought tolerance the equivalent of your Lipitor or Viagra?

It has the capacity to be a blockbuster, to use your pharmaceutical example. We haven’t made any projections, but it would be in the $1 billion–plus range.

The learning from the pharmaceutical industry is to work out how to share one’s product at the early stage with people who aren’t able to pay you for it. Three years ago, we started to work with a team at the University of Nebraska on this. The need for drought–tolerant crops is most acute in sub–Saharan Africa, where the climate is hot and the shortage of water is acute. We donated the technology to an NGO on the ground in Africa that comes out of USAID, that will guide villagers on its use. Both the Gates Foundation and Warren Buffett’s son, Howard Buffett, who’s a farmer just across the river here, who kicked in $47 million, have helped. A product that will move the needle will be launched, probably in three years, in Africa.

Spending $1 billion on R&D, you have considerable intellectual property to protect, and, considering that you charge a premium for seeds, how do you convince farmers they’re worth the extra cost?

Simple. You have to deliver yield on the farm. The sophistication of the grower has increased enormously. The grower is running a combine, a John Deere equipped with a computer with a satellite uplink, through his fields that gives him accurate yield data on every square yard. This is the norm, not the exception. He knows the yield and gross margin right away. If your product can provide an incremental yield improvement, you’re invited back next spring. If you don’t, then you’re not. We sell technology solutions to a grower who grows globally traded commodities. It’s absolutely focused on efficiency leverage.

Yes, but as Intel’s Andy Grove used to point out, one’s technology lead is never permanent. Syngenta, for example, is introducing a drought–tolerant product. How do you maintain a lead and a price premium?

That’s the key question, because it’s an increasingly crowded and competitive space. That’s the nature of this business. Growers are discerning customers, focused on functionality. The way you stay ahead is through the strength of your technology. Hence the 11 biotech advancements in our R&D pipeline. In addition to the drought–tolerant corn, we have drought–tolerant cotton. We’re developing insect–protected soybeans, where the protection is within the seed itself. We’re working on high–yielding corn aimed at boosting the potential of corn hybrids. Also, we’re working on corn that uses nitrogen more efficiently, giving farmers more choices.

Products that deliver consistently on farms will provide the competitive edge. Despite an increasingly crowded field, our products yield better. The increment of yield translates into premium price position. It’s that basic.

Speaking of feedback, some analysts contend that due to increasingly aggressive low–cost competition, Monsanto has been unable in recent quarters to increase market share in some of its businesses, forcing a change in core strategy. Explain what has happened recently and what it means for the future.

The strategy’s still the same. It’s more about how we’re executing. We have two challenges right now. One is our Roundup business, which is 35 years old, still important and a nice profit generator, but every year it declines as it’s diluted by the growth in our seed business. We’re faced with a challenge from Chinese generics, which are about half of the world’s supply. We are in the process of skinnying down, revising our cost structure as prices decline.

On the seed side, our product strategy remains exactly the same. We’re taking another hard look at how we price. Since themid ’90s our pricing approach had been to introduce them at a lower price point, and as they grow and experience with those technologies expands, we would grow our prices within the segment.

But with the newer products that are significant differentiators, we have to position and price them accordingly. For example, yield in soybeans on a yearly basis increases by about a percent a year. So every year, the grower would see about a 1 percent yield improvement, based on genetics.The product that we’re rolling out, Roundup Ready 2 Yield, delivers 7 percent to 11 percent more yield— representing a five– or six–year yield advantage in one year. Launching something that represents five years of incremental value in the first year— the technologies are game–changers— presents a positioning challenge.

An asset manager at an investment fund based nearby was horrified to learn that Monsanto was chosen as this year’s honoree. She didn’t use the word “evil,” but it was clear that was what she meant when referring to the company prohibiting farmers from reusing the seeds it sells. Asked about Microsoft or HP penalizing those who violate the terms–of– use of their products, she rejected the analogy, saying that while North American farmers can afford to buy the seed each planting season, South American farmers cannot. To her mind, and to those other highly educated urban professionals we encountered, this practice makes Monsanto yet another example of a heavy–handed U.S. multinational bullying indigent peasants.

The romance with agriculture is directly proportional to the distance that you are from it. I spent five years in Asia and spent a lot of time in rural India building our business there. There is no romance in it. In small landholder farming you get up before the sun comes up, draw water from a well, cook breakfast for your kids and go out and work until it gets dark. And then you collect firewood on the way home. You cook an evening meal for your kids, and you repeat that until you can’t do it anymore.

We have more farmers growing our biotech cotton in India than we have in America, including the entire Mississippi delta and all of Texas. The reason is that it works better. It yields more and costs less. Farmers—by the way, most farmers outside North America and Europe are women—are super smart. They figure out what works real fast. In our research talking to women in India about product that kills bugs and worms, they don’t talk about bug control. They talk about spending less time in the field. The biggest perceived benefit, they say, is that “I’ll get more time withmy family.”

Cumulatively, no more than two billion acres of these crops have been planted. The first billion acres took 10 years. The second billion took three years. How is that possible? It’s because a big piece of the second billion is smallholder agriculture—the very people your Greenwich fund manager thinks are oppressed. They are rushing towards it. Brazil, Argentina and Mexico are stepping up their use of insect–protected cotton, not because of Monsanto, but because the economics dictate it.

There will always be people who will not be persuaded by the facts, but to the vast middle ground we’re seeing a more constructive dialogue. The fact is that farmers are ahead of the critics. They look around and see the reality—that there will be more people on the planet to feed and clothe. They aren’t persuaded by some government’s ag policy or by any company’s clever marketing.

Describe this company five years from now. How will it be different?

I’m always worried about dramatic sharp turns. I call it the Jetsons effect, where it’s assumed everyone is traveling in personal spaceships. The nice thing about our business is the investment cycle. You plant a seed, you harvest a handful of seed; you plant a handful of seed, you harvest a truckload. Five years from now, our business will have grown to the mid–teens in revenue, generating well north of $1 billion in cash. It will be a business focused exclusively on biology, sitting comfortably in the Fortune 100.

By 2016, we’ll have commercialized our first drought–tolerant products. We’ll be seeing the first of those products in the hands of growers in sub–Saharan Africa. And we’ll have made significant progress on our yield genes. We will havemade significant progress in the early ramp towards doubling yields in corn, soy and probably cotton. Five years is only four spring plantings from now.