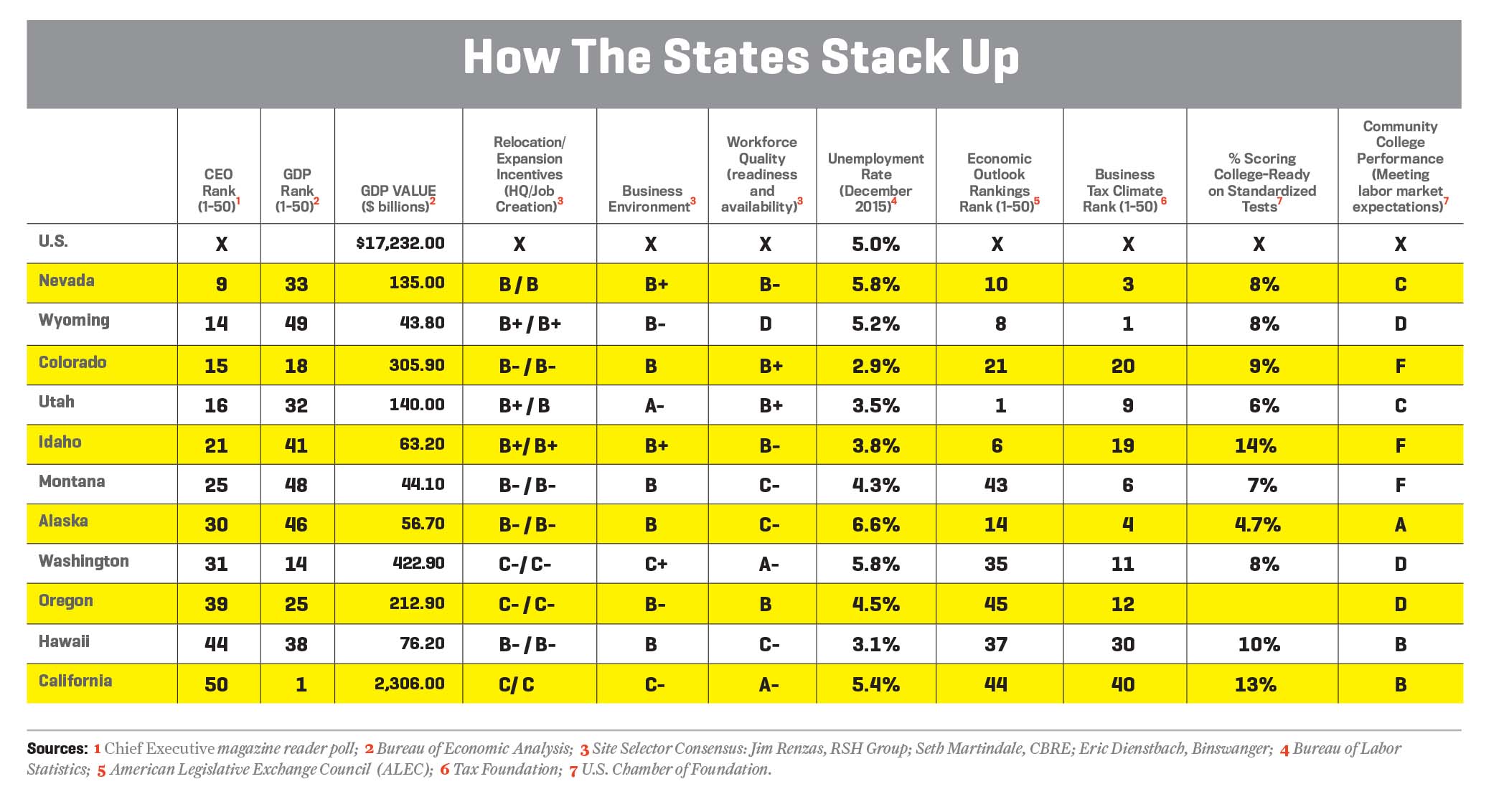

NEVADA | #9 | WHAT HAPPENS HERE…

Nevada, one of the states hit hardest by the Great Recession, has been among the slowest to recover. Las Vegas experienced 14% unemployment at the epicenter of the recession, now down to 5.8%. Jobs are coming back; the Sagebrush State ranked fifth last year in job creation. “We’ve turned the corner on the recession and the recovery,” says Steven Hill, Nevada’s top economic development official. “That’s all in our rear-view mirror right now.”

Nevada, one of the states hit hardest by the Great Recession, has been among the slowest to recover. Las Vegas experienced 14% unemployment at the epicenter of the recession, now down to 5.8%. Jobs are coming back; the Sagebrush State ranked fifth last year in job creation. “We’ve turned the corner on the recession and the recovery,” says Steven Hill, Nevada’s top economic development official. “That’s all in our rear-view mirror right now.”

Expansions of local companies and an influx of tech businesses have fueled Nevada’s recovery. Apple’s decision to open a $1 billion data center in Reno in 2012 gave the state instant cred as a platform for tech operations. And the aforementioned Tesla decision instantly propelled the state into the economic development’s major leagues.

The elevated status comes at a cost to taxpayers; Nevada is the third most aggressive issuer of relocation and expansion incentives in the country, behind only Texas and Florida. Its flexible approach to property tax abatements enticed eBay to open a $412 million data center in the Reno-Sparks corridor last year.

While the lion’s share of economic attention goes to Reno, Las Vegas has made headway, as well. It inked a $1 billion factory development deal early this year with Faraday Future, the other electric car company, and is working hard to overcome what some suggest is a perception problem. “People perhaps don’t realize there is a large city outside the strip with a big labor force,” says Seth Martindale, a managing director with CBRE in Los Angeles.

WYOMING | #14 | ENERGY BLUES

For more than a decade, Wyoming—whose energy sector accounts for 40 percent of GDP—well outpaced national economic growth and job-creation activity. Not anymore. The air continues to rush out of the Cowboy State’s oil and gas balloon. Sector employment will bottom out this year at 13,800 jobs, before inching back beginning next year, predicts University of Wyoming economist Anne Alexander.

For more than a decade, Wyoming—whose energy sector accounts for 40 percent of GDP—well outpaced national economic growth and job-creation activity. Not anymore. The air continues to rush out of the Cowboy State’s oil and gas balloon. Sector employment will bottom out this year at 13,800 jobs, before inching back beginning next year, predicts University of Wyoming economist Anne Alexander.

Mining has a bright spot—trona, which supplies about 90% of the nation’s soda ash and whose production is seen rising through 2019. Federal government employment, a main labor cluster, is also down. Agriculture is a mixed bag: better growing conditions have improved crop product, but increased supply has lowered prices. Many Wyoming residents feel the pain; personal income will drop 2.1 percent this year, estimate state economists.

Casper, the state’s biggest city, has made strong gains in leisure and construction while holding onto its energy-sector workforce. Along with Cheyenne, the state’s second-largest municipality, both metro regions are seeing new businesses and restaurants opening, with more tourists coming for the scenery and recreation, says Alison Felix, economist at the Kansas City Fed.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.