Making predictions about the future of the world is a fool’s errand—especially in these days of explosive change, global dislocation and technological disruption. But that won’t keep us from trying! After all, knowing what America’s CEOs think is going to happen is far more useful when it comes to strategy and planning than whatever actually happens. It’s also a lot more fun.

And so it is, once again, that we’ve turned to the CEO community nationwide for your best guesses about the year ahead. Before last year closed, we looked at how CEOs’ predictions for 2023 panned out (results here) and asked you to forecast how 2024 might unfold. Here’s what you had to say:

The Stock Market

A majority of CEOs (57 percent) among the 210 we polled in December 2023, said they expect the Dow Jones Industrial Average to end 2024 within the 35,000 to 40,000 range—unchanged from its current average of around 37,000. Only 28 percent of CEOs predict the Dow will end the year lower than 35,000, a better forecast for this year than you had last year, when 37 percent of CEOs predicted the Dow would end 2023 below 35,000.

“Dow may go over 40,000 but I believe it will ultimately trade in a narrow range after some exuberance over Fed rate cuts that have been telegraphed,” says the CEO of a large chemicals company.

Inflation

After hitting its highest levels in over a decade—9-plus percent in 2022—the rate of inflation slowed significantly in 2023, falling to 3.1 percent at year-end. Now, 64 percent of CEOs predict it will continue to subside in 2024, most likely gradually. And even though 29 percent of CEOs predict inflation will stay the same, just 7 percent forecast inflation getting worse.

Interest Rates

Controlling inflation didn’t come cheap, of course. In an effort to smother it, the Fed jerked rates up from near-zero in 2020 to a target between 5.25 and 5.5 percent by September 2023. They have kept it there ever since. Late last year, Powell & Co. signaled—or at least seemed to signal—that they might be inclined to start trimming rates through 2024 if inflation continued to behave.

When CEOs were asked about the trajectory of rates, 49 percent predict that the Fed will lower the effective target rate to between 4 and 5 percent next year—though nearly a third of those polled believe rates will end 2024 between 5 and 6 percent.

“If the Fed reduces interest rates to less than 3% by EOY24, and unemployment remains static, inflation will begin rising again,” says the CEO of a mid-size industrial manufacturing firm.

Recession?

Recession chatter has been persistent over the past years, with many expecting a crash landing after the Covid-19 economic crisis. One year ago, at the start of 2023, 95 percent of CEOs forecasted a recession in the coming year. And while many argue over what constitutes a recession, the economy has still avoided two quarters of negative growth coming out of 2020—the official definition of a recession.

This year, the outlook is much more favorable—66 percent of CEOs surveyed predict a U.S. recession in 2024, and the vast majority (59 percent) expect it to be mild. Over one third of CEOs predict no recession over this year, a much higher proportion than the only 5 percent who predicted the same last year.

“2024 will be hard to predict,” says the CEO of a upper-midsized company that specializes in trade shows and live events. “History tells us that the impact of raising interest rates always has a lagging impact on the economy. The unknown is when that lag effect will have the greatest impact.”

China

According to CEOs, Xi Jinping’s stronghold on the Chinese government doesn’t seem to be losing grip anytime soon despite Covid woes, human rights abuses and economic instability. They predict no change in leadership, with 98 percent of those we polled saying Xi will be president by this time next year—slightly more than the prior year where 90 percent said the same.

“China is likely to increase pressure or constraints on Taiwan, further stoking concerns around the world,” says the CEO of a mid-sized professional services firm.

Russia-Ukraine War

We also asked CEOs to share their forecast for where the Russia/Ukraine war would be in December, 2024. Forecasts have grown dimmer over the past year as the war continues with no end in sight. In 2022, 41 percent of CEOs predicted a brokered halt, such as a cease-fire or negotiated peace agreement, while 45 percent predicted a continued slog. This year, 70 percent of CEOs predict a continued slog, with Russia maintaining territory as fighting persists. Only 17 percent now predict a brokered halt one year down the line.

