So earlier this month, Goldman Sachs chief economist Jan Hatzius made plenty of headlines by breaking down the potential impact of a “Blue Wave” on markets and business. His verdict: 1.5 thumbs up.

Big negative: Corporate taxes increasing to 28% (up from 21%, but less than the 35% it was a few years ago.) Positive: He predicted a tasty $2 trillion Covid-recovery spending package (as well as heaps of other spending), a reduced risk of escalating trade wars with China and others and substantially easier U.S. fiscal policy.

Overall, he predicted markets would rally and business would do more than survive in the years to come.

And that was with the Democrats holding all the reins of power in Washington.

Well, a few days and an actual election later, the big Blue Wave sloshed into a kiddie pool. Unless something pigs-with-wings/the S.E.C.-stops-football-for-Covid incredible happens—ie, Georgia elects two Democrats to the Senate—the nation’s capital will be a house divided for at least the next two years.

And that’s why, over at The Wall Street Journal, longtime Capital Account columnist Greg Ip is making the case that the election “may yield a dream scenario for business: a moderate Democratic president whose more aggressive plans can’t pass the Senate, but who eschews the unpredictability that has often marked the Trump administration.”

In all likelihood, Biden will muddle through policy-making the same way his two predecessors did for much of their tenure in the Oval Office—with executive orders, rather than actual lawmaking. That means no new taxes, but movement on regulation, rolling back Trump rollbacks wherever he can.

And, as Ip points out, Biden will have plenty of other, formidable restraints as well, including a business-friendly Supreme Court and Federal judiciary, holdover appointees—and outright majorities—on many key rule-making agencies like the National Labor Relations Board, the EEOC, EPA and others. For a while, Trump appointees will run the Fed and the SEC as well.

Still, the Biden administration isn’t about to make the business of America business. He will do what he can to strengthen labor unions. For financial companies a re-invigorated Consumer Financial Protection Bureau will continue to add friction. Big tech already knows it’s in the crosshairs—that would have continued either way—and the anti-trust suits of the past few months may be just the beginning.

But there will be benefits for many industries under Biden, especially for companies that rely on a steady flow of immigrants—especially those entering under the embattled H1B visa program. He may not expand immigration, but he’ll make it more predictable. He’ll likely find a way to reunite with old friends across the aisle to smooth the way on big-ticket items like infrastructure and defense spending. He’ll do nothing to rein in the national debt, but then again, who in Washington ever will?

Bonus: it’s unlikely the new president will cancel you on Twitter in the middle of the night for announcing a plan to move a factory. That’s got to count for something.

