The business world as we know it, no longer exists. Every industry is being redefined by new technologies that blur the lines of the physical, digital and biological worlds. These shifts are accelerating change like never before, creating great opportunities … and risks. Business practices are also rapidly evolving, becoming automated, intelligent, agile, and ubiquitous. What TCS calls “Business 4.0.”

M&A has always been a part of every business strategy. In today’s era of rapid transformation, mergers, acquisitions and divestitures have become the dominant play to capture new customers, compete in emerging markets, and jettison assets that no longer enable competitiveness.

Your M&A Strategy

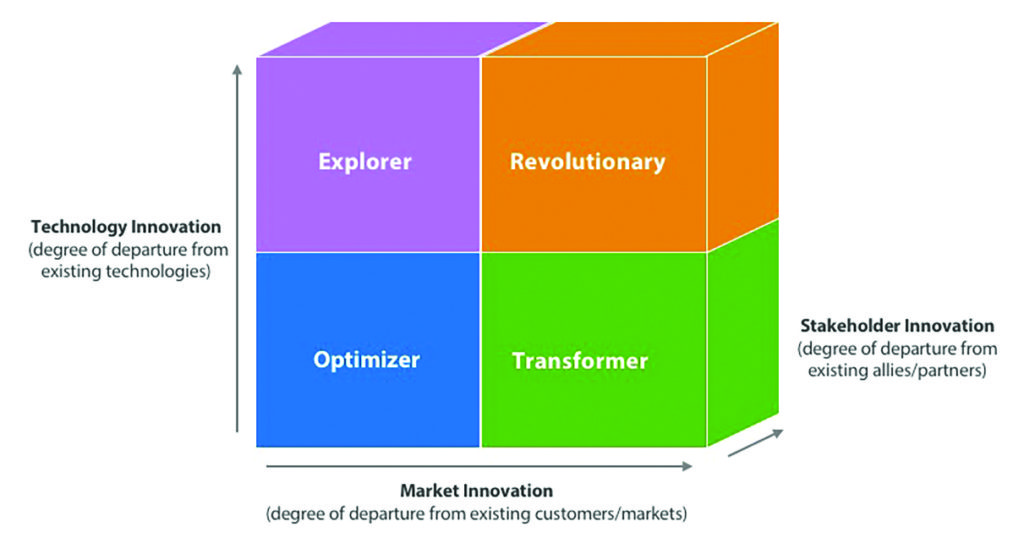

Your M&A StrategyFrom TCS’ experience, there are four dominant M&A strategies. Most companies embrace one as its primary M&A strategy and are opportunistic in the others:

1. Optimizers focus on improving existing products, services and business practices to maximize customer satisfaction and profitability.

2. Transformers seek incremental technological innovation to actively capture new customers and markets.

3. Explorers are the mirror image of the Transformers. They invest in leading edge technologies to expand customer capture within existing markets.

4. Revolutionaries take the boldest steps. They seek ways to disrupt and cannibalize so they can take on new competitors and capture new markets and create new industries.

Successful M&A is a combination of good strategy and great execution. TCS’ FITME framework can help companies evaluate options and create the M&A strategy that’s right for them.

Accelerating Deal Due Diligence

Accelerating Deal Due DiligenceIn today’s world of low-cost capital, competition for M&A opportunities can easily come from competitors willing to make decisions with limited data. Accelerating deal due diligence is crucial. To speed this process:

1. Build a trusted M&A advisory team with the right industry, operational and technology knowledge to be engaged at the earliest stages of M&A exploration. This team will likely be a combination of internal and trusted third-party experts.

2. Establish risk thresholds to address unknowns. Managing risk is a part of evaluating every M&A opportunity, especially when acquiring cutting-edge technologies or entering new markets. Companies waiting for concrete answers will likely find themselves out-flanked by more nimble competitors. Defining likely risks and rapidly testing “Go-No Go” tolerances will accelerate decisioning.

3. Give the CIO a starring role. Business and supporting systems are no longer separate considerations. IT cannot make an M&A deal, but certainly can break one. When it comes to the potential system impact of an M&A opportunity, the best person to make that judgement is generally the CIO. Engaged early, the CIO can quickly assess compatibility and identify pitfalls and deal breakers.

4. Formalize your Playbook. Every company should have an M&A playbook that scripts the activities for due diligence, M&A planning, financial modeling, execution and synergy management. A good playbook also describes the roles, both internal and external, to execute these scripts. For Due Diligence, pre-defined assessment and analysis frameworks can greatly accelerate the process.

In business, time to market is everything. Creating the M&A strategy that fits your company’s growth and risk profile will provide clarity as to where to capitalize on opportunities that enhance competitiveness. Add to that your own Due Diligence accelerators to quickly evaluate and exploit those M&A opportunities that best advance your strategic ambitions and enhance business outcomes.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.