A decade ago, in the wake of the Great Recession, Lee County, Florida was dubbed “the foreclosure capital of the country” by the national media, the poster child for all that had gone wrong with the American economy.

“Homes are selling at 80 percent off their peak prices,” reported The New York Times in February, 2009. “Only two years after, there were more jobs than people to work them, fast-food restaurants are laying people off or closing. Crime is up, school enrollment is down, and one in four residents received food stamps in December, nearly a fourfold increase since 2006.

“Welcome,” boomed The Times, “to the American dream in reverse.”

What a difference a decade makes. Today, Florida—and Lee County—is thriving again, with thousands of businesses and hundreds of thousands of people flocking to the Sunshine State annually. It seems that—surprise!—warm weather and zero income tax are catnip for employers and workers alike.

But Florida is hardly alone. Job growth in the U.S. over the past decade has been about 13 percent but some states and some regions have been outperforming the nation by a large margin. So which states are hot, and which are not? And what does the future hold—especially in key sectors like technology and professional services?

To find out, we analyzed recent job growth data for all 50 states over ten-, five-, and one-year periods. For each time period we looked at overall growth, as well as the manufacturing, high-tech and professional and technical business services sectors.

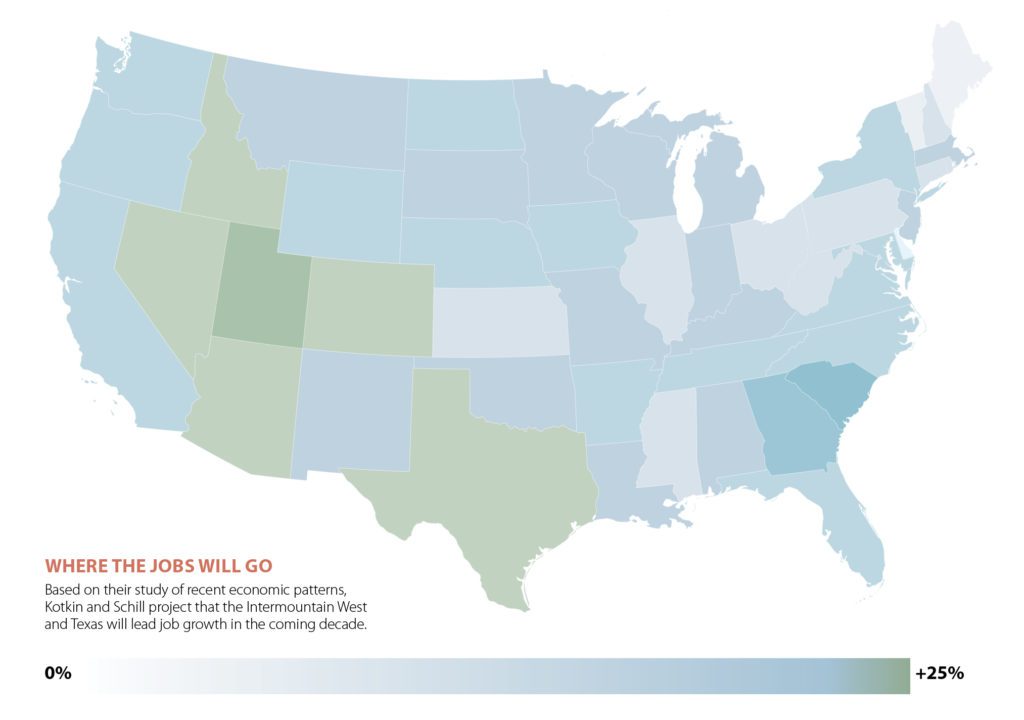

What emerges is a picture, particularly for job creation, that is complex but consistent over the past 10 years—and likely will be for the decade ahead. All people may have been created equal—but states are not. Simply put, the big winners are all in the Sunbelt and the Intermountain West. And we project that trend will continue.

At the top of the heap—with growth rates over 20 percent—are, in order, Utah, Nevada, Florida, Texas and Colorado. Their growth has been more than the rate of growth of states like New York and others on the Atlantic seaboard, as well as most Midwestern states. Not surprisingly, these states all boast the highest population growth rates and are home to many of the nation’s fastest growing metros. Austin leads the pack, followed by Orlando. Denver, Dallas and Las Vegas can all be counted among the fastest growing metropolitan regions.

