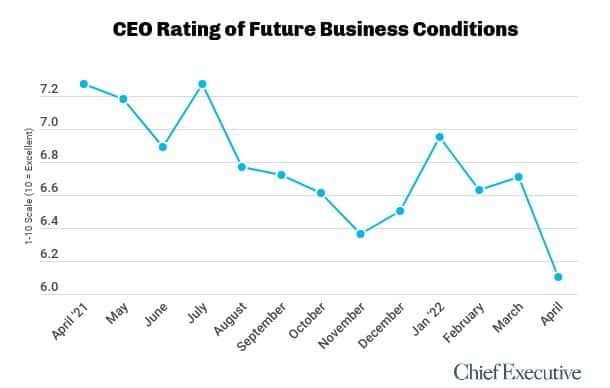

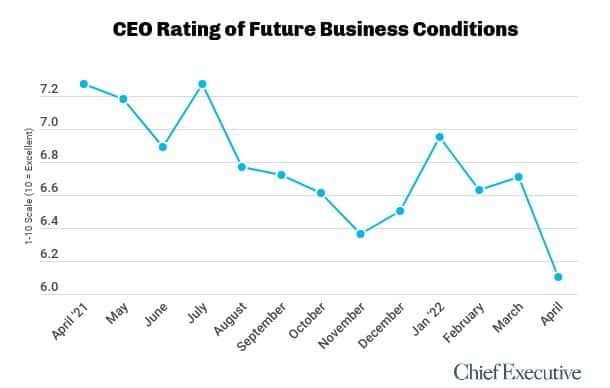

April Poll Finds CEO Optimism At Lowest Level Since Fall 2016

Chief Executive’s CEO confidence index rating plunged 9 percent this month, as America’s chief executives grow increasingly troubled over the state of business. Inflation and supply chain issues are the main drivers of their worries—as is the growing threat of a Fed-induced recession.

Our poll of 207 U.S. CEOs, presidents and chairmen, fielded April 5-7, shows their rating of future business conditions fell to 6.1 out of 10 from 6.7/10 in March. That is the lowest our indicator has been since the fall of 2016, amid the unsettled runup to the Clinton v. Trump election, Brexit and heighted terrorism around the world.

CEOs’ rating of current business conditions also fell this month, down 3 percent, its largest fluctuation since August. The rating now stands at 6.6/10, down 6 percent from one year prior when states began lifting Covid-19 mask mandates and vaccinations were ramping up.

Inflation has been weighing on CEOs’ minds even heavier than Covid-19 since the vaccine gained widespread adoption last spring. Inflation is now the major driver of sentiment, at 4.5 on a 5-point scale, where 1 is not at all impactful and 5 is significant impact. Following inflation, CEOs say that supply chain disruptions have a significance level of 4.2/5 on their optimism for future conditions. Far behind their top two concerns, CEOs rate the interest rate increase and the invasion of Ukraine a 3.5/5 and 3.3/5, respectively.

“I believe the Russian invasion of Ukraine became the tipping point in terms of stressors the economy can handle without an adjustment. We are experiencing a dramatic slowing of incoming orders over the past six weeks,” says Tim Zimmerman, president/CEO at Mitchell Metal Products. He expects conditions will drop to a 6/10 from 7/10 now.

Michael Uffner, CEO at AutoTeam Delware, an upper-mid size car dealer, expects conditions to drop to a 5/10 from 8/10 now. “We are worrying about the possibility of stagflation which is the worst of all worlds,” he says. This sentiment has been growing among CEOs as inflation becomes a larger issue for businesses and consumers alike.

A whopping 50 percent now expect conditions to worsen over the course of the next year, versus 38 percent last month. This is by far the highest proportion forecasting deterioration since we began to measure the metric at the start of 2021.

“In light of the potential shocks of a broader war, there are continued Covid-19 impacts, threats of new variants and increasing potential for stagflation all impacting my rating,” says Bradley Lundquist, president at ALFA International, a wholesale/distribution company. He also expects future conditions to hover at 5/10, down from the 6/10 he gives them currently.

Deborah Malek, CEO of United Equipment Accessories, a mid-size industrial manufacturing company, says, “We have limited capacity due to inability to find skilled talent. Automating but takes time; this gap is preventing us from capitalizing on increase business / revenue.” She shares that talent is a driver in why she believes businesses conditions will deteriorate from a 7/10 currently, to a 6/10 next year as businesses try to catch up in the race.

A declining proportion of CEOs expect improvements to profits and revenues over the next 12 months. In April, 60 percent of CEOs expect increases in profit and 75 percent expect the same for revenues, down 6 and 7 percent, respectively, from the month prior. This is the third consecutive month of declines in hopes for more revenues and the fourth for profits.

The proportion of CEOs planning to increase their capital expenditures also declined this month, down 7 percent since March to 55 percent.

CEOs have a similar sentiment towards hiring. Only 55 percent plan to add to their headcount over the next 12 months, down 15 percent since March. This is the lowest proportion since January of 2021, before widespread vaccinations.

CEO optimism in future business conditions is down across nearly all industries this month. Advertising and wholesale CEOs’ ratings fell the furthest, both down more than 25 percent. They share concerns over talent availability and labor costs constricting their ability to expand their business. Separately, fuel and transportation costs are a major reason why wholesale/distribution CEOs’ forecast dropped. And adv./mktg./PR CEOs are troubled by slowed projections and business.

“We have seen a number of clients slow their projections for the near term. Store traffic is down, etc. Our domestic policies seem to be causing a big increase in core inflation which effects everyone,” says the CEO of an upper-mid sized ad agency.

On the other hand, CEOs in professional services have dampened their rating of current conditions but boast the only month-over-month increase to their rating of future conditions. Their hope stems from the prediction of a legislative change in the midterm elections, bringing a more business-friendly and -forward legislative branch of government.

Year-over-year ratings are down by both size and industry. In April of 2021, many Americans were receiving Covid-19 vaccinations and businesses began to open up as states abandoned mask mandates and regulations related to the virus—plus, the variants of the future (namely, highly-transmissible Omicron) had yet to develop.

Compared to last month, CEOs in companies with under $10 million in revenues are the only ones whose rating did not drop but increased slightly. Their concerns with inflation and staffing and balanced by hope for a favorable outcome in the midterm elections and increased demand.

CEOs in larger companies are concerned with inflation and political missteps which will lead to a recession in the future, even with a change in Washington.

Paul Hylbert, CEO of Kodiak Building Partners, a real estate firm with over $1 billion in revenues says plainly, “Inflation is the number one issue. The end of this story is recession.”

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.