“We have identified five levers to protect and bolster the company’s financial vitality in 2020…The first lever is that we are working diligently to maximize revenue in the retailers and categories that are growing.” – Ravichandra Saligram, President & CEO Newell Brands

“By creating one operating sector…we believe we can enhance our focus on accelerating topline growth.” – Ramon Laguarta, Chairman & CEO PepsiCo

Like Newell and Pepsi, many companies are looking to restart and accelerate top line growth to recover lost sales as the initial economic shock from Covid-19 begins to ebb. Many will rely on traditional revenue growth management (RGM) strategies focused on pricing, promotions, assortment, and trade investment. “High growth” categories, customer groups, or regions will be targeted, typically defined by their potential to generate incremental revenue, and sometimes by their incremental gross profit or contribution profit.

Unfortunately, the evidence suggests that many of these efforts—despite growing amounts of data and advances in analytics—will unintentionally lead to reductions in cash flow and shareholder value at a time when cash is critical. Companies that avoid the pitfalls of traditional RGM strategies can minimize their risk.

For all companies, shareholder value is driven by investor expectations of future cash flows and economic profits (profits earned in excess of the opportunity cost of capital). When looking at the companies in the S&P 500, there is a very high correlation between their Intrinsic Value (the discounted value of their future cash flow[1]) and their actual share price and market value.

For all companies, shareholder value is driven by investor expectations of future cash flows and economic profits (profits earned in excess of the opportunity cost of capital). When looking at the companies in the S&P 500, there is a very high correlation between their Intrinsic Value (the discounted value of their future cash flow[1]) and their actual share price and market value.

However, few if any RGM practices attempt to link top-line growth strategies directly to maximizing cash flow and economic profits[2]. There is an underlying assumption that if companies grow the top line, and manage costs, that profits will naturally grow as well. But this approach to growing profits by managing these line items individually, rather than through changes in strategy, is just as likely to fail as it is to succeed, according to empirical data.

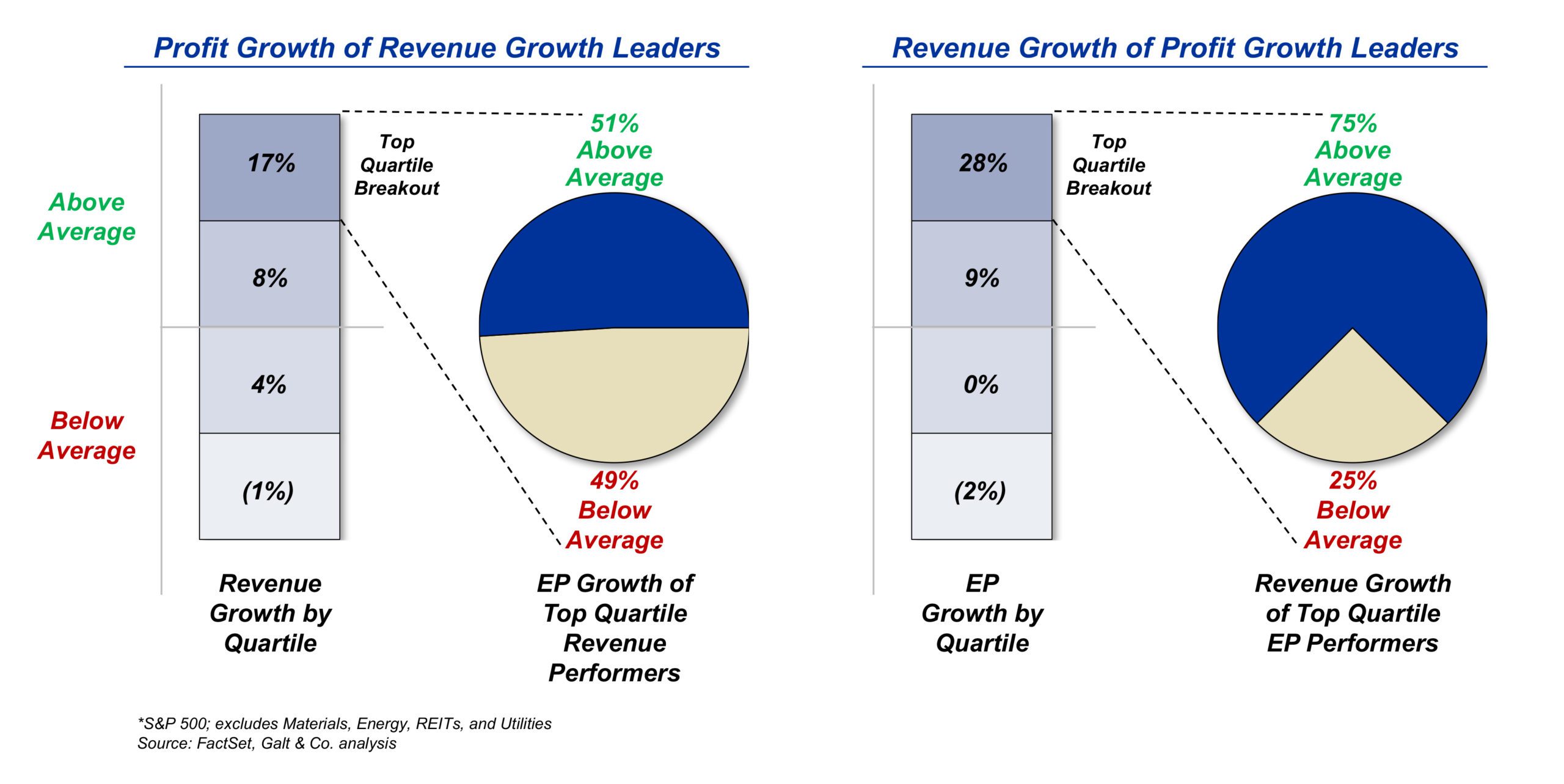

In fact, almost 50% of companies in the S&P 500 that delivered top quartile revenue growth also delivered below average economic profit growth—and more than 40% had bottom quartile economic profit growth. The unfortunate result is that these companies had less cash to reinvest in new products, capabilities and technologies that could help build competitive advantage.