At the top of the heap—with growth rates over 20 percent—are, in order, Utah, Nevada, Florida, Texas and Colorado. Their growth has been more than the rate of growth of states like New York and others on the Atlantic seaboard, as well as most Midwestern states. Not surprisingly, these states all boast the highest population growth rates and are home to many of the nation’s fastest growing metros. Austin leads the pack, followed by Orlando. Denver, Dallas and Las Vegas can all be counted among the fastest growing metropolitan regions.

At the end of the list, sadly, there’s consistency as well. The bottom rungs are dominated by poor, resource-dependent states such as Louisiana, West Virginia and Wyoming—but also now include traditionally buoyant economies such as Connecticut, whose 3.3 percent growth over a decade is roughly one quarter of the national average. There’s nothing in the data we looked at that shows these trends will change, either.

Momentum Tilts to the Heartland and the Sunbelt

In our modern high-velocity economy, 10 years can seem like an epoch. Yet our top states generally have remained remarkably consistent in performance. The slowing growth in hyper-regulated California and the generally mediocre performance along the Northeast corridor has boosted the status of states like Texas, Florida, Arizona and Idaho, which are benefiting from mass migration of both companies and people.

Unlike its East Coast counterparts, the Golden State, however, has been a solid performer, though growth has slowed in the past year. It ranked a solid 9th over the past decade, with almost 18 percent growth. California’s strength can be attributed in part to its economic diversity, with strong concentrations in agriculture, information, professional services and entertainment.

It has started to fade, likely due to high housing prices, rising out-migration (Los Angeles lost population last year) and sky high taxes. Last year, the state ranked 13th and, given the fires and new regulatory burdens, one can expect that to drop further. The state’s manufacturing economy is withering, and after averaging about 100,000 new healthcare jobs annually in the nine years before 2018, just 20,000 were created in the last year.

We may be on the cusp of continued weakening for high-tax, highly regulated states—particularly those that lack California’s ideal weather (most of the time) and spectacular topography. New York ranked a respectable 19th over 10 years, but last year it dropped to 22nd. Massachusetts, 16th over the decade, fell to 27th last year. Other traditional leaders, like Illinois, which dropped from 17th worst over 10 years to 4th worst last year and especially Connecticut also are losing momentum, according to last year’s figures. All have dropped off their 10-year pace.

