Diego Francisco, 46, an upholsterer at Lexington Home Brands in High Point, North Carolina, learned about the brand-new Catawba Valley Furniture Academy from a coworker last year. He quickly registered with the two-year, certificate-granting program. When he graduated, Lexington welcomed him back with a $4.50 hourly raise plus a status change that could add up to $10 an hour to his paycheck.

“I’m very glad I did this,” says Francisco. “I’d definitely do it again.” The Academy, organized by Lexington and four much-larger manufacturers in the furniture-manufacturing hub, is housed at the local community college. Its faculty is comprised of craftsmen and technicians from the five companies who teach high-demand sewing, cutting, upholstering and spring-tying skills.

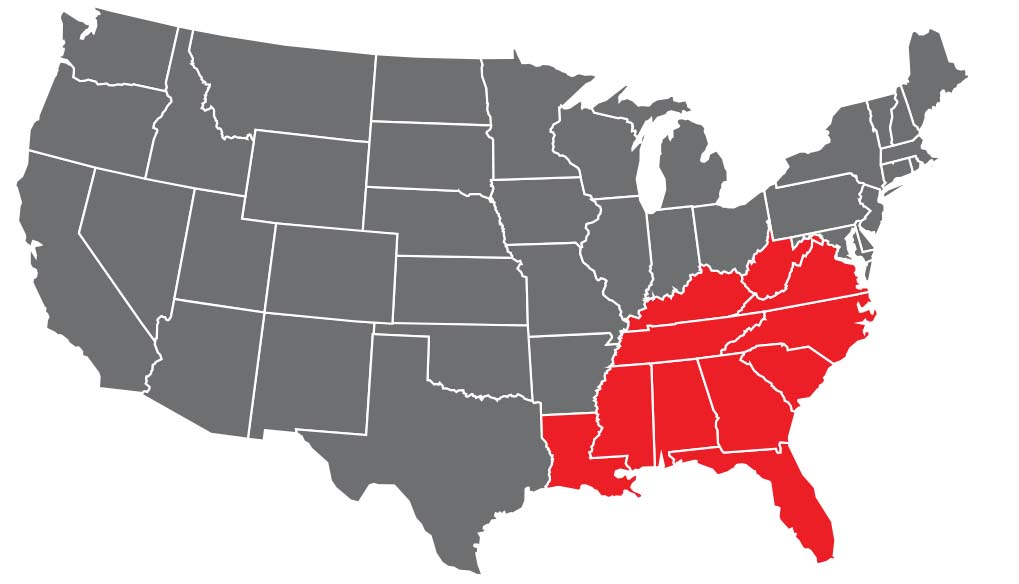

The program came about because regional manufacturers were struggling to attract and retain skilled workers, often raiding each others’ labor forces. Furniture companies “weren’t getting the trained workers we used to get,” explains Bill McBrayer, human resource manager at Lexington. “People believed there was no future making furniture in North Carolina. They stopped learning the skills. We had to change that perception.” Manufacturers like Lexington say they need skilled workers more than ever, as quality and efficiency drive revenues.

All 67 members of the first graduating class have found jobs. Increasingly, workforce development is the new face of economic development. Companies weighing incentive packages often tip their decisions in favor of deals that provide skill training and STEM-based (Science, Technology, Engineering and Math-based) education to workers.

In Tennessee, a government initiative known as Tennessee Promise pulled 4,000 students into the state’s post-secondary pipeline, helping high school grads start skill-based training programs. The program, administered through a nonprofit called tnArchieves, helps finance tuition for state residents who want two-year degrees. Another Tennessee education-promotion program, Drive to 55, primarily helps older students enroll and complete baccalaureate programs. Its name refers to the goal of increasing the population of Tennesseans with college degrees to 55 percent by 2025. Currently, about 28 percent of state residents have sheepskins; nationally, the rate is about 32 percent. Both programs are funded by state lottery revenues.

Last year, the number of freshmen enrolled full-time increased 10 percent at public four-year programs, 20 percent at technical colleges and 24 percent at community colleges. “Our statistics indicate that our students are graduating at a rate three times the state average,” says Krissy DeAlejandro, head of tnAchieves. “We definitely believe the program’s working.” “Workforce development is economic development,” says Randy Boyd, Tennessee Economic Development chief. “It’s that simple.”

Florida created or retained over 21,000 total jobs in the 12-month period starting May 2015, led by financial and professional services, headquarters, manufacturing, life sciences and logistics/distribution. Major recent announcements include NBCUniversal Telemundo’s $250 million headquarters, Blue Origin’s $200 million launch facility and OneWeb’s $85 million satellite-manufacturing plant. Renovation and expansion are underway at Orlando, Miami and Tampa airports. The state’s manufacturing sales tax exemption, set to expire next year, was made permanent earlier this year.

This past spring, legislators voted down Gov. Rick Scott’s $250 million economic-development funding request, eliminating the discretionary fund that in past years had financed many incentive packages. At Enterprise Florida, the corporate-recruitment agency chaired by Gov. Scott, board members signed off in July on a $6 million cost-saving/restructuring plan that will lay off some two dozen workers. Meanwhile the search continues to replace former CEO Bill Johnson. The organization continues to promote the state to employers; in June, it was managing 380 expansion and pipeline-relocation projects.

In South Florida, a strong dollar and weakening South American economies continue to vex Miami-Dade and Broward counties. Macquarie Group’s decision to put a 120-employee global services headquarters in Jacksonville could spur further FinTech investments in that city.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.