This story first appeared as the cover story of the March/April issue of Chief Executive. Though it went to press just before the virus struck, leaders will find the advice below even more relevant now than it was then.

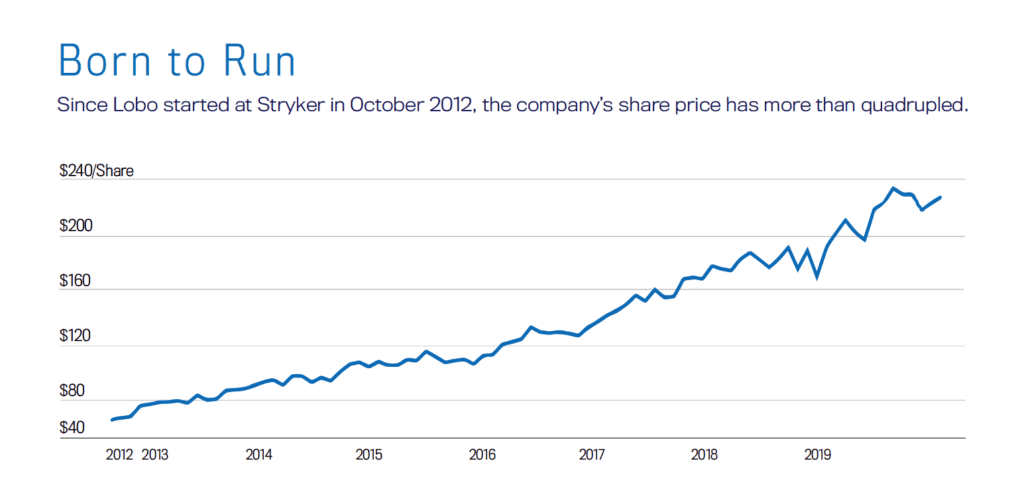

Since Kevin Lobo became CEO of medical device company Stryker in 2012, revenues have grown from $8 billion to over $15 billion—a phenomenal track record. Ask him how he’s done it—as we did at our recent Healthcare CEO Summit—and the answer is pretty simple: deals, each and every one made with an intense focus on customers.

Since Kevin Lobo became CEO of medical device company Stryker in 2012, revenues have grown from $8 billion to over $15 billion—a phenomenal track record. Ask him how he’s done it—as we did at our recent Healthcare CEO Summit—and the answer is pretty simple: deals, each and every one made with an intense focus on customers.

In the medtech industry in which Kalamazoo, Michigan-based Stryker plays, he says, innovation “can only be derived if you’re very, very closely collaborating with customers… We don’t want to invent anything without iteration with our clinical customers.” For Lobo, that translates to a decentralized structure that that pushes power and acquisition strategizing down through the organization and as close to the customer as possible.

“We spend 6.5 percent of our revenue on R&D but don’t have any central R&D at all,” he says. “And even though we do a lot of deals, we only have two people in corporate business development. All the other business development people—28 people—sit in each of our divisions.”