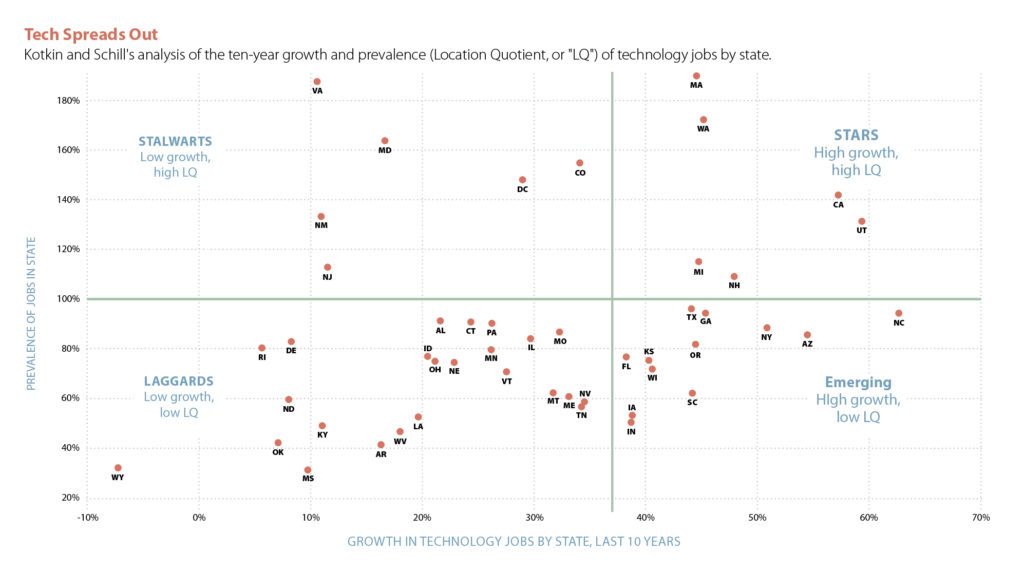

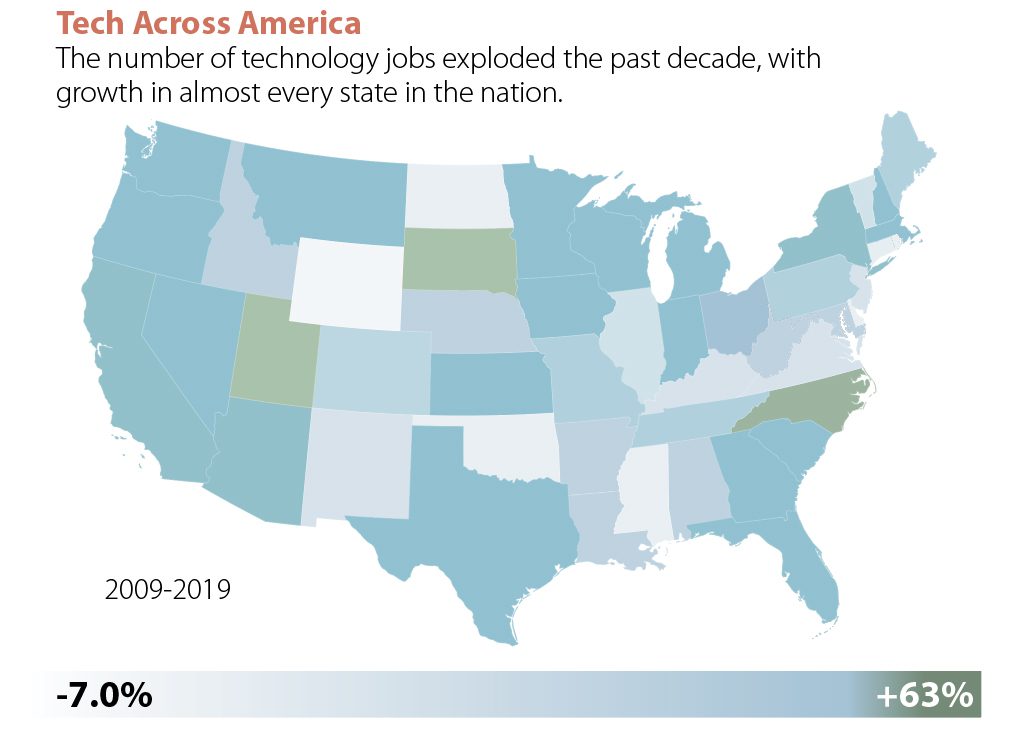

Where Tech Is Headed

Of course, not all jobs are the same. Some tend to pay more, and some occupations are expanding more rapidly as the economy changes. High-tech employment has grown in almost all our leading states, but the biggest winners over ten years have been varied: led by North Carolina, Utah, South Dakota, California and New York.

