CEOs Predict Better Business Conditions By End Of 2023

After two months of decreasing optimism, CEOs are once again looking to a brighter future by the end of 2023 and reflect that in their outlook for Chief Executive’s latest CEO Confidence Index. The leading indicator now stands at 5.9 on our 10-point scale, up almost 4 percent from the November reading, with our America’s chief executive’s now projecting recovery and even growth by the end of 2023.

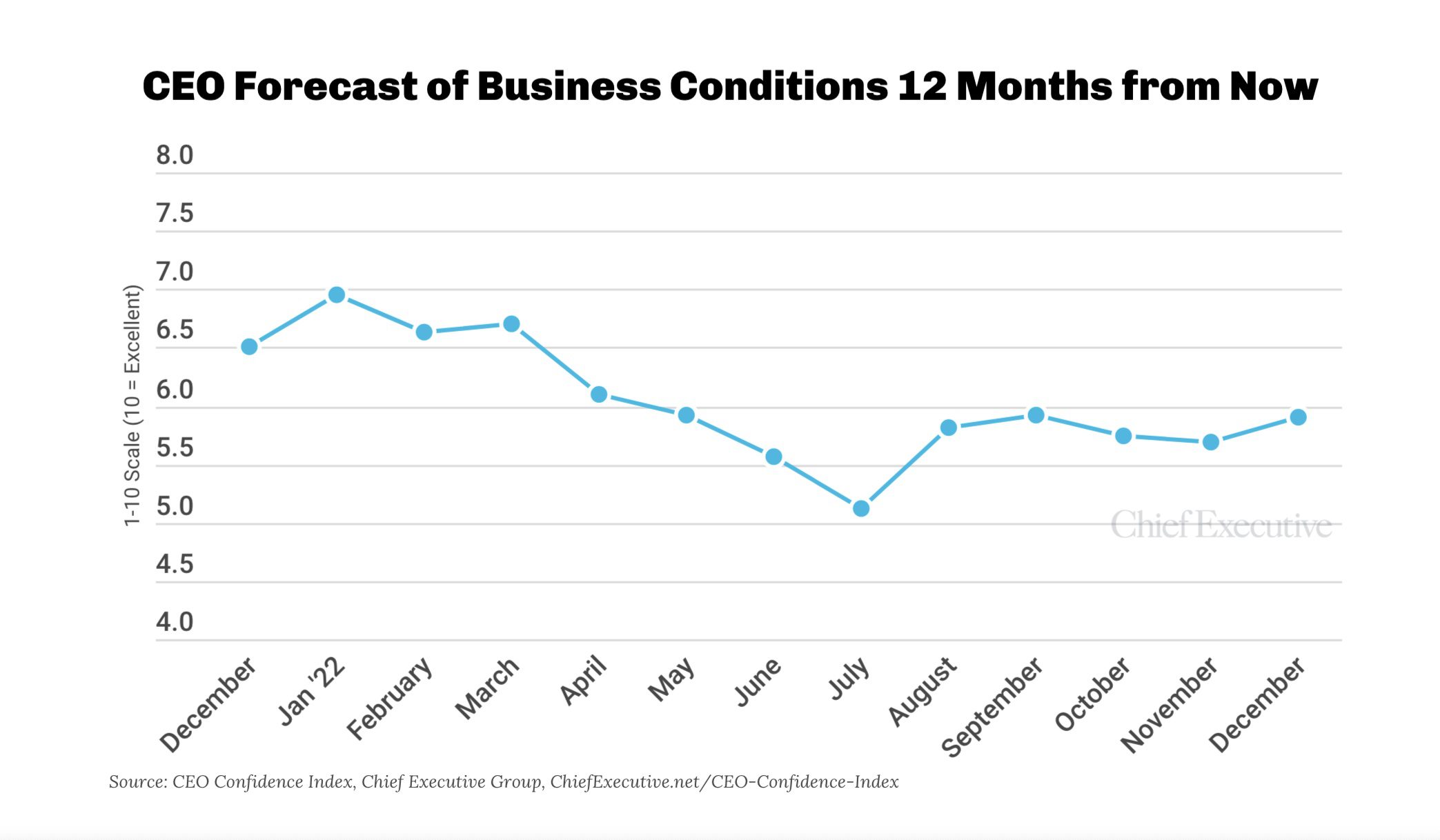

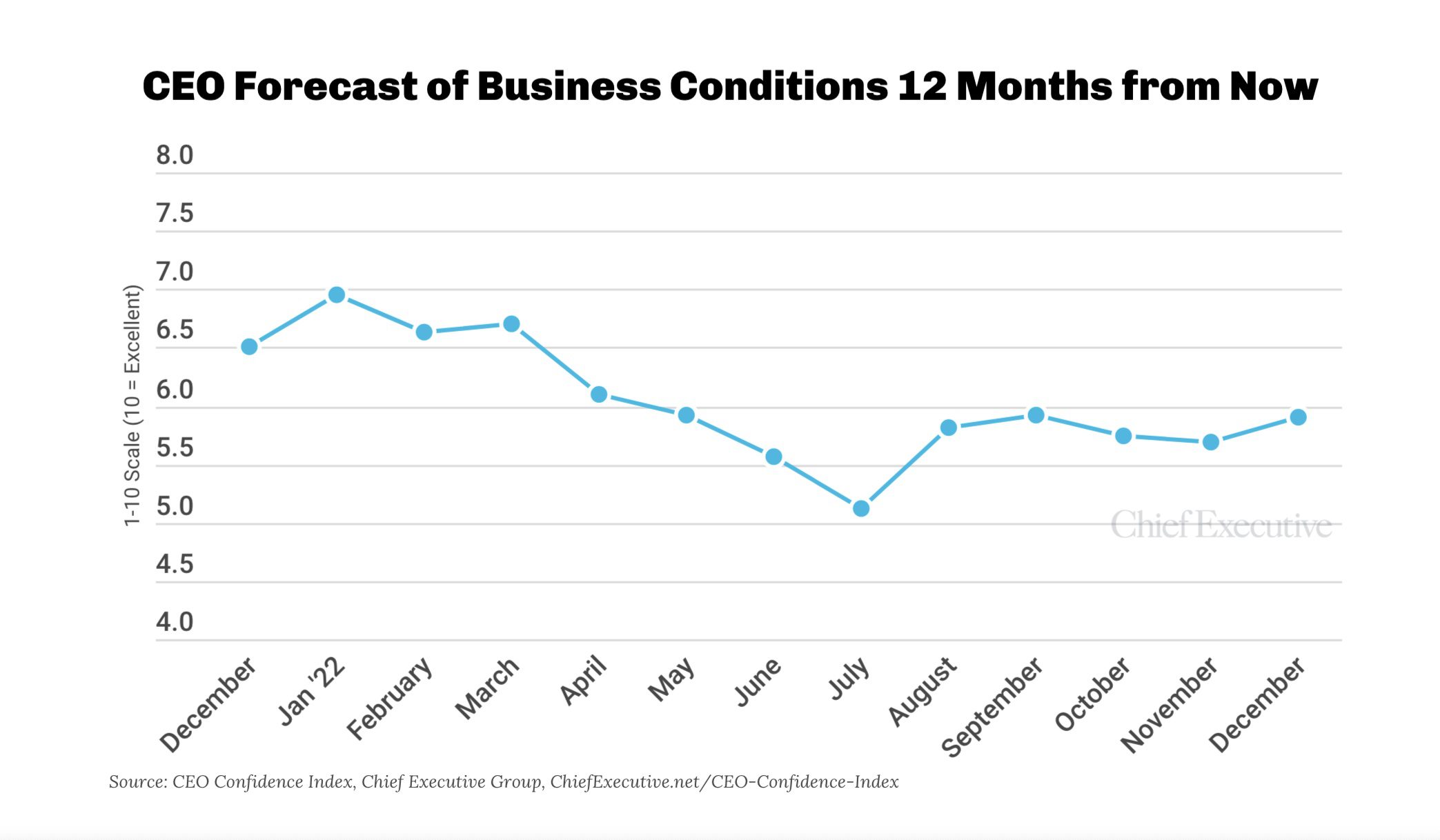

The Index, which measures CEOs’ assessment of U.S. business conditions for the 12 months to come, hit a decade low in July on fears of recession and concerns of inflation, including the current administration’s ability to contain it, and has struggled to regain ground since. This month’s climb signals a welcome change from the prior months and most of the year when the Index has been in decline.

