Poll: CEOs Remain Wary In February Amid Continuing Economic Uncertainty

If there’s anything clear about where the economy might be headed in the next few months, that’d be news to chief executives across the nation.

Our February poll—of 177 U.S. CEOs, fielded February 7-9—finds muted optimism about the future as strong economic indicators including a surprisingly robust labor market—normally great news—continue to fuel fears of a Fed-led recession instigated to snap inflation. Overall, CEOs say they are motivated by easing inflation and strong employment numbers but remain concerned that high interest rates and potential layoffs will diminish consumer spending power and slow the economy.

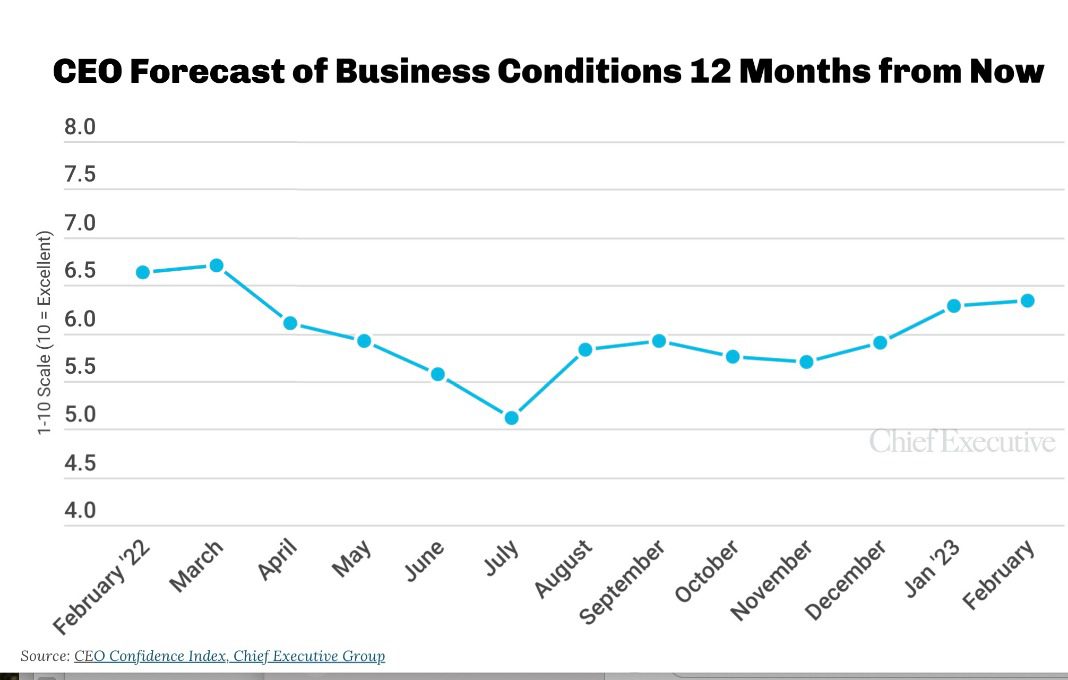

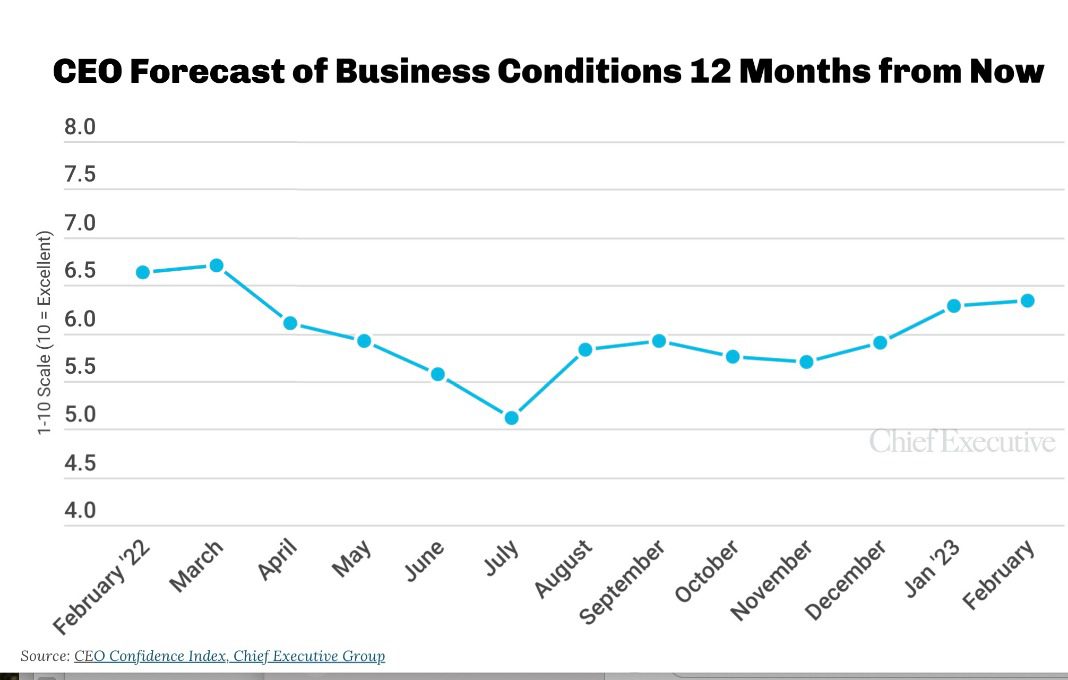

The Index—which asks CEOs to predict business conditions 12 months from now—remains at 6.3 out of 10 on our scale (1=poor and 10=excellent), unchanged from last month. Meanwhile, the proportion of CEOs who forecast improving conditions slid this month, after reaching a multi-year peak in January. CEOs’ confidence in current business conditions ticked up 2 percent to 6.2 out of 10, up sharply from last quarter as business owners say that demand has yet to falter in most industries.

“Due to a brisk first half of 2022, our overall 2023 expectations are slightly below 2022 results,” says Jim Vandegrift, President at R&M Materials Handling. “However, we exceeded our January forecast and appear to be headed to do the same in February. I do not see recessionary pressures on our business at this time, but the prospect is hard to ignore through the constant chatter of the media.” He predicts future conditions at a 5, below the 7 out of 10 he rates current conditions.

Vandegrift is part of the one-third of CEOs who forecast worsening conditions in February, ticking up from 28 percent the month prior. Many of these CEOs otherwise rate current conditions as good (6) or better, yet point to uncertainty in the market, in politics and in consumers as what drives their downgrade of future conditions.

