Innovation demands taking risks, which is hard to do when you’re ducking for cover, says Avik Roy, president of the Foundation for Research on Equal Opportunity, an Austin-based think tank. “CEOs are cautious and reluctant to do anything that might rock the boat on health benefits because they fear there will be a backlash among employees,” he says. “I respect that concern and the need to make sure employees are happy, but at the end of the day, they will be happy if you can increase their compensation because your healthcare costs are lower than your competition’s. There’s too much fear and not enough courage and innovation.”

Helman adds that doing nothing to address rising costs can have a lasting, if not permanent, effect on future bottom-line costs. “That inaction has a compounded future cost. You take a year off and you never get that back. Because guess what? Inflation didn’t take a year off.”

Calling on Consumers

Calling on Consumers

Employers continue to offload some of the burden with high-deductible plans and health savings accounts (HSAs), which shift more control and responsibility to employees. In 2017, 55 percent of employers offered an HSA, up from 42 percent in 2013, according to the Society for Human Resource Management. Helman says that a year in which premiums don’t go up generally is a perfect time to impose a modest increase in employee premiums, so that when they go up the following year, the bite will be less painful.

“But employers know there’s a limit to that,” says Ron Williams, former CEO of Aetna and a board member at Boeing and Johnson & Johnson, who notes that cost-sharing can only take one so far. “The real question is how do companies get better value out of the money they are spending?”

The more innovative approaches move away from the classic fee-for-service model that rewards quantity over quality toward value-based reimbursement. With bundled payments, for example, providers receive one fee for all the care required to treat a patient’s medical condition. “From pre-op to surgery to post-op physical therapy, it’s one fee,” says Brian Marcotte, CEO of the National Business Group on Health (NBGH). “If it gets screwed up, you don’t pay again. That’s a more value-based arrangement.”

Chuck Ludmer, principal at tax advisory firm CohnReznick, says he is working with third-party firms to negotiate costs with providers using a method called focused average cost tracking, which caps expenses based on what Medicare/Medicaid would reimburse. “They can bring the costs down by as much as 30 percent,” he says. Benefits consulting firms have also sprung up, offering employers a way to dramatically slash hospital bills.

One way for self-insured employers to experiment with bundling is to work with an accountable care organization (ACO), a network of providers who share responsibility for quality and cost of care. Because they are rewarded both for positive outcomes and for efficiency, typically in the form of bonuses, they’re incentivized to give only the quality care that’s needed. According to the most recent survey from NBGH, 20 percent of large employers are currently experimenting with ACOs, and that number will rise to 50 percent by 2020.

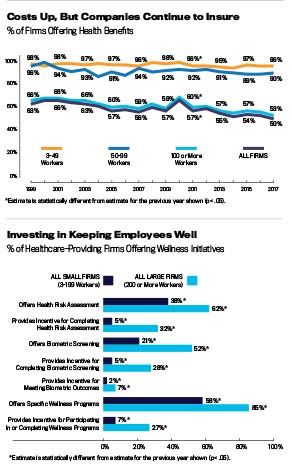

Efforts are also underway at companies of all sizes to bring down consumption of healthcare through alternative delivery, such as telemedicine, and workplace wellness initiatives. Stead swears by the carrot method and credits IHS’s health incentives—which have a 70 percent participation rate—for the fact that the company has raised employee premiums only once in five years. “The key is you have to start with an assumption that it will take five years to break even,” he says, noting that companies often scrap wellness plans when they don’t see results in two years. “But it really does take that long to educate people.”

The Search for Value

“It’s incredibly difficult to calculate an ROI for wellness,” syas Linda Keller, COO of employee benefits for global insurance brokerage Hub International, who says she sees the language moving away from ROI and toward VOI, or value for investment. “If you can organize it around engagement, your [company] will see the value because that improved morale results in decreased absenteeism and improved productivity.” Hub’s annual survey of companies with 50–1,000 employees found that 54 percent cited morale as their most improved metric from implementing workplace wellness programs.

According to Transamerica’s survey, 70 percent of employers said their wellness programs had a positive effect on cost. “Facts are our friends,” says Stead. “If you measure it, you’ll see it.”

CEO involvement is also key—though rare. Williams recalls a meeting of CEOs during which he asked how many of the participants knew how to reach the person responsible for the company’s supply chain. “All the hands went up, even if that person was two levels down. Then I asked how many know the name, location and number of the person responsible for purchasing healthcare benefits in their organization. I didn’t get a lot of hands.”

He likens healthcare to IT, which was also once seen as a specialized area. “Most companies recognize that IT is a central vector of the business, and they don’t leave their digital strategy to a unique part of the business. It is the business,” he says. “Now they just have to think that way about healthcare.”

Read more: Self-Insurance Is Not Just For Big-Caps

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.