CEO confidence in current business conditions also ticked up 2.3 percent in December, up to 6.13, after a 4 percent drop in November. Many of the 199 CEOs we polled December 6 to 8 credit their gain in confidence to continued improvement in equity markets, forecasts of reduced interest rates, hopes for falling inflation and a quieter political environment with a balance of party power.

Despite the slight rally, the Index remains 9 percent below its reading one year prior and 15 percent under its January high of 6.95. Many CEOs say that global and domestic uncertainty, coupled with stagflation and falling disposable income for consumers sets the stage for a challenging environment for business, at least in the first half of 2023.

“Getting labor is an issue. Part shortages (even for machinery) is an issue. Demand appears very high but ramping to fulfill is difficult. Costs (especially energy) are sky rocking,” Cheryl Merchant, CEO of TACO Comfort Solutions, a large family owned industrial manufacturer, lists as reasons driving her 7/10 forecast of future business conditions, down from her 8/10 rating of current ones.

A slight majority (50.5 percent) of CEOs say that demand for their products/services is up from the beginning of the year, while 57.7 percent expect demand for their products/services to increase one year from now as well. Both measures have increased since last month, when only 46 percent of CEOs said that demand for their products/services had increased since the beginning of the year, and an even smaller proportion predicted that demand would be up one year down the line.

“Our industry should have improving business conditions by late 2023/early 2024 once the Fed ceases its rate increases and our clients see a stabilizing lending environment for commercial buildings,” says Britt Schmidt, CEO of The Teal System, a clean tech company, echoing what most CEOs believe will happen one year down the line. He expects conditions to turn around significantly over the course of the next year, from 5/10 now up to 7/10.

Still, nearly a third of CEOs say that demand for the products/services is down since the beginning of the year, and a nearly a quarter expect it to remain down one year from now. “We are seeing a fairly dramatic slowdown in demand and at least a mild recession appears to be upcoming in the next few quarters as the Federal Reserve’s interest rate hikes to fight high inflation take full effect,” says Brian Conner, President at Select Resources, an IT staffing firm.

And overall, 42 percent of CEOs are forecasting conditions to decline, down 2 percent since November. This proportion has fallen 38 percent since reaching its peak in July. The proportion of CEOs predicting conditions to improve has also fallen this month, down 3 percent to 28 percent.

Leighton Carroll, CEO at Baylin Technologies, is one of the 30 percent of CEOs who forecast no change in business conditions one year in the future. He says that his 6/10 rating for both current conditions and future condition can be attributed to, “Supply chain issues, inflation, and consumer sentiment. Our B2B businesses are doing well whereas our businesses with consumer elements are seeing headwinds.”

The proportion of CEOs forecasting profit increases in 2023 rose another 3 percentage points again in December, from 56 percent the month prior to 59 percent—the highest proportion forecasting increases in profits since April of this year. The proportion of CEOs forecasting an increase in revenues also jumped this month, up 10 percent to 72 percent. This also surpasses the reading in May, before the summer months dampened CEO confidence across most measures.

Kathy Mast, President at NeuvoNow, LLC, a consulting firm, expects profits to climb more than 20 percent. “Business resilience that I see working with clients. Companies continue to work around constraints and find a way to do business,” she shares, explaining her optimism.

The proportion of CEOs planning increases in capital expenditures over the next 12 months also climbed, up 9 percent in December. Now, 45 percent of CEOs project increases in capital expenditures. This measure has hovered between 40 and 45 percent since June, when the proportion fell by 30 percent.

“New products (year 2 of investment for us), pharma needs better measures and more patient centricity,” says Jeremy Wyatt, CEO at Actigraph, a BioPharma company.

The proportion of CEOs planning to increase hiring hit its highest point since May, up 13 percent in December to 53 percent. Like the proportion planning increases in capex, the proportion planning to increase hiring over the next 12 months also hit its trough in June, when it fell 29 percent.

The proportion of CEOs projecting increases is up across measures, signaling that CEOs expect recovery by this time next year, but are bracing for challenges in the months ahead.

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.