Andrew Wahl, President at IG Partners, Inc. a global M&A advisory firm, says he expects conditions to deteriorate. “This will be my 6th recession since graduate school. The data is similar to the Dot Com bust.”

Still, some 41 percent of CEOs forecast improving conditions—the highest that number has been in a couple of years.

Among those predicting a thaw is Steve Schlesinger, Executive Chairman at Schlesinger Group, a large international data collection and research services company. He expects conditions to improve from 6 to 8 out of 10 a year down the line. “Inflation has peaked, and we should see strength in the 2nd half of 2023.”

Karim Chichakly, Co-President, isee systems, inc., a simulation software company agrees. “While I expect the U.S. and world economy to go a little deeper into a recession, I anticipate a quick recovery.”

The proportion of CEOs who say that demand for their products/services is up today compared to one year ago fell, from 42 percent in January to 38 percent in February. Now, an almost equal proportion of CEOs say that demand for their products/services is down today compared to one year ago, at 37 percent.

But the majority of CEOs expect demand to be up one year from now at 53 percent, almost unchanged from last month.

Forecasts for growth are widely scattered this month, with a smaller proportion of CEOs forecasting increases in profits and hiring in the year ahead than last month, while the proportions forecasting growth in revenues and capex remained unchanged and climbed, respectively.

In February, 56 percent of CEOs forecast increases in profits over the coming year, down 9 percent from January. Meanwhile, 70 percent of CEOs project increases in revenues, unchanged from the month prior.

CEOs seem to be more optimistic around capital expenditures. The proportion who are planning increases over the next 12 months jumped 18 percent m/m. Now, 53 percent of CEOs say they are looking at increasing capex—the highest proportion since April 2022.

Only 49 percent of CEOs are planning to increase their headcount over the coming year, down 5 percent from January.

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.