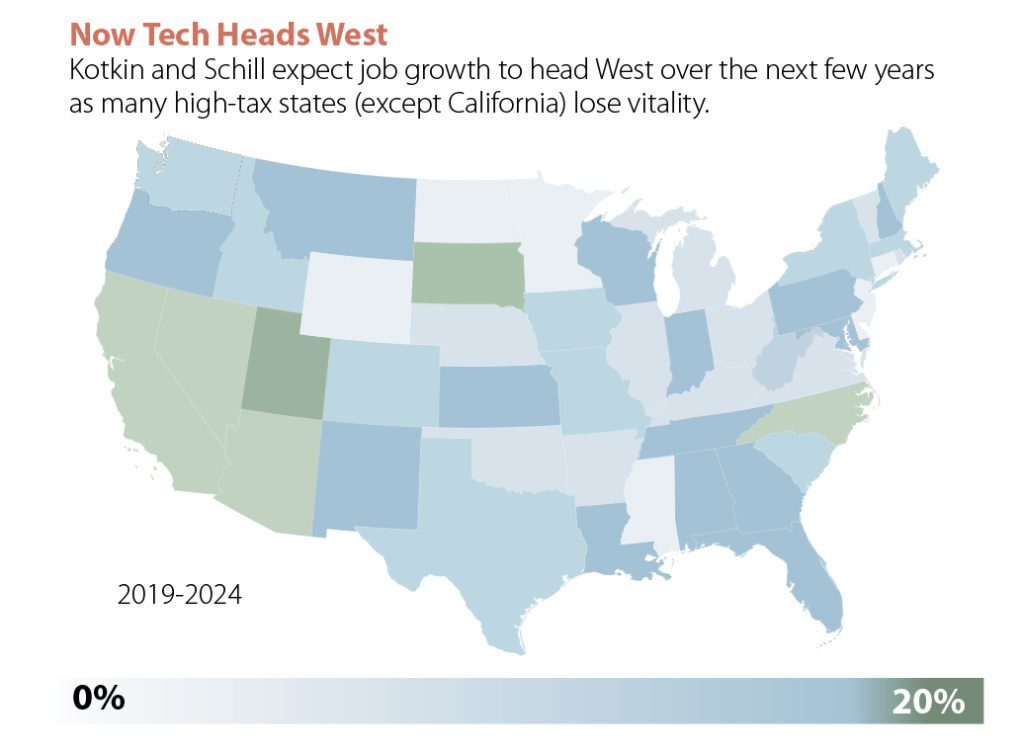

But here again last year’s numbers project something of a different cast. The biggest change was the emergence as the fastest-growing state in the past year: Idaho. Over 10 years, Idaho registers in the bottom third, but last year it enjoyed the fastest tech growth in the nation. Boise and its surrounding region are booming, with newcomers pouring in from the West, not only California. It is now the fastest-growing metro in the nation.

In contrast, New York fell from 6th over 10 years to 15th last year. Even New York City’s much ballyhooed tech sector is essentially middle of the pack in growth among large metros. Millennial out-migration—a key element for this field—is now the highest in the country, notes Brookings, followed by Chicago and Los Angeles.

This could also impact California and Silicon Valley. Population growth in the core Bay Area has slowed considerably, and surveys reveal many residents, even most, are contemplating an exodus, particularly as they enter their 30s and seek to buy a house. Statewide, notes a recent UC Berkeley poll, roughly half of all residents are considering a move out, particularly between the ages of 30 and 50.

Yet as long as the Bay Area—and its Puget Sound doppelganger Seattle—remain the home base for the world’s top tech firms, it’s growth will likely continue as companies staff up with young workers who may not stay for long, but could power the economies. High costs in the Bay Area are likely helping to propel Utah to be the second-fastest growing high-tech state over both the ten- and one-year time periods.

Professional and Technical Services: New Homes

Professional and Technical Services: New Homes

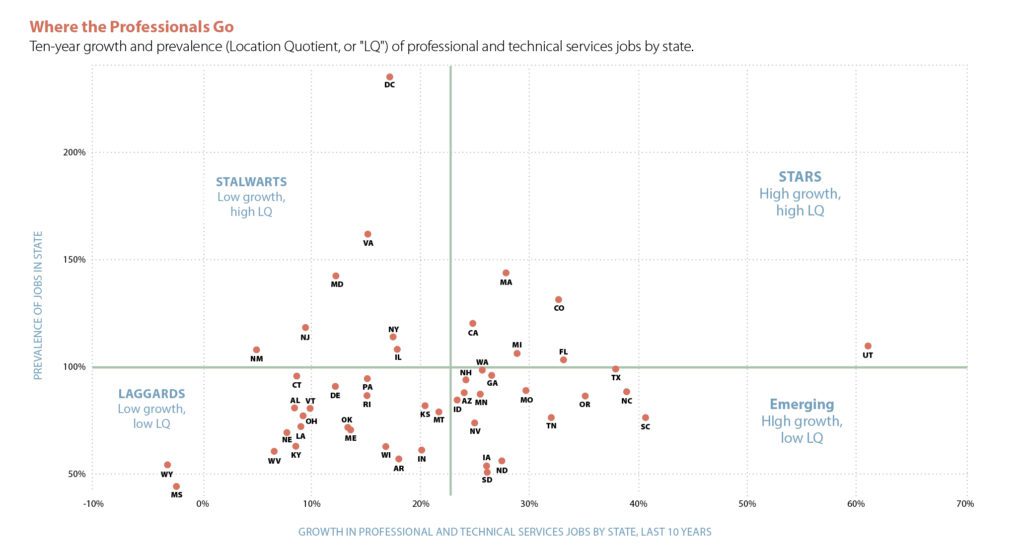

Equally important for growth in this evolving economy are professional and technical services. This is—by far—a larger sector than technology and it has traditionally clustered in highly urbanized states such as New York, Illinois, Massachusetts and California, as well as Maryland, Virginia and the District of Columbia. With 62 percent more than national average, Virginia is home to the highest concentration of professional and technical services jobs, while Maryland ranks third. If it were a state, the District of Columbia would take the top spot.