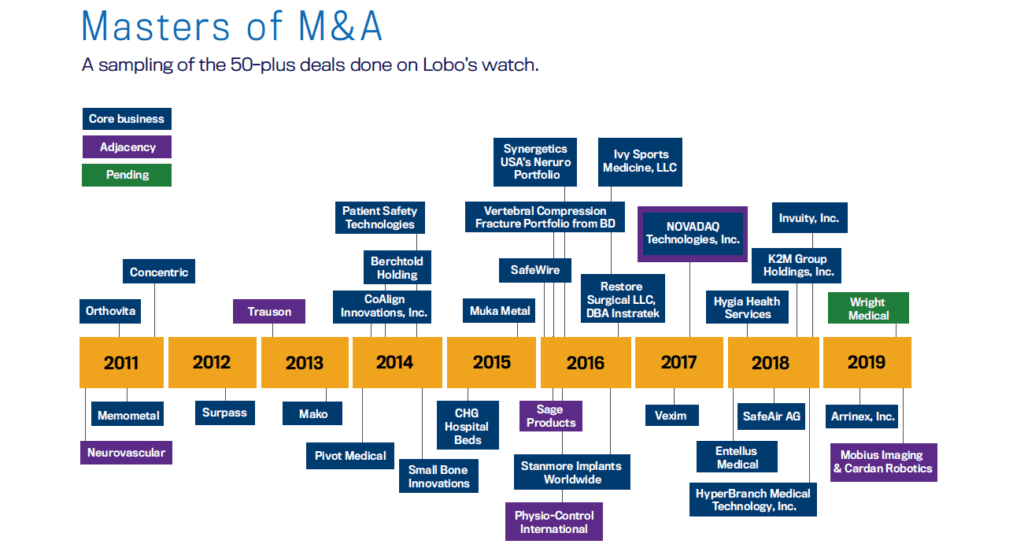

The result? Stryker excels at identifying emerging opportunities across a broad spectrum of medtech categories. And Lobo has built a culture capable of repeated success in deal-making. During his tenure, he’s done 55 deals across a spectrum of products and companies—robotics, surgical devices, pharmaceuticals—each and every one strategically chosen to strengthen a category position.

The acquisitional tear shows no sign of abating. In November, Stryker announced plans to acquire Wright Medical, which develops medical devices for the extremities and biologics markets, for $4.7 billion. The move came shortly after the company closed on a $500 million deal to purchase Mobius Imaging and its robotics-oriented sister company, GYS Tech.

“It’s really by design that wherever we play we want to be absolute leaders in the field,” Lobo explains of Stryker’s “tuck-in” approach to deal-making. “When a hospital customer is thinking, ‘Who should I be partnering with for neurosurgery or orthopedic surgery?’ We want to be the obvious choice. All these deals, frankly, have just strengthened our category position just as much as a new product would. It’s just bought versus made.”

Chief Executive recently had the opportunity to talk with Lobo about his approach to deal-making. Excerpts of that conversation, edited for clarity and length, follow.

Since 1941, Stryker has found a way to kind of see the next bend in the road and deliver growth every year. How do you sustain that kind of performance?

The simplest way of describing it is customer focus, that first pillar of the strategy. I have customer focus, I have innovation, I have globalization, and then cost transformation. We do customer focus structurally. Every single business has their own sales, their own marketing, their own R&D, their own business development. They have this whole sense of accountable businesses, and they’re very close to their customers. So when customers are changing, we see things early. At my previous company, occasionally we would hear about a competitor buying a company. I would call and say, “What’s this company they’re buying?” [They’d say], “We don’t know who they are. But let’s go find out.”

In my years at Stryker as CEO, never once have they said, “We don’t know.” Our businesses always know who they are, they know the owner, we don’t like it because it’s too expensive, or we have intellectual property problems or an internal project that we think is gonna be better than that. I get those three answers every time. How does that play out on the ground? They sit in the same building. Sales, marketing, R&D, business development, they’re all in the same building. Salespeople say, “Hey, I saw this great product in surgery.” They call marketing, marketing looks over to R&D and says, “Hey, did you hear about this product?”

If R&D says no, they say, “Well, let’s go visit them.” Then they get on a plane. If it looks interesting, they call the BD people in. But they’re not asking anybody at corporate. We’re not involved. They can do all this on their own inside the walls of their building. That’s the way we’re structured. It’s a structural advantage.

We have a strong balance sheet, so they know that as soon as they see something interesting, they can come to us, and funding has never been a problem. The question is, can you make the business model work and the economics work? And if we pass on something, they know that they can come back the next week with another deal.

They have to convince themselves they can make the numbers work, because one thing we are is very tough on the deal model.

Whatever deal model they put together, it doesn’t go on a shelf, it goes into their bonus plan for the next two years. And if they’re missing their numbers, they feel the pain. We’re very tough on holding them accountable to the metrics of the model. It’s very entrepreneurial that way.

Does everybody see themselves as a bit of a deal maker?

Absolutely. It’s an expectation. If you’re gonna be put in as division president, you better be spending a good percentage of your time looking at deals.

Do you have a matrix in place where you say, “Okay, that many billion and this percentage must come from new products?”

