It’s no secret that uncertainty has a dampening affect on economies, and election years are, by definition, a time of uncertainty. In fact, once the nation’s new leader is anointed, sluggish voting-year growth is often bolstered by a post-election “relief rally” as businesses breathe a collective sigh of relief and get on with things. But this November—with the two top presidential candidates so diametrically opposed on so many compelling issues—just might be different.

It’s no secret that uncertainty has a dampening affect on economies, and election years are, by definition, a time of uncertainty. In fact, once the nation’s new leader is anointed, sluggish voting-year growth is often bolstered by a post-election “relief rally” as businesses breathe a collective sigh of relief and get on with things. But this November—with the two top presidential candidates so diametrically opposed on so many compelling issues—just might be different.

According to a recent survey by U.S. Trust, 68% of high-net-worth executives and business owners are concerned about the impact of the presidential election on their companies. In fact, depending on whether Donald Trump or Hillary Clinton becomes president—and on which candidate each business leader has bet—some American CEOs’ worries may go sky-high by Inauguration Day.

CEOs can make a positive case for either candidate: Clinton, who had a front-row seat to the action while serving as First Lady and then went on to develop her own formidable political skill set in Congress as New York’s senator and as the country’s secretary of state, may be viewed as the experienced and steady hand. Meanwhile, Trump can be seen as the no-nonsense, billionaire hero who can’t be bought and will unleash a new era of business growth by taking a Roto Rooter to sclerotic Washington, D.C.

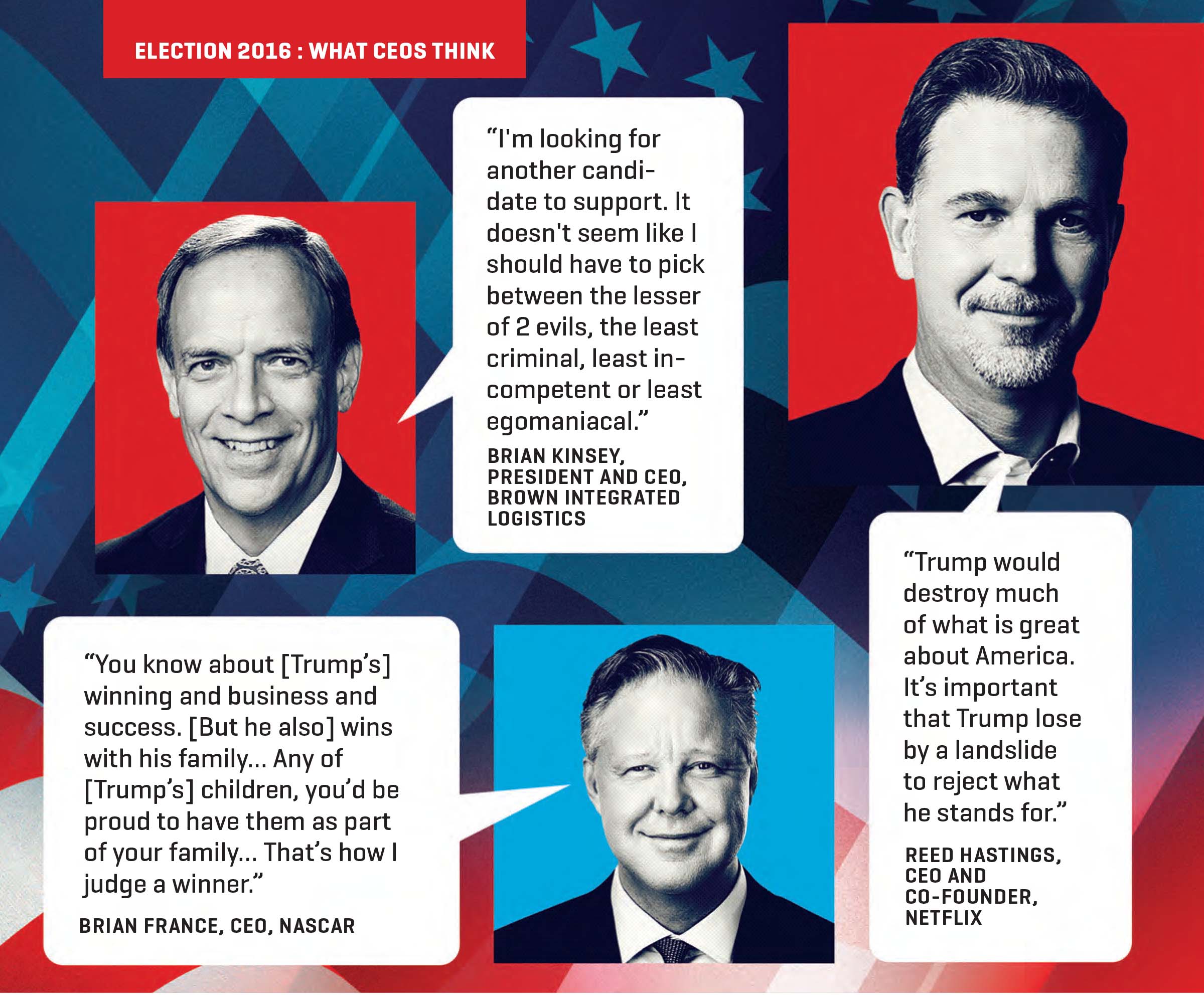

Yet, what may be much more persuasive to many CEOs is the negative case against whichever candidate they fear more. And that decision is often based largely on fears around how the new administration might impact our economy and the business climate. (See this sidebar, for the perspectives of four top economists.)

One block of CEOs believes that the election of Clinton would ensure nothing short of disaster in the years ahead, as she continues what they see as the anti-business philosophy of President Obama, tries to wring even more taxes out of the 1 percent and scrambles for the government to fulfill all the economic promises she’s made to her growing coalition of what some describe as the “47% of Americans who pay no income tax.”

The other block is just as frightened at the prospect of Trump as the next president, with their trepidation fueled by saber rattling on trade and immigration that may translate into policies that will throw the U.S. economy into reverse. They also fear the simple uncertainty a Trump presidency would bring, because the unknown is one of the worst things for business decision-making.

FEAR-FUELED FAVORITES

Put another way: Many CEOs fear Clinton could decelerate the U.S. economy by adding taxes and regulatory burdens over the next eight years, while others fear Trump could blow up the U.S. economy almost immediately by turning it over like an apple cart. “The choice between Clinton and Trump is really a choice between the lesser of two evils,” says Robert Johnson, CEO of the American College of Financial Services. “There is a time-worn adage—‘the markets dislike uncertainty’—and Trump epitomizes uncertainty.”

Indeed, it’s a curious twist when a lifelong progressive activist who’s never held a job in business becomes the presidential choice of significant numbers of business leaders. But Clinton is the devil they know versus the one they don’t.

Johnson believes that neither candidate is “appealing” to CEOs but that many of Trump’s promises to shake things up are “very concerning and potentially disruptive to business interests.” Meanwhile, although Clinton advocates higher taxes on wealthy Americans, “she definitely has more of a track record that business people can rely on.”

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.