Fiat Chrysler CEO Sergio Marchionne was able to say something on Thursday that perhaps no chief of the company once known as Chrysler ever has been able to say: “FCA is positioned to be a top performer,” he told a conference call with financial analysts.

It’s been a difficult slog for Marchionne to get to that point, and it may be even harder for him and his successor–he plans to retire early next year–to say that in the future. But the sweater-clad Italian leader has made a career lately of surprising observers on the up side.

Propelled by strong sales of its Jeep and Ram vehicles, FCA nearly doubled its earnings in the latest quarter as it strives to meet stretch targets, surpassing profitability at Ford. He got a jump on the industry by abandoning sedan production, which now looms as an option for Ford. And he has abandoned his glum talk of a couple of years ago about the need for the auto industry to consolidate because of overcapacity.

“The biggest question and challenge for Fiat Chrysler is how it will deal with the coming transformation of the auto industry.”

“The fact that Chrysler is still here is Marchionne’s legacy,” said Michelle Krebs, analyst for AutoTrader.com. “It came extremely close to extinction. He promises its debt will be gone this year, possibly by June. FCA has a strong product line of trucks and SUVs. He looks brilliant–and he got really lucky–eliminating most of the car models.”

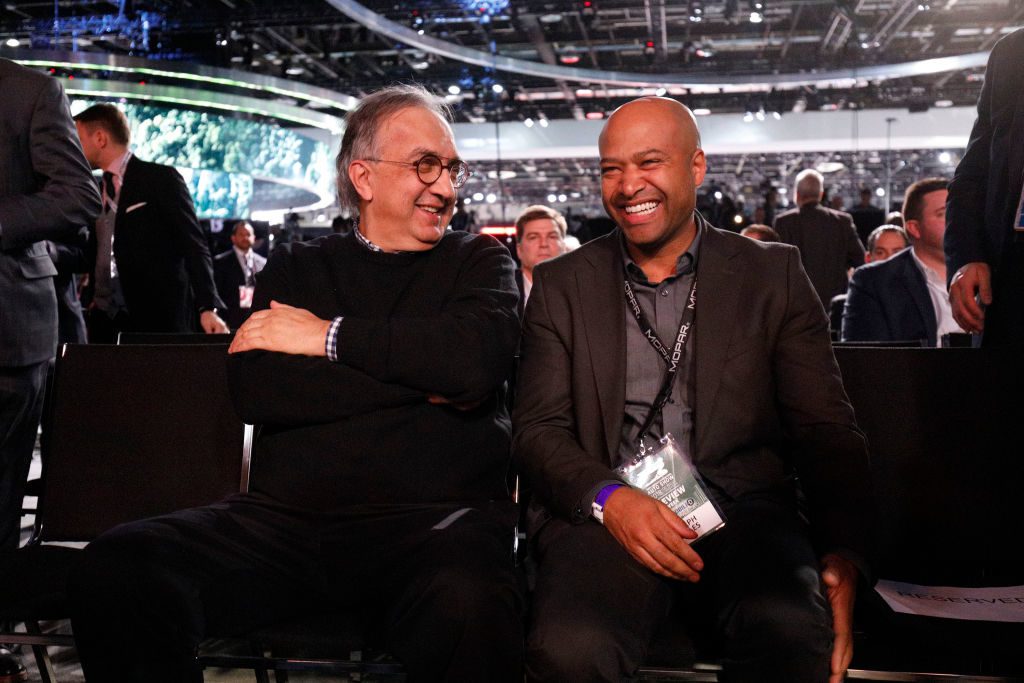

Marchionne said he expects FCA to meet its 2018 financial targets and continue to outperform under his successor. He hasn’t named an heir apparent, but at the North American International Auto Show recently he told journalists that the candidates are internal, and they’re all male. The company’s new strategic direction, which he plans to reveal on June 1, will bear the successor’s imprint, Marchionne said.

A leader who likes to create waves, at the Detroit auto show, he openly critiqued Ford’s strategy for doubling its investment in electric vehicles while the market for EVs remains minuscule. “Is that a wise economic thing to say?” Marchionne said to reporters. “The answer is probably ‘no.’”

Marchionne’s knock on Ford presumably stemmed partly from the fact that FCA has barely participated so far in the EV revolution. But if challenges such as cost, charging infrastructure and driving range are overcome, Krebs said, “What will FCA do then? Will it be behind or will it be able to be a close follower?” Marchionne’s strategy faces risks.

It’s similar to the approach that he took initially at least to autonomous-driving technology, where FCA moved deliberately slowly. Only in 2016 did Marchionne do a bit of an about-face when FCA signed up as partner with Alphabet’s Waymo automotive unit in fielding a fleet of driverless Pacifica Hybrid minivans.

“The biggest question and challenge for Fiat Chrysler is how it will deal with the coming transformation of the auto industry,” Krebs said. “For now, it has opted to partner with companies like Waymo. Will that be the right strategy for the future? Will that strategy be evolved? We will have to see.”

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.