That’s something that Stryker used to track. We called it the Freshness Index. I killed the metric because it’s a useless metric for some of our businesses. I’ll give you an example. Our knee business, we have the oldest knee on the market. It’s 13 years old. Two of our competitors launched new knees three or four years ago, and we’re taking market share from them with an older knee. Why? Because instead of investing in a new knee, we chose to invest in robotics to help put the knee in perfect balance, and we chose to invest in one component of the knee that’s 3D printed so that you don’t need to use bone cement when you do the procedure.

For that business, the Freshness Index would have encouraged the wrong behavior, which is “We better launch a new knee so that we score high on the Freshness Index.” It really varies by business, how we choose to measure the level of innovativeness. So, the orthopedics groups decided not to invest in that. It ended up being a very good bet. We’re the fastest-growing implant company in the market, have been for the last four or five years. It was counterintuitive. It’s the first time in the history of orthopedics that the oldest knee is the fastest-growing knee.

That particular decision—acquiring Mako Surgical with the goal of bringing robotassisted surgery to knee replacement procedures—did that come out of being very close to the customer?

That particular decision—acquiring Mako Surgical with the goal of bringing robotassisted surgery to knee replacement procedures—did that come out of being very close to the customer?

Yeah. Of all the deals we’ve done, that was the most controversial. It was my first big deal as CEO. Even my customers were very upset, it was a disruptive idea. Most of the deals we do are simple tuck-in products, they’re obvious. It’s a need that we have, we fill the gap. This was very disruptive.

The idea of robotics in orthopedics, most customers told me, “We don’t need it.” The consultants that we work with, the orthopedic surgeons that use our products, said, “We’re not asking for it.” But that’s one of the areas where there were a few surgeons who really believed in it. As a new person coming into orthopedics, I said, “These implants are all good now. But it’s not about the implant now, it’s about how well the knee is balanced and how much soft tissue we’re disrupting.” If we can do a less invasive procedure, the surgeon can have better information with a 3D plan, so they can make it more personalized. It’s gonna be a better outcome. But that was more of a bet that we made.

Our stock went down 5 percent the day we announced the deal. We were loudly criticized and even our own customers didn’t support us initially, but now we’re coming up on 800 robots in the market. And almost one out of every three knees is going in with a robot. So it’s been wildly successful, but it wasn’t that obvious.

But it is obvious that if you can have a machine—our saw blade—that’s cutting your bone in your knee that will only let you cut where you’re supposed to cut—even if the surgeon tries to cut the PCL ligament, they can’t do it—why wouldn’t you want some robot that absolutely 100 percent guarantees you’re not gonna cut or even nick the PCL?

The culture question in M&A is usually the difference-maker. How do you handle integrating acquisitions?

It’s changed over time. We were not great at it early. When I became CEO, Stryker was a very sporadic acquirer. It would do one or two deals a year, maybe. And we had this balance sheet that was very strong. Frankly, investors thought it was inefficient. Having a great balance sheet 10 years ago or 20 years ago—AA or AAA—was a badge of honor. Now, investors are like, “Why are you wasting your money? Give it to us. Give us the dividends or buy back stock or spend it.”

I felt that the company’s decentralized structure lent itself to being able to get into new spaces. I thought we were being overly conservative as a company with our cash. So I said, “We need to get more aggressive on M&A. I wanna use the money for acquisitions.” Shareholders were screaming at me, they wanted me to buy back stock. This was seven years ago, buybacks were in vogue. I refused. I took a lot of heat from that. Now, those same investors, by the way, are like, “Hey, what’s the next deal you’re gonna do?”

You have to listen with one ear to the investors. You can’t listen with both ears. I refused to buy back the stock because it’s not a long-term value creator. We started getting busy on deals. We started doing acquisitions. The more you do, you get better at it, you build muscle, you build know-how.

Initially, we were buying products. When you buy technology without all the people, it’s easy to integrate. You buy the technology, and you stick it into your own R&D team. They usually have distributors, so you get rid of the distributors. It’s actually very easy.

The hard ones are when you buy a company that brings across a lot of people and have to figure out, okay, now what? What I’ve learned is you need to rip the Band-Aid off quickly. We used to be way too nice to these companies. “Hey, you wanna keep the same name? Fine, you can keep your name. You guys wanna dress this way or whatever do this, that’s fine.”

