Not ranked are the 19 REITs in the June 30, 2015 S&P 500 Index. (Also, several companies were not ranked due to incomplete data for the measurement period.)

Again this year, we used a methodology recommended by Bennett Stewart, CEO of EVA Dimensions. CEO performance was assessed using four measures based on the concept of Economic Value Added, or EVA. EVA is profit remaining after subtracting the full cost of the capital the business uses—known as economic profit.

The first and most important measure, EVA Momentum, shows the trend in the growth of the firm’s economic profits (EVA) over the past three years. It is a better measure of wealth-creation

progress over time than growth in sales, EBIT, EBITDA or earnings per share, since it only counts profit growth after covering the full cost of capital, including a minimum shareholder return to compensate for risk.

The second, EVA Margin, shows how profitable the firm is per dollar of sales. It blends pricing power, operating efficiency and how well assets are managed into a single net-margin score. The third, Market-Implied EVA Momentum, measures the expected long-run growth rate for economic profits reflected in the company’s stock price. It shows how well the CEO has positioned the company for continued profitable expansion, as far as investors can tell, through initiatives targeting growth markets, innovations, brand value and operational excellence.

The fourth measure uses the concept of Market Value Added or MVA, to judge wealth creation. MVA is the difference between a firm’s stock-market value and the overall amount of capital it has invested. It’s the shareholder wealth the business has created.

MVA Margin, our fourth metric, is MVA as a percentage of sales—the higher, the better. All of the measures were computed for each company using June 30, 2015 share prices, and the most recent reported financial data up to, but not after, June 30, 2015. The measures were then ranked within their industry groups to arrive at percentile scores. A company’s final score is a weighted combination of the four percentile scores above. Those ranked at the very top consistently outperform their industry peers across all four measured categories. They show an exceptional rate of profitable growth, are highly profitable and valuable and justify continued confidence in their future success.

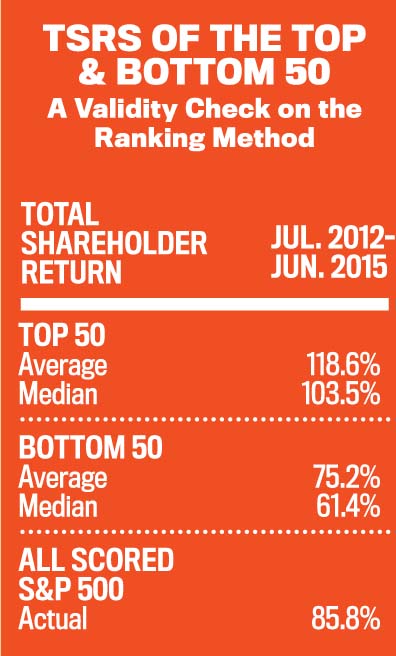

The top 50 companies in the ranking delivered an average Total Shareholder Return (TSR) of 118.6 percent between July 2012 and June 2015 (the period covered in the reported financials). The bottom 50 companies’ TSR averaged 75.2 percent, while the actual for all of the scored S&P 500 companies was 85.8 percent. The top 50’s median TSR was 103.5 percent; the bottom 50’s was 61.4 percent.

As the table shows, the top 50 companies in the wealth-creation ranking far outperformed the bottom 50 companies and the scored S&P 500 between July 2012 and June 2015. [Note: Total Shareholder Return = share-price return plus dividend yield reinvested dividends, expressed as a percent.]

The 2015 CEO Wealth Creation Index appears in the November/December issue of Chief Executive magazine, on page 28. To subscribe to Chief Executive magazine, click here.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.