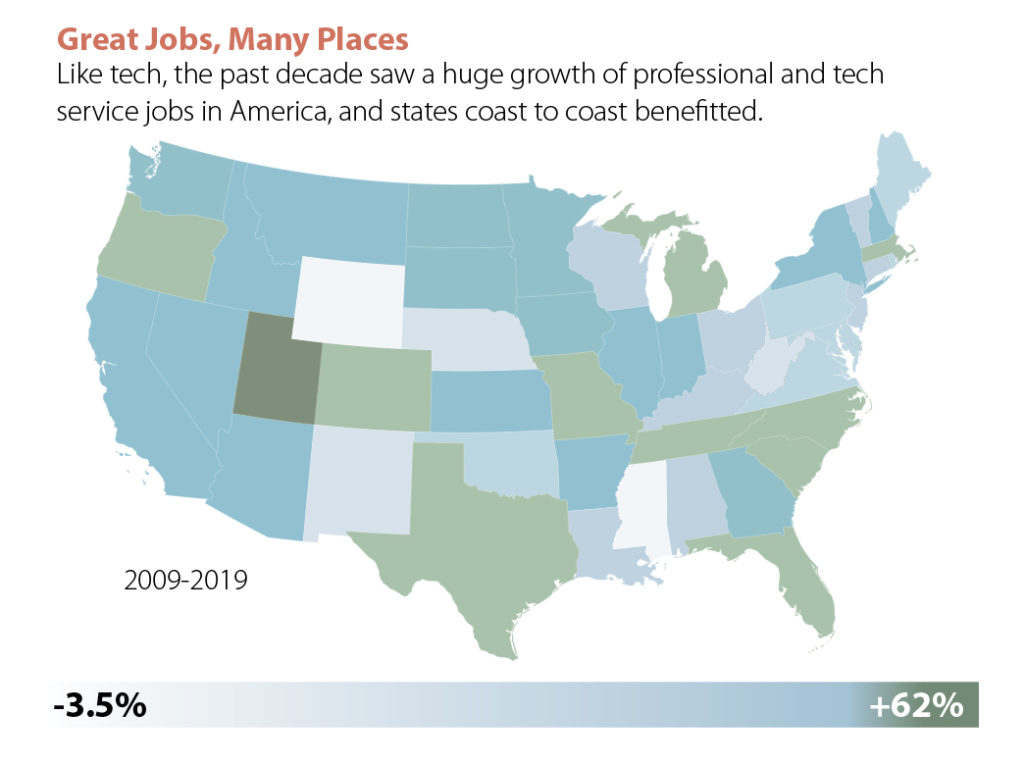

Yet increasingly, these industries are growing fastest in non-traditional locales, often with much lower tax rates and house prices. Over the past 10 years, the top six fastest-growing centers for this key sector have been led by Utah, North and South Carolina, Texas, Oregon and Florida. Along with Colorado and Tennessee, each of these states has seen their share of the sector expand employment more than 30 percent, compared to a national average of 23 percent.

