Companies are increasingly taking advantage of this opportunity, particularly in Cheyenne. The small town of just 60,000+ residents, located in the southeast corner of the state, has easy access to Denver, Colorado and sites in Nebraska. It has been emerging over the last year as a data center hub with deals inked by Microsoft, EchoStar and Green House Data.

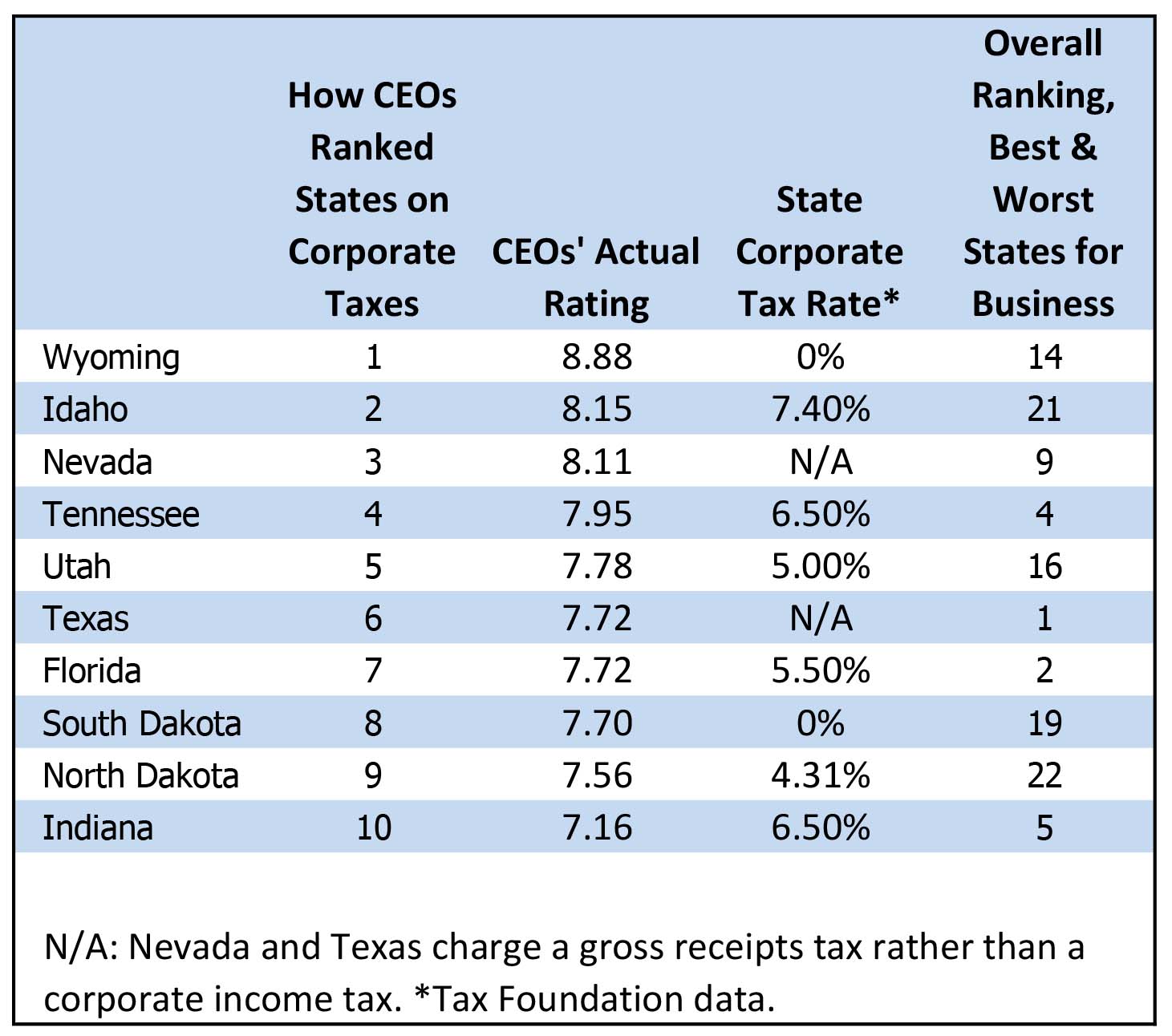

CEOs gave Idaho the second highest rating for its tax and regulatory environment, despite the fact that the state’s corporate tax rate is 7.40%. Idaho has the highest corporate tax rate of any state on the list. So what’s the difference? “States like Wyoming, Montana and Idaho may attract relatively few migratory companies, but continue quietly nurturing their own home-grown industries—crops, cattle, minerals, fuel, light manufacturing—while maintaining their traditional sense of independence and resistance to government overreach and regulatory creep,” Warren Strugatch noted in Chief Executive’s latest Regional Report on the Western states.

Like Wyoming, South Dakota also has a 0% corporate tax rate, yet CEOs ranked it 8th out of 10. The Tax Foundation puts it higher, ranking South Dakota’s state and local tax burden 3rd-lowest out of 50 states and 2nd in business tax climate.

South Dakota’s economy grew 0.6% in 2014, well below the national 2.2% rate. In April, the state passed a law that e-commerce companies could be sued for tax revenue. S.B. 106 affects any organization that sells at least $100,000 worth of products into the state or completes at least 200 separate transactions. This could be a possible future growth deterrent.

Of the top 10 list, just two states—Utah and North Dakota—have corporate tax rates at or below 5%. The three remaining states—Tennessee, Florida and Indiana, capped their rates at 6.50%, 5.50% and 6.50%, respectively.

The top 10 states ranked by CEOs as having the lowest tax and regulatory environment were all within the top 22 best states for business in Chief Executive’s 2016 Best & Worst States for Business.

The top 10 states ranked by CEOs as having the lowest tax and regulatory environment were all within the top 22 best states for business in Chief Executive’s 2016 Best & Worst States for Business.

Note: Regional data was sourced from Chief Executive’s Regional Reports. The Regional Reports are written by Warren Strugatch.

Review the entire 2016 Best & Worst States for Business survey, including individual state rankings, CEO comments, methodology and more at https://chiefexecutive.net/2016-best-and-worst-states-for-business

[vc_row][vc_column][vc_column_text]

[/vc_column_text][vc_row_inner css=”.vc_custom_1462313887635{margin-right: 0px !important;margin-left: 0px !important;}”][vc_column_inner width=”1/3″][vc_media_grid element_width=”12″ gap=”0″ item=”54767″ grid_id=”vc_gid:1462412412814-17e64e37-cd18-5″ include=”54867″][/vc_column_inner][vc_column_inner width=”1/3″][vc_media_grid element_width=”12″ gap=”0″ item=”54765″ grid_id=”vc_gid:1462551568042-8c93bcb9-ccf2-4″ include=”54930″][/vc_column_inner][vc_column_inner width=”1/3″][vc_media_grid element_width=”12″ gap=”0″ item=”54765″ grid_id=”vc_gid:1462551644835-05984b90-e5a1-8″ include=”54932″][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row]

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.