Chief Executive’s April survey of CEO confidence, fielded April 1-3, finds CEO confidence in the current business environment fell by 34 percent since March to an anemic 4.3 out of 10, on our 1-10 rating scale. This is the lowest level in our survey’s history, slightly down from Q4 2011 when the U.S. national debt topped GDP for the first time since the late 1940s.

Yet, optimism for business conditions one year from now remains high among polled CEOs. At 6.7 out of 10, the leading indicator is still flirting with “very good” territory (achieved at 7 out of 10)—and remains far higher than it was during the trade war last summer.

Many CEOs say they believe pent-up demand, government stimulus and rock-bottom low interest rates will drive the resurgence of most businesses by the end of June—although many admit they are basing their forecast on hope rather than data. While the robustness of the economy pre-crisis is a factor several respondents cited to explain their optimistic view, the majority say it is based on the assumption that the U.S.—and the globe—will soon get COVID-19 under control and find a cure or treatment.

“I’m assuming the good economic fundamentals we had going into this recession will be present to help us rebound quickly following COVID-19, and that we will have testing for the virus and anti-bodies that will allow a sufficient portion of our workforce to get back to work by summer,” says the CEO of a mid-sized construction company who has had to furlough a portion of his workforce and close facilities. He, nonetheless, sees business as “very good” a year from now, rating his forecast an 8 out of 10.

“The effects of COVID-19 on the economy [will] start to ease up in mid- to late summer. By this time next year, business should be picking up again—especially if treatments are found,” says the president of a global tech company whose revenues haven’t yet been impacted by the crisis. He advises CEOs to “keep calm and don’t rush back to normal too early.”

“Our optimistic view is that this crisis will resolve by the end of June, and then we will see a V-shaped recovery,” says Michael Uffner, CEO and chairman of mid-sized AutoTeam Delaware, who says he does not intend to furlough or lay off any employees despite projecting revenues to decline by 50 to 80 percent in April. He advises other CEOs to “conserve cash and employees” to emerge strong from the crisis and take advantage of what he forecasts as a “very good” economy a year from now. Until then, however, he views business conditions as poor (2 out of 10) and has chosen to cut costs by reducing senior executive salaries, closing facilities, halting all business travel and slowing payables, among other actions taken.

“Demand is there, and the business will come back,” says George Bell, CEO and president of Office Resources Inc. (ORI) who has had to furlough and lay off some employees and apply for an emergency loan to counter declining revenues. While he views the current environment as weak (4/10), he projects business conditions will be very good (8/10) one year from now.

“We think there will be pent-up demand, and, with low interest money, [the economy] will come roaring back,” says Bob Case, CEO of GARDINER, a mid-sized construction company in the Midwest. He is among the 9 percent of CEOs with a 10/10 outlook of business conditions this time next year, despite the fact that he anticipates revenues to continue to decline over the coming weeks due to the crisis.

“After this horrible pandemic, the economy will quickly ramp up and, in three months, get back to what it was in January,” says Brian Engel, CEO and chairman of Strategic International, a small global manufacturer of industrial goods. While his company has had to lay off some employees and reduce wages after seeing revenues decline by more than 80 percent in March, he expects business one year from now to be stellar, rating it a perfect 10 out of 10.

“This is a short duration issue; two-three months. It will take time to recover, but it’s not a financial system crisis,” says Steven Leafgreen, CEO of Western Vista Federal Credit Union. He advises CEOs to “look at this situation as something to bridge. We will make it through it. But we need to find ways to get through it.”

Amid the current environment, 69 percent of CEOs are now expecting revenues to decline over the coming year, compared to 19 percent just last month. Similarly, 68 percent expect profits to be lower, vs. 19 percent in March. Nearly half (48 percent) anticipate cutting their headcount in the months to come (14 percent in March), and 59 percent forecast decreasing capital expenditures (vs. 17 percent the previous month).

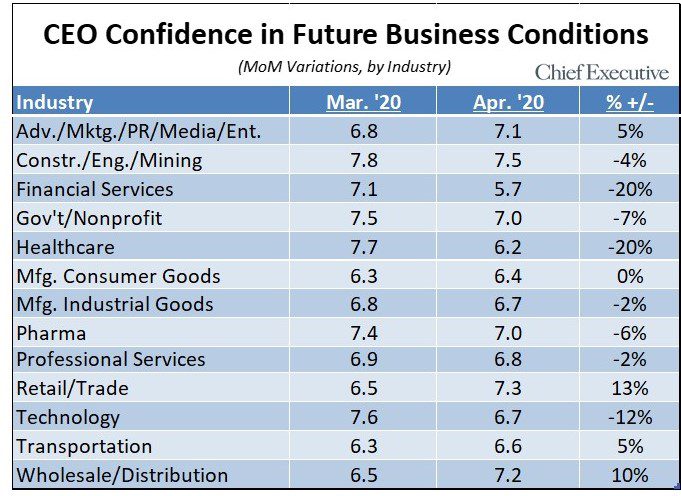

Expectedly, the impact of the COVID crisis differs by industry, business model and company size. When looking at the industry component, the data reveals highly significant variations across sectors. The confidence level of Financial Services CEOs, for instance, dropped 20 percent over the past few weeks, while Retail/Trade CEOs show an increase in confidence of 13 percent, which some say is due to new opportunities in the current climate.

“Competitors are giving up too early, driving business toward our door,” says the president of a small company in the sector. “Some will not recover due to high debt and overhead structures.”

“We are in ag, and farmers need to farm,” chimed a peer at a mid-sized company.

When looking at company size, while most CEOs share a similar outlook for what lies ahead, those at large companies experienced the sharpest decline in confidence month-over-month. It is also that peer group that has reported the biggest hit to revenues so far, with 11 percent reporting declines upward of 80 percent—compared to 6 percent of small companies reporting similar figures.

When looking at company size, while most CEOs share a similar outlook for what lies ahead, those at large companies experienced the sharpest decline in confidence month-over-month. It is also that peer group that has reported the biggest hit to revenues so far, with 11 percent reporting declines upward of 80 percent—compared to 6 percent of small companies reporting similar figures.

On a year-over-year basis, CEOs of mid-sized companies show an uptick in confidence this month. While this is likely to turn if the crisis continues, the data is indicative of the challenges those companies faced in the midst of the tariff wars last spring, when many had chosen to rethink their supply chain to move away from China due to mounting costs.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.