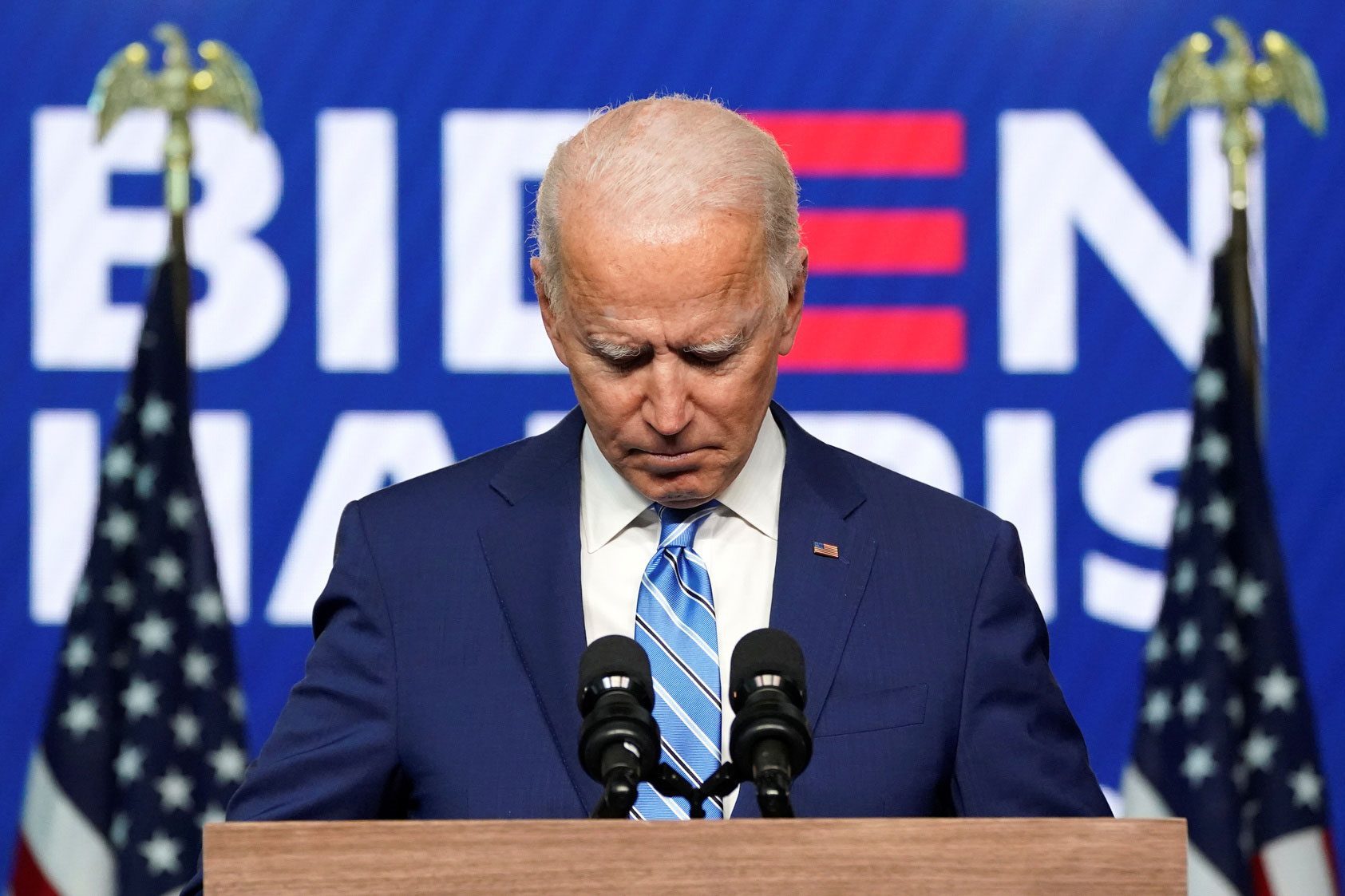

Here’s the thing, though, the much bigger thing: If Joe Biden wants to make good on his pledge to “heal” a divided nation—and he certainly must try—the most essential thing he can do is not let the economy slide back into recession.

For Biden, it’s a very Jim Collins, “genius of the and” moment. He must fight Covid, and he must do it in a way that doesn’t shutter the economy. He must help push through stimulus that’s robust enough to stave off bankruptcies and carry the most at-risk in society at a time when they most need it, and he must do it without dis-incentivizing work at the same time or spending in ways that don’t accelerate the velocity of money in the economy.

And in every way he can—but most specifically through his cabinet appointments—he must signal to the nation that he isn’t perusing an economic agenda that was clearly rejected at the ballot box. Elizabeth Warren? That’s no way to run a railroad, unless you want it off the rails (and no, we do not want it off the rails.)

For today, the only thing that is absolutely certain is that Joe Biden has just taken on the toughest assignment of any U.S. president in nearly a century. If he really wants to make good on his pledge that he will be a president for all Americans, he can start by listening to what we all said—together—on election day, if you were listening closely enough.

As the U.S. Chamber of Commerce said in a statement on Saturday: “This election shows that the American people want and expect cooperation when Congress convenes in January. And that’s good—because we have lots of work to do.”

Okay, maybe we didn’t say exactly that. But it sounds pretty good, doesn’t it?

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.