CEO Poll Finds Increasing Number Of U.S. Companies Still Growing, But That Could Slow

Layoffs, a hawkish Fed, stubborn inflation and the incessant talk of a recession would have anyone thinking times are bad for business.

But just-released data from Chief Executive’s 2023 edition of the annual Financial Benchmarks Report for U.S. Companies shows three-quarters of companies reported a positive annual net revenue growth rate in 2022, with 42% reporting an increase of at least 10% from prior year.

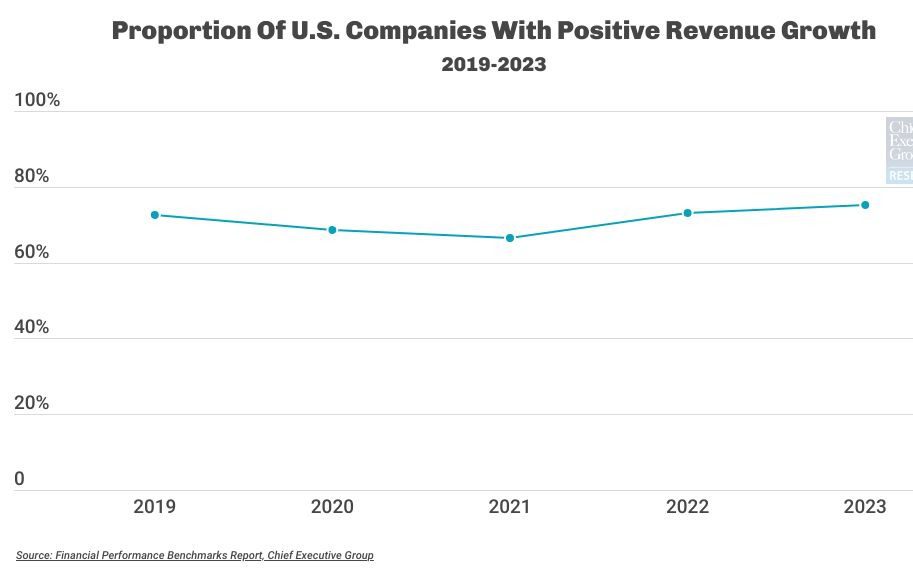

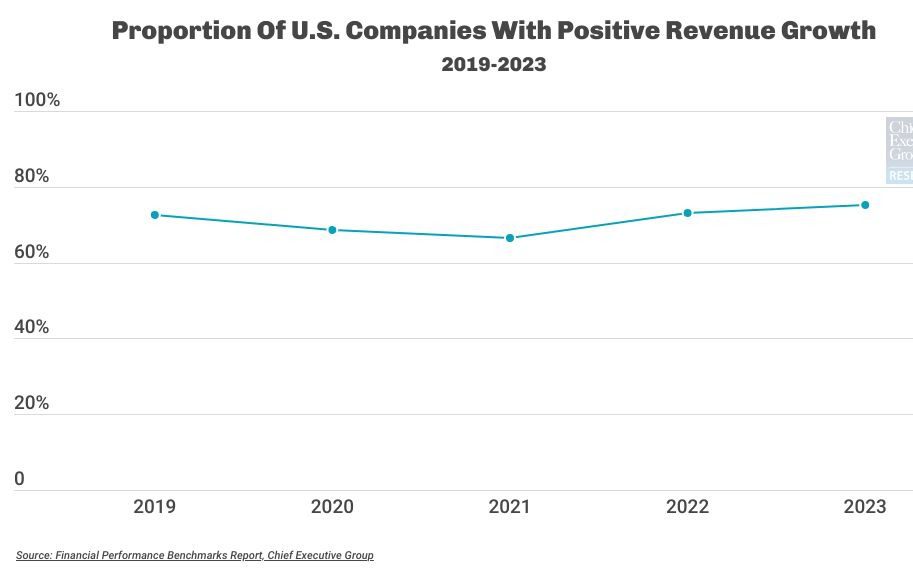

After a pandemic-driven dip in the proportion of companies posting positive revenue growth in 2020 and 2021 (69% and 67% respectively, down from 73% in 2019), things rebounded in 2022, with 73% of U.S. companies achieving growth that year, according to the report.

That trend should continue, CEOs we polled say, despite a potential recession and financial sector uncertainty, with 75% of companies projecting positive net revenue growth this year, surpassing pre-pandemic levels.

As the Fed knows, curbing demand in the U.S. hasn’t been easy. In survey after survey, CEOs report strong demand driving their company’s net revenue and supporting healthy bottom lines. In our April CEO Confidence Index survey, 55% said they still expected demand to continue rising in the months ahead, further supporting revenue growth.

What the data does show changing is the speed of the growth. In 2021, 21% of U.S. companies reported revenue growth of at least 20% from prior year, which is unsurprising considering the spending halt caused by the pandemic of 2020.

The climb continued into 2022, with the proportion of companies posting 20%+ growth jumping to 24%.

For 2023, though, things seem to be tapering off. While a growing number of companies expect revenues to grow, only 16% expect their revenue to grow by as large of a margin as it did last year. Now, some 40% expect their revenue growth rate to be less than 10% for the year.

This is also contingent on sector, as one would expect. Nearly all (93%) Energy companies reported positive revenue growth in 2022—the largest proportion across sectors, followed by Tech (86%) and Real Estate (80%). In contrast, 58% of Entertainment & Travel companies reported growth, with 42% saying their revenues were either flat or down for the year.

For the year ahead, 93% of Energy companies and 86% of Tech companies expect positive revenue growth again this year, with 40% and 42% respectively expecting it to remain strong at 20%+ compared to prior year. In contrast, only 3% of Healthcare Services companies expect that level of growth—and only 62% expect growth at all.

Many other factors, such as pricing strategies and price increases, as well as company size, played a role in the outcome. You can find more information and additional breakdowns in Chief Executive’s 2023 Report, which offers you key benchmarks updates throughout the year—from revenue and pricing to working capital to profitability to employees staffing and turnover, and so much more.

Check out the full report>>

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.