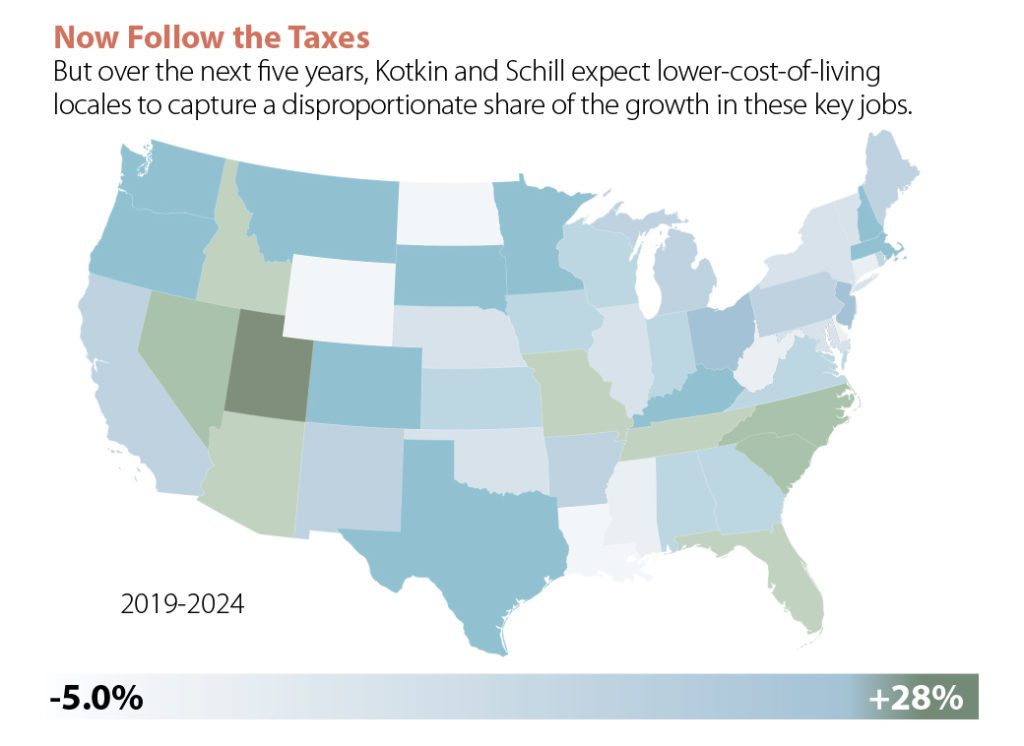

In contrast, the traditional centers of this industry—except for California—have done far less well. In fact, over the decade, growth in New York, Illinois and the District of Columbia has been roughly half that of the leaders and below unlikely states like Missouri, Kansas, Idaho, Iowa, Indiana and the Dakotas. The most recent numbers suggest this trend is just beginning. Last year Utah, Idaho, Texas, Nevada, Colorado and—surprisingly—South Dakota led the pack. New York, for example, ranked 42nd last year, well below its 10-year ranking of 27th. Illinois, New Jersey and Connecticut are also losing steam, mired in the bottom 10 of states. These critical knowledge-based services sectors that clearly clustered in major metropolitan areas in the 1990s and 2000s may be showing signs of decentralization. If this pattern accelerates, these states may all see many of the prized jobs headed elsewhere—something made easier by the ability of firms to access talent digitally outside the traditional, often very expensive centers.

Where’s Manufacturing Going?