On the other hand, strategies that drive long-term economic profit growth as the primary objective are more likely than not to generate above average top-line growth. In the S&P 500, nearly 80% of companies delivering top quartile economic profit growth also had above average revenue growth. In other words, maximizing economic profit growth over time will also lead to advantaged revenue growth. However, on the flip side, maximizing revenue growth over time is just as likely to destroy value as it is to create shareholder value. This is because economic profitability is a good signal that customers place a higher relative value on a company’s products, which is likely to drive demand and decrease price sensitivity (e.g., Apple iPhones).

In the long run, only RGM strategies that grow cash flows and economic profits will succeed in growing shareholder value. While calculating economic profit requires a bit more effort than traditional measures, there are few initiatives with a higher ROI.

In the long run, only RGM strategies that grow cash flows and economic profits will succeed in growing shareholder value. While calculating economic profit requires a bit more effort than traditional measures, there are few initiatives with a higher ROI.

Insufficient Granularity:

A focus on economic profits is a strong first step, but RGM strategies can still fall short if measurement occurs at too aggregate a level.

A focus on economic profits is a strong first step, but RGM strategies can still fall short if measurement occurs at too aggregate a level.

The growing amount of data available to managers can provide insights at an increasingly granular level – such as by customer segment, customer or transaction. But most IT systems and reports developed to leverage this detailed information can only provide insights at a net revenue or gross profit level. Few reporting systems can reveal how cash flow or economic profitability varies across a company’s SKUs, outlets, customers, and channels, let alone the intersection of one or more of those dimensions. As a result, management often makes RGM choices for a broad segment of the business, unaware of the dramatic profit differences that exist at a granular level (e.g. customer, outlet, SKU, etc.).

System limitations and Inadequate Procedures: [3]

One reason that few companies perform RGM analytics at an economic profit, or even operating profit level, is inadequate systems and procedures.

Fortunately, gaining visibility into economics at a more granular level does not require a complete overhaul of IT systems or standard reports. The capability can typically be built within an existing finance organization with the right training, oversight, and access to existing data systems.

The exact requirements vary across industries and companies; however, all organizations should:

Insufficient Governance:

Beyond developing a granular view of profitability, maximizing the value of this data over time requires proper governance, training, and incentives. For example, it is not unusual for companies to say they want profitable growth, but then compensate RGM teams on incremental sales or volume. Once visibility into granular profit concentrations are available and the drivers understood, incentive practices must evolve to compensate management for successfully capitalizing on these concentrations.

Beyond developing a granular view of profitability, maximizing the value of this data over time requires proper governance, training, and incentives. For example, it is not unusual for companies to say they want profitable growth, but then compensate RGM teams on incremental sales or volume. Once visibility into granular profit concentrations are available and the drivers understood, incentive practices must evolve to compensate management for successfully capitalizing on these concentrations.

In addition, simply having better data and incentives is not sufficient for long-term success. Employees using this data must understand the impact of assumptions, look for the underlying drivers of profit concentrations, and develop RGM strategies with a more thorough understanding of the ripple effects on the business (e.g., impacts on the supply chain, distributors, net working capital, etc.).

Creating Long-Term Differentiation through RGM:

Companies that develop RGM practices that are disciplined, granular, and economic profit-driven position themselves not only for short-term improvements, but also for long-term outperformance in the capital markets. Economically profitable growth generates incremental cash flow that can be reinvested in the business to continue driving competitive differentiation or returned directly to shareholders. Yes, overhauling RGM strategy with these practices involves shifts in mindset, culture, and capabilities, but that is precisely why those that make the journey enjoy a competitive advantage over peers.

Granular Profitability: Orignal Equipment Manufacturer Example

Management of an industrial equipment manufacturer desired profitable growth but lacked a granular understanding of bottom line profitability of their portfolio. Since most sales were profitable on a contribution margin basis, leadership focused on maximizing market share (of revenue). When sales were at risk of failing to meet growth targets, managers offered higher and higher discounts to move product faster. The result: The company met revenue growth goals but shares underperformed the S&P 500 by over 9% annually over a 3-year period.

A granular assessment of economic profitability across their portfolio revealed that much of the topline growth was concentrated in the least economically profitable products and regions. The company began evaluating why this had occurred, and learned that some of these products were overdesigned and too expensive for customers in these segments and could not be sold on an economically profitable basis to these customers. This knowledge, and identification of other previously hidden pockets of value creation and destruction across the portfolio, enabled the company to begin generating consistent economic profit growth. The result: the company outperformed the S&P 500 by 2% annually in the following 5-year period.

[1] Based on Valueline forecasts

[2] Economic profit is earnings less a charge for the capital investment required to product those earnings

[3] Deloitte. Cost Transparency | Helping Finance Create Business Value. 2016.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.