CEO confidence in the country’s 2018 business outlook remains unshaken by the stock market turbulence of February, according to our monthly poll of U.S. chief executives, landing only .06 points shy of the Index’s January high of 7.62, as ranked on a 1-10 scale.

CEO confidence in the country’s 2018 business outlook remains unshaken by the stock market turbulence of February, according to our monthly poll of U.S. chief executives, landing only .06 points shy of the Index’s January high of 7.62, as ranked on a 1-10 scale.

Undeterred by a correction they deem healthy, 80% of the 213 CEOs surveyed say they still expect future business conditions to be “excellent” or “very good,” mainly based on the belief that underlying economic fundamentals remain robust and the new corporate tax plan, once fully deployed, should further support growth.

Yet, as market volatility continues to test the resolve of many investors our poll reveals signs of concerns about the Fed’s next moves. “The U.S. national debt is going to rear its ugly head as interest rates rise,” remarked one of our pharma respondents who believes the business outlook will nevertheless remain strong thanks to deregulation and a more favorable tax code.

Yet, as market volatility continues to test the resolve of many investors our poll reveals signs of concerns about the Fed’s next moves. “The U.S. national debt is going to rear its ugly head as interest rates rise,” remarked one of our pharma respondents who believes the business outlook will nevertheless remain strong thanks to deregulation and a more favorable tax code.

“Rising interest rates will dampen growth in the last half of 2018,” forecasted the president and CEO of an upper middle-sized manufacturing company.

But where CEOs seem most concerned isn’t necessarily over the guarded growth that rising interest rates may bring, but rather concerning the velocity at which the Fed will implement those increases, particularly when paired against a change in the value of the dollar.

Additionally, some CEOs told us they are paying close attention to the many balls currently being juggled in Washington and their potential impact on the economy: an expanding national debt, the mid-term political uncertainty, a challenging trade environment, the tightening labor market and debate over immigration are among the issues many fear could culminate to cause a recession sooner, rather than later, and that a low unemployment rate, strong consumer confidence and reduced taxes and regulations may not be able to curb that setback.

Carpe Diem

Against this backdrop, most CEOs said that their main priority is to seize opportunities and strike while the iron is hot: Expansion, revised pricing structures, acquisitions, new product lines and market and customer diversification have now made their way to the top of several 2018 agendas.

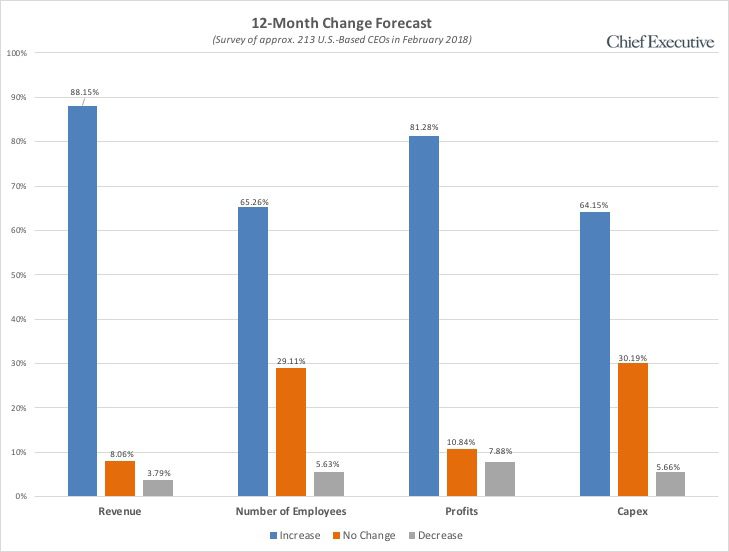

Many also reported doubling down on their efforts to find, develop and retain key talent, noting that the pool of skilled workers is getting shallower by the day. Two-thirds (65%) say they anticipate adding to their workforce over the next 12 months.

Technology also made the top three list of priorities for CEOs in 2018, with the majority saying that in addition to keeping ahead of innovation and industry transformation they are hoping for improved efficiencies and productivity. Surprisingly, very few listed data or cyber security as a top priority, perhaps leaving that responsibility in the hands of their CISO.

And while the nation’s business leaders admitted feeling very confident, on average, that they are on the right track to achieving their objectives—88% anticipate increases in revenues and and 81% anticipate rising profits over the coming year—they did have worries. An economic downturn is by far the most feared event; jarring spikes in the market, a sharp increase in commodity and raw material prices, high inflation and interest rate levels, as well as a strong dollar all made the list of big picture concerns for CEOs.

The availability of a skilled workforce in certain markets and industries came second, followed closely by a political upset during the mid-term elections and the ensuing potential for a reversal in regulatory and legislative policies that have so far showed bias for American businesses.

It’s all relative

CEOs at large companies (over $1 billion in revenue) continue to have the highest levels of confidence in future business conditions, with a rating of eight out of 10— 11% higher than their counterparts at small companies (less than $10 million).

“The Amazon’s and Microsoft’s are doing great and continue to stockpile cash,” noted the owner and CEO of a small professional services firm who expects business conditions to worsen over the next 12 months. “Small businesses are still struggling to recover from the last recession.”

Nevertheless, confidence levels across all revenue ranges show an increase year over year, indicating that despite current worries, the majority of CEOs still anticipate growth in 2018.

Professional and financial services firms show the highest level of pessimism in the business outlook, rating current conditions 6.02% and 5.42% more favorable than what they forecast for the next 12 months, respectively. In contrast, CEOs of wholesale/distribution companies are the most optimistic, expecting an uptick in 5.17% by the same time next year.

Professional and financial services firms show the highest level of pessimism in the business outlook, rating current conditions 6.02% and 5.42% more favorable than what they forecast for the next 12 months, respectively. In contrast, CEOs of wholesale/distribution companies are the most optimistic, expecting an uptick in 5.17% by the same time next year.

In the end, it may very well be a zero-sum game, as different sectors and sizes thrive under different economic environments. In the meantime, however, the absence of economic forecast consensus and a rocky equity market appear to be rousing feelings of uncertainty. The question remains, will confidence hold if variants such as inflation, interest rates and volatility continue to spike amid a mid-term change of the guards?

In the end, it may very well be a zero-sum game, as different sectors and sizes thrive under different economic environments. In the meantime, however, the absence of economic forecast consensus and a rocky equity market appear to be rousing feelings of uncertainty. The question remains, will confidence hold if variants such as inflation, interest rates and volatility continue to spike amid a mid-term change of the guards?

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across corporate America, at organizations of all types and sizes, to compile our CEO Confidence Index data.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.