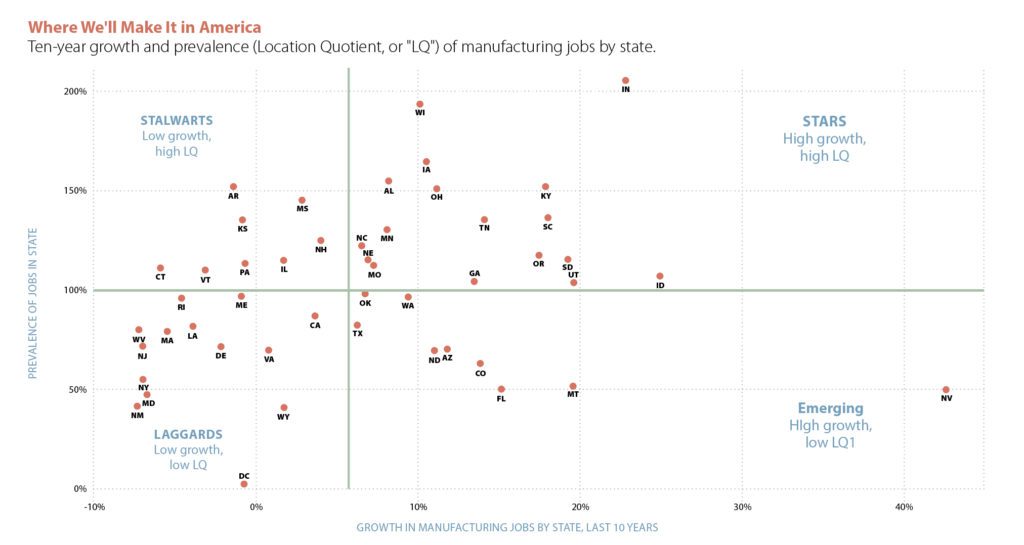

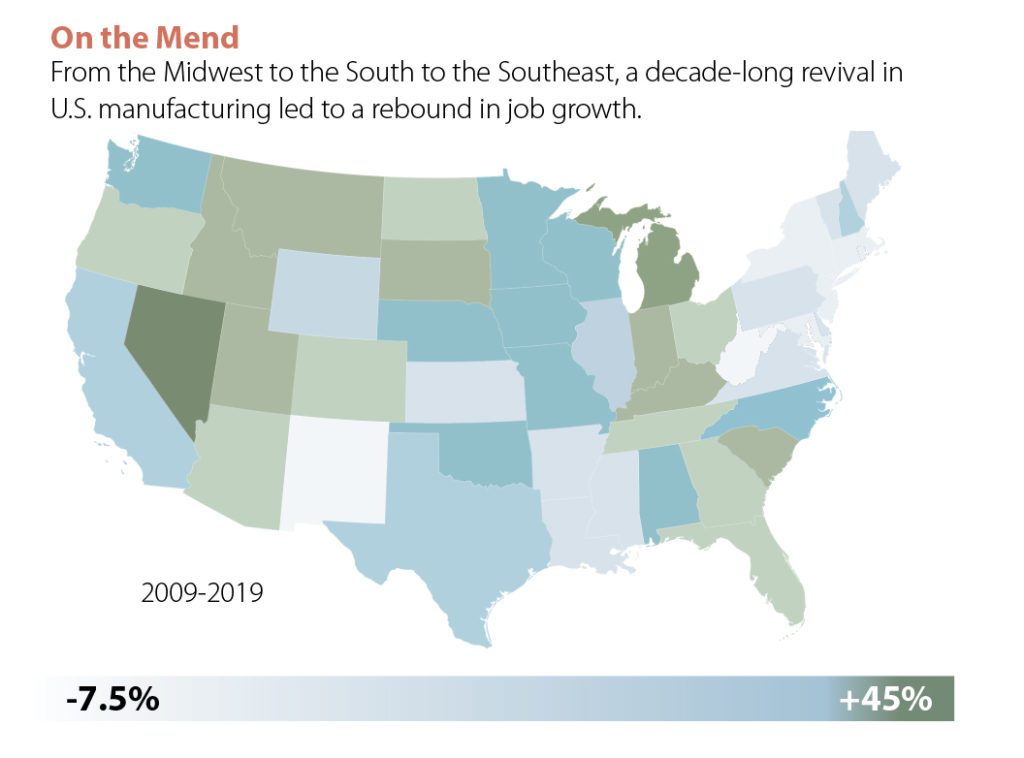

Some, like futurist John Naisbitt, have called manufacturing “a declining sport,” and it certainly does not account for the share of GDP or employment it once did. But over the past decade, the industrial sector has enjoyed steady growth, which has only lately slowed.

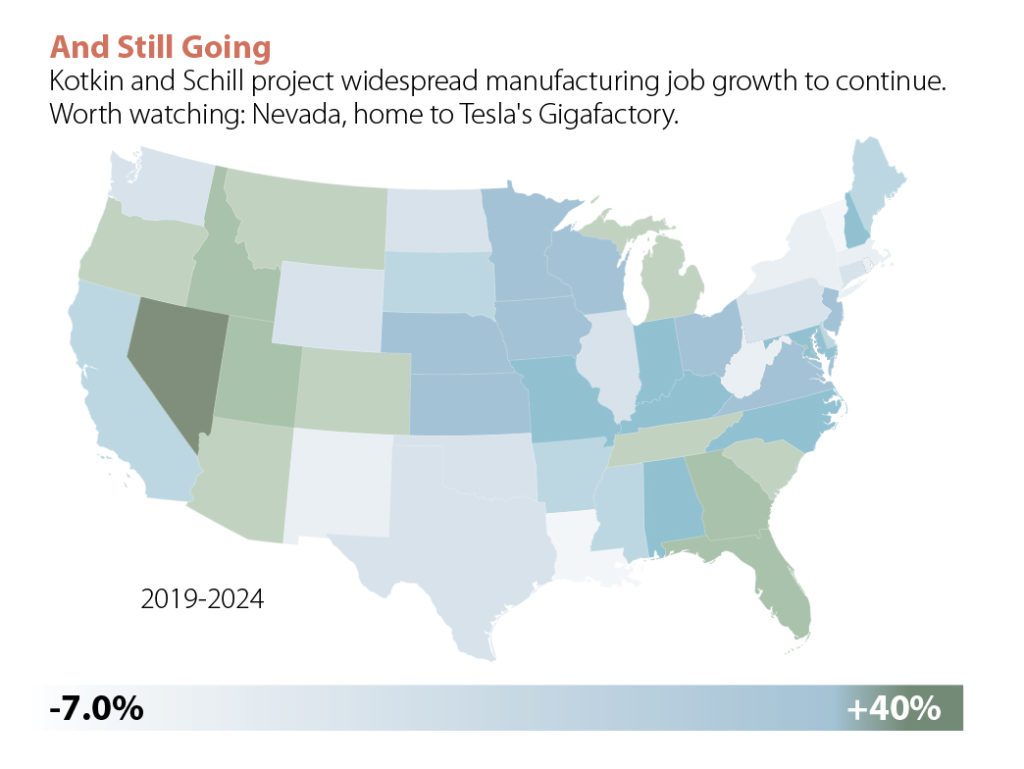

Certainly, some of the states that have won the employment race overall have also done well here. The consistent big winner has been Nevada, which topped the 10-year, five-year and one-year measurements for manufacturing. Its 10-year growth of over 42 percent is far higher than the national average of 7.5 percent.

