THE CHALLENGE:

THE CHALLENGE:

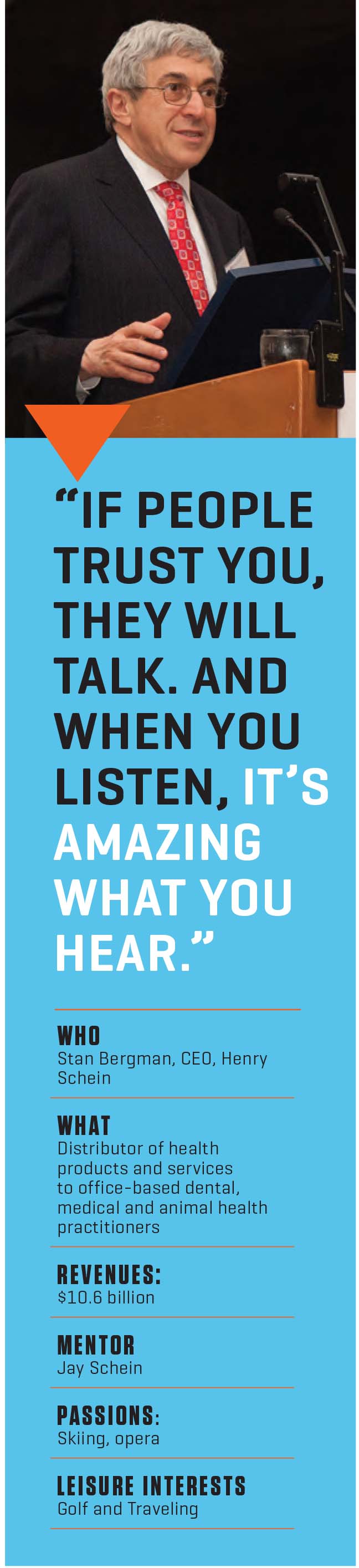

You are named CEO of a Henry Schein, a family-owned dental distribution business after the death of its leader, your mentor. The family has hived off a profitable pharmaceutical division and tasked you and a team of young, untested executives with building up its remaining distribution business and taking it public within five years.

THE BACKSTORY:

Founded in the back of a soda shop in 1932, Henry Schein was the brainchild of its namesake, a Columbia University College of Pharmacy graduate who had the bright idea of selling medical supplies to doctors by mail order. After the company moved into dental supplies in the 1960s, that business took off, accounting for about 12 percent of the U.S. dental-supplies market and $225 million in revenue by the time Stan Bergman was named CEO in 1989.

However, fierce competition from thousands of hungry competitors, all offering equivalent products at similar or lower prices, was putting pressure on prices and driving margins down. Meanwhile, the company lacked the field sales teams that many of its peers boasted and was ill-equipped to compete on service. Clearly, something needed to change.

THE SOLUTION:

Looking to both increase margins and differentiate from competitors, Bergman and his team decided on a three-pronged strategy: to become more than a mere supplier to its clients, to diversify into other types of medical practices and to extend Henry Schein’s geographic reach.

Over the past 20 years, the company has done just that—transforming itself into a full-service provider to dental, veterinary and medical practitioners around the world. In addition to selling supplies and medical equipment, it offers value-added products and services, such as practice-management software and financial consulting.

“Our job is to help healthcare practitioners understand the business aspects of running a medical practice,” explains Bergman. “Veterinarians go to veterinary school because they like animals. You have to explain to them that you can love pets and do a great job for your clients, but they’re also the CEO of a business. They need to worry about managing a staff, building banking relationships, designing their buildings, being able to afford their mortgages. We have about 4,500 field sales consultants today whose job it is to help practitioners run their businesses well.”

THE EXECUTION:

Five years into its transformational journey, Henry Schein raised $72.8 million in an IPO, giving the company an influx of expansion capital. It promptly began gobbling up smaller distribution and manufacturing companies to gain new product lines, add field sales consultants and establish itself in new regions through a combination of outright acquisitions and joint ventures that involve a stakeholder position for Henry Schein.

“About a third of our sales are in joint ventures,” explains Bergman. “We’ll invest in a company that’s doing something that we want to do. We give them capital and whatever help they need—finding a CFO, getting lawyers, that kind of thing; they give us good ideas, great talent and business.”

Navigating these relationships has become a core competency for the company, he adds. “They’re not easy. You have to pre-negotiate everything. It’s like a marriage. If [the] husband says to the wife, ‘This is the way we’re going to do it, I don’t care what you think,’ the marriage is over.”

THE HURDLE:

Like many companies pursuing acquisition-fueled growth, Henry Schein has had its share of hiccups, reports Bergman, who says the company has learned to vigorously vet potential partners. “We’ve had deals for superb businesses that we haven’t done because we thought there would be a clash with the culture and the values,” he says.

He also stresses that social responsibility and the notion of “our ability to make a difference in society” is a core value for Henry Schein. “We do a lot of due diligence up front; and if we find somebody who is not going to walk the talk, then we part ways.”

That vigilance extends to new hires as well. “When you’re recruited as an officer at Schein, you’ve got to meet 20 to 25 people; to become a board member, you have to meet the entire board and 15 people within the company,” says Bergman. “We’re very careful who we let in organically.”

THE RESOLUTION:

Today, Henry Schein continues to sell supplies and equipment, primarily through electronic and telephone sales, but also has an army of 4,500 field sales consultants who serve more than 1.5 million medical practitioners. While margins remain slim on the distribution side of the business, the bump from value-added services brings average gross profit to a healthy 30%.

Already in 33 countries, with a third of its revenue from abroad, the company intends to push into new areas and regions, says Bergman. “We will continue to make investments that advance our geographic presence; there is still a long way to go globally. Also, we will advance our market share in under-penetrated markets. There are parts of the U.S. where we’re not that strong, so we may buy a regional player to get us into there.”

THE LESSON:

Bergman acknowledges that nurturing a culture of trust and shared values becomes more and more challenging as the company grows. “As you grow and grow, you no longer know everyone personally, so you need to industrialize trust,” he says. “Everyone in management has to be a DNA carrier of trust and of your values. I try to set an example by traveling extensively and fostering open dialogue.

“If people trust you, they will talk. And when you listen, it’s amazing what you hear. I talk and talk and talk. I walk and walk and walk. You have to get out of your office and communicate. If I do it, others do it. There is no shortcut to institutionalizing trust other than walking the talk and making sure that everyone else is doing that as well.”

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.