Volatility is one of the most overused words of the past five years. Not without reason: Wars, inflation, the advent of generative AI, tariffs, and, of course, a global pandemic. It’s been a very rocky decade.

But a new, long-term analysis of our ongoing CEO Confidence Index finds a twist: The only thing even more disruptive than volatile events is the anticipation of the volatility they may cause. With two exceptions: The Great Recession and 2025.

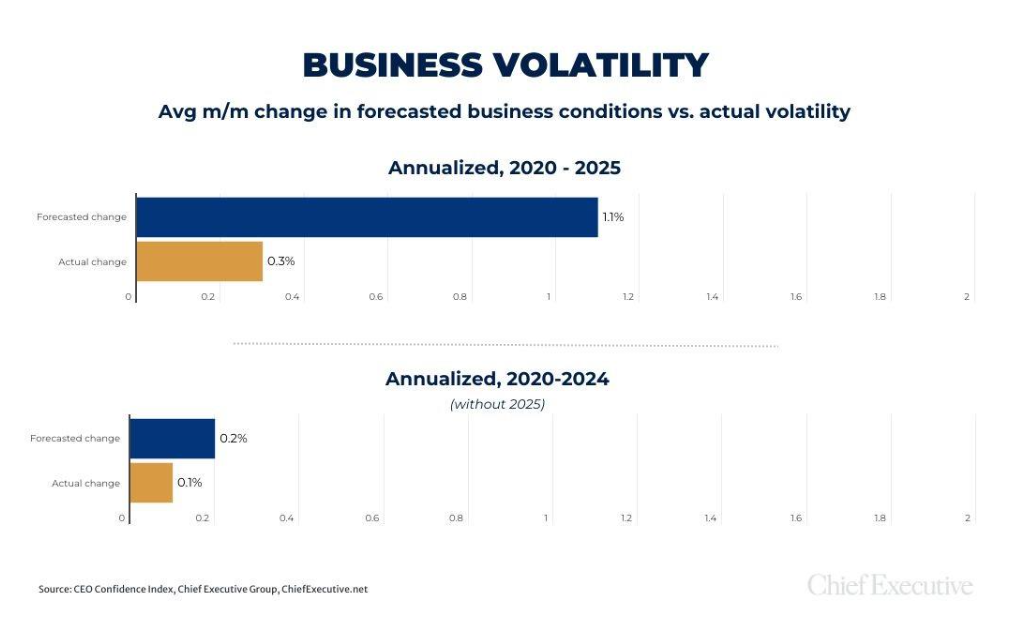

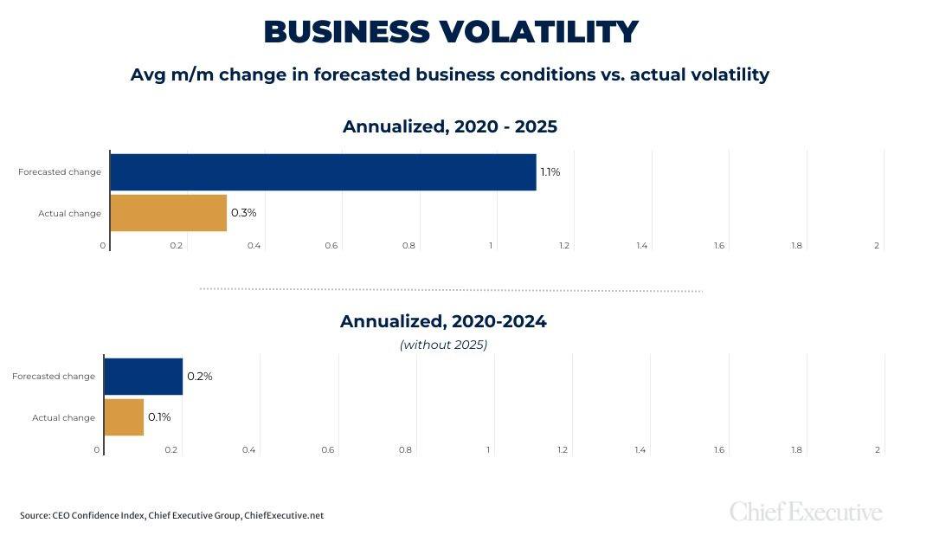

Data from our monthly CEO Confidence Index shows that while CEOs forecasted an average month-over-month change in business conditions of -1.1 percent during the period spanning 2002 and 2025, their assessment of business conditions in real time over that period only fluctuated by an average of -0.3 percent on a month-to-month basis, indicating that the anticipated level of volatility has been greater than what eventually transpires almost every time. As one CEO put it, “We can talk ourselves into a recession if we’re not careful.”

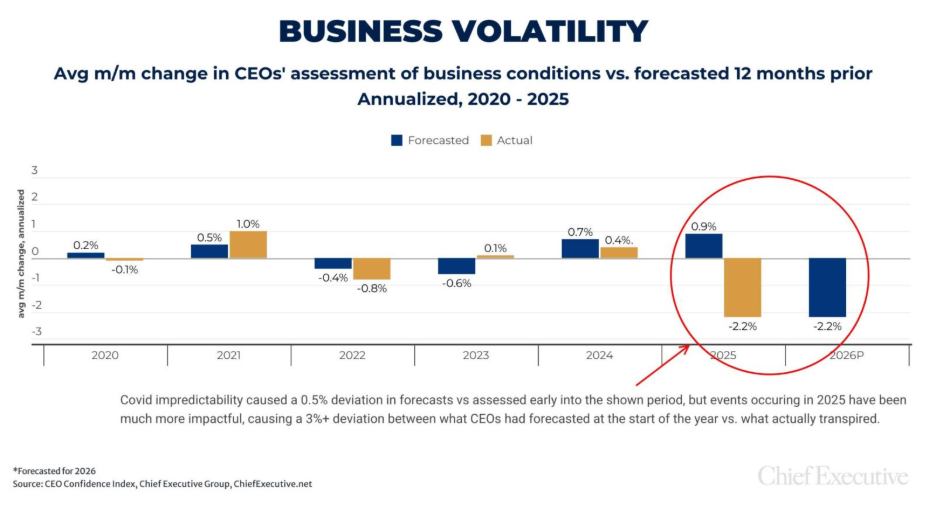

But our analysis also found that the pattern may be changing in 2025. The average monthly change in both CEOs’ real-time assessments of business conditions and their 12-month forecasts has been -2.2 percent so far this year, a significantly high number compared to historical data.

Over the past 23 years (since our Index’s inception in 2002), there have been only five periods when the average month-over-month change in CEOs’ forecasts fluctuated by as much as it has this year. Two were positive: The 2003 Iraq war and capture of Saddam Hussein (+3.0 percent) and 2010, as the Great Recession waned (+2.2 percent).

Two others came in 2008, at the height of the Great Recession (-6.2 percent) and as indications of its end began to emerge in 2009 (+13.7 percent).

If we subtract 2025 entirely from the 2020-2025 period that is considered to be so volatile, the results are even more telling: The forecasted volatility of the period without this year normalizes to 0.2% (from -1.1%) and the actual recorded change in conditions moves to 0.1% (from -0.3%)—a much more normal deviation.

This perhaps explains why CEOs’ confidence has been averaging 5.3 out of 10 so far this year, the lowest level since 2011-2012, a period that was marked by cyber breaches, mass layoffs, anti-capitalist movements and global credit downgrades.