Nevada industrial growth seems to stem from two factors—the movement of industry from California, leading some to label the state “California East,” and, in particular, the development of Tesla’s Gigafactory outside Reno, which accounted for roughly half of the state’s manufacturing job growth in the past decade. Similar migration can be seen in Idaho and Utah, as firms look to settle in areas with a skilled workforce, relatively low taxes, a favorable regulatory climate and cheap—particularly compared to California—electricity.

We also now see significant industrial growth in its traditional heartland, notably Michigan and Indiana, which enjoyed growth rates over the decade of 34 and 22 percent. But that’s changing, too. Last year, the biggest industrial growth took place not in traditional manufacturing areas but in sunbelt states like Nevada, South Carolina, New Mexico and Texas, as well as Intermountain West stalwarts like Utah, Montana and Idaho. Indiana, it should be noted, is on this list as well—still holding its own despite the shift.

The really bad news on the industrial side, however, is on the coasts. New York, New Jersey and Connecticut all lost industrial jobs over the past decade, and rank in the bottom 10 of states. This trend is not turning around; in 2018, generally a banner year for the economy and the industrial sector, both Massachusetts and New York continued to lose manufacturing jobs. California saw negligible (3 percent) manufacturing job growth over the decade.

Looking Forward

Looking Forward

Given the enormous risks in projecting forward, let’s approach this with more than grain of salt, because the large economic shocks of the future with the biggest impact on job totals are inherently unknowable. Estimates for growth over the next decade by EMSI largely duplicate the past; the top five on the list are Utah, Colorado, Nevada, Arizona and Texas. The firm projects New York and California in the top 15.

On the local level, it’s especially difficult to project the impact of regulations and higher taxes since these are determined politically. Clearly, high tax rates in Connecticut, New Jersey and New York are leading to an exodus of citizens, notably among the affluent.

Out-migration among the affluent cost Connecticut in 2016 the equivalent of 1.6 percent of its annual adjusted gross income. New Jersey and New York are suffering similar drains. This has not happened as decisively in California, where out-migration tends to be strongest among people in their 30s and 40s.

That’s critical, since population growth trends need to be factored in any sensible projection. On that score, Texas and Florida are adding the most people, while Idaho, Nevada and Utah lead in percentage terms. In contrast, New York, Connecticut and New Jersey, as well as many Midwest states have population stagnant growth; even California is now growing slower the national average. This migration, particularly from the Northeast, has profound economic ramifications.

Yet, even the immediate past is not necessarily prologue, particularly in our era of hyper-divisive politics. A victory by a left-wing Democrat, like Massachusetts Senator Elizabeth Warren, could prove catastrophic for many states. According to the U.S. Chamber of Commerce, the kind of ban on hydraulic fracturing that Warren has proposed could cost some 14 million U.S. jobs—far more than the 8 million lost in the Great Recession. In Texas alone, by some estimates, 1 million jobs would be lost. Growth would also slow in numerous other states, such as Oklahoma, North Dakota, West Virginia, Pennsylvania and Ohio.

On the other hand, Warren policies, such as giving free college tuition away to every student, would be a boon for other states, notably her adopted home state, which counts education as a key growth industry. And anything that improves access to higher education—particularly for two-year degrees and certificates—could engage a new workforce and unlock growth opportunities in states that can mobilize their education systems to take full advantage.

In contrast, a Trump victory and continued Republican control of the Senate would be a huge boon to the energy-producing states, and likely industrial firms across the board. Meanwhile, migration to low-tax states would continue, such as the shift of industries like finance to states like Florida, where Carl Icahn has moved his operation, and to Texas. Dallas, in particular, is emerging as a new financial center.

But a Trump victory packs its own perils for many states. A continuing and escalating trade war would continue to impact areas deeply involved in international commerce like California, New York and Texas, as well those who are home to big exporters in industries like aircraft, earth-moving machinery, and financial services. Agriculture-focused states are already feeling the pain as farmers in other countries rush to backfill demand abroad created by the trade war. If tech policies impact trade with China, even the Internet giants on the West Coast could be affected.

But all things being equal, it seems we are continuing to experience a secular shift towards lower tax, less regulated states and away from the coasts. The stronger states, like California and Massachusetts, with their powerful innovation economies and highly educated populace, still might be able to buck the trend, but the economic future seems likely to favor places like Utah, Idaho, Colorado, Tennessee and Texas—now and in the years to come the likely locus of our most dynamic growth.

Of course, no matter how dire the picture for some states right now, things can change—especially over a decade—all you need are the right policies to fulminate growth and opportunity. Just ask Florida.

Source for all charts and data: EMSI, 2019, economicmodeling.com