The Race for President

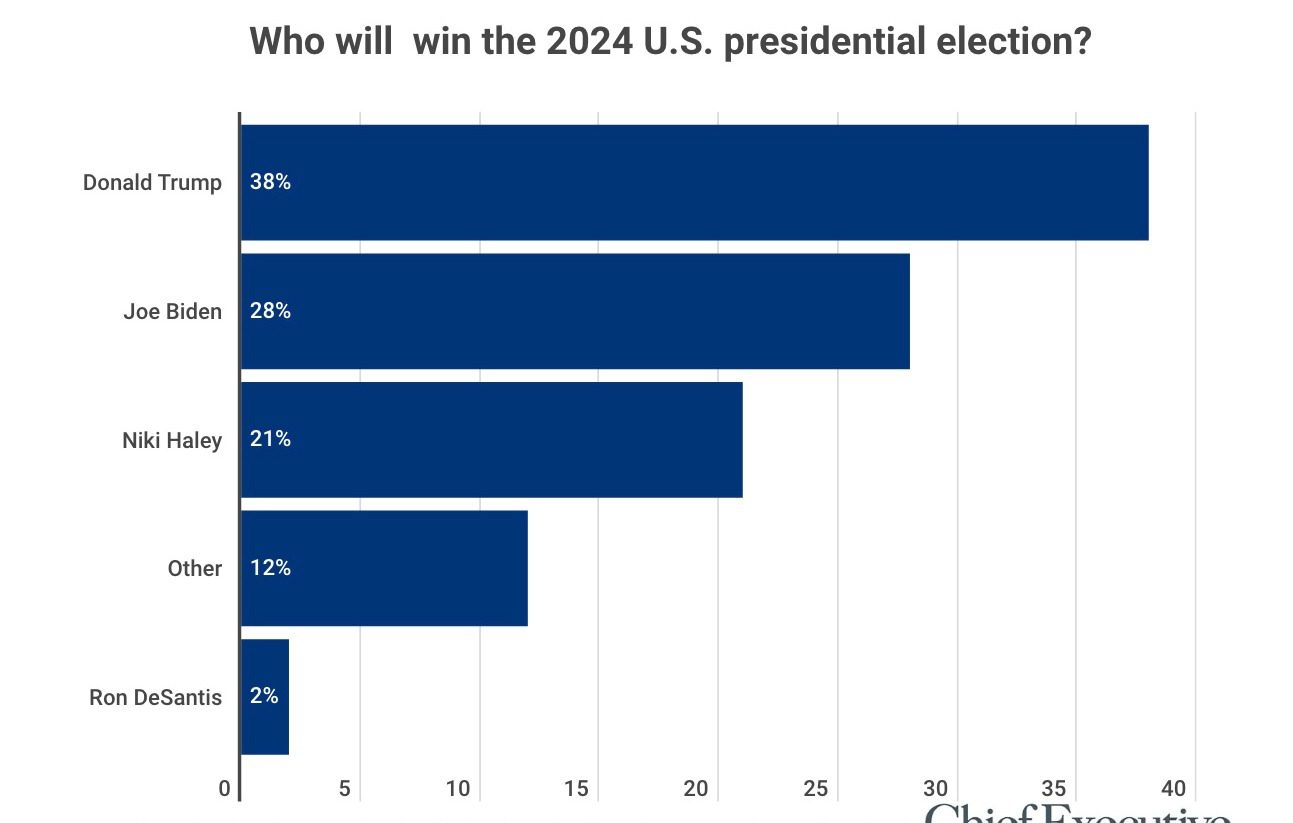

After the abysmal accuracy of CEO predictions for the state of the presidential race by the end of 2023 (81 percent expected Ron DeSantis to be the frontrunner at this point), we asked them again, but this time we wanted to know who they expect to win the White House.

Among those polled, 38 percent predict a Trump victory in 2024, while 28 percent predict a Biden win. These predictions are wildly different from last year; since then, Nikki Haley has emerged as a strong voice from the Republican party while Ron DeSantis has fallen from favor. Now, 21 percent of CEOs predict a Haley win for the presidential race.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/