We used to just feed them with money and investment and leave them alone. We don’t do that anymore. Basically, within a year, we want all the signage to be Stryker. We want the mission values on your wall. We always had a habit of putting in a Stryker finance people and a Stryker HR person, typically. But now we’re starting to see in certain organizations, let’s put in a Stryker sales leader. Let’s sprinkle in a little bit more Stryker. We don’t want to completely change the culture because each division is unique and we’re buying them for a reason. If they’re a really good innovative company, the last thing I want to do is kill their innovation.

But one of the tricks I do, a very subtle way of forcing change, is to take the board of directors to visit within a year. Two things happen: When the board goes to the visit, I don’t have to ask them to put the Stryker signage up. They know the board of directors is coming so they do it themselves. It gives them a lot of motivation.

We also learned that with the [number of] deals we do, we need some people who spend all their time on integrations in HR, in operations and in certain functions in legal and finance. We have to carve out a few resources that are virtually full-time on deals because there’s so many of them. There’s always the next deal coming. That wasn’t the case six years ago. We’ve had to tweak our model. We have a common playbook. Now, people get their computers right away on day one. These things matter for people. When they show up on the first day the deal’s closed, we show up, they sign up for their Stryker benefits. Little things like that really helped.

Does that give you a strategic advantage? That people want to do a deal with you versus somebody else because they’ll have a better outcome?

Does that give you a strategic advantage? That people want to do a deal with you versus somebody else because they’ll have a better outcome?

Definitely. Our brand is very strong at treating people we acquire well and growing the businesses that we acquire. We’re not good at cutting costs. We’re good at growing. So, someone selling to Stryker knows their employees will be taken care of and that we’re gonna grow the business, invest in the business. So, if someone outbids us, we’ll lose the deal if they outbid us by a lot. But if we get the price close, they prefer to sell to us—especially if it’s like a lot of the companies we buy, which are private, and sometimes family-run businesses. They care about the legacy.

You seem to hire a lot of veterans at Stryker. Why?

We’ve had great success with men and women coming out of the military. It’s the sense of purpose. What works at Stryker are people with high drive and low ego. And that is hard to find. High drive, low ego is rare. We screen for humility. It’s a trait that we look for. Some of the companies we buy, the owners of those companies don’t have humility. And they’re out the door. For R&D engineers who aren’t leading large teams to have a bit of an ego is okay. We find a way to massage them. But to lead teams, you can’t have big ego. You have to have high humility. But high drive, high humility is hard to find. In the military, it’s about the mission. It’s team first, me second. They’re organized. They’re disciplined. They have the drive for results, that is what we look for in Stryker.

In our mission statement, it said, “Together with our customers, we are driven to make healthcare better.” “We are driven,” those words were very, very thoughtfully chosen. People who don’t have high drive don’t do well at Stryker. But people that who don’t have that high humility, low ego, they get chewed up and spit out really fast.

If I give an order to a division president and they don’t think it’s good for the customer, they are free to disagree with it and disobey it—no problem. Everyone in the center at Stryker is at the surface of the divisions, they’re the center of gravity of our company. The hardest part is hiring people in the corporate staff. Those people need the lowest ego, because nobody cares what your title is at Stryker.

That’s got to be a blow for someone who comes in as CFO or whatever and suddenly they’re in service of everybody around them.

What I say is that people in the corporate centers of Stryker or shared services, including me, are in the sell business, not the tell business. I have to sell the divisions on why they should do anything. If I tell them what to do, and I’m not selling them on why to do it, they’re not gonna embrace it. It won’t work. If you don’t have the patience and the fortitude to sell something, go work somewhere else. Go work for a centralized company. I’m not saying they’re bad, it’s just not us.

Our process is not efficient. It’s painful, being in the center and having to go to each division president and get them to buy into something, it takes longer. But that’s how it works. Every company has their own magic, and that’s ours.

How is your marketing and sales model changing?

Let me start with what’s not changing. The first thing that’s not changing is we are continuing to specialize our sales forces more and more at a time when many of our competitors are actually increasing the size of the product bag. I believe focus drives growth.

But what’s changing is we’re building tremendous marketing capabilities. We were not a great marketing company seven or eight years ago. We created a marketing council, which was voluntary, every division could send whoever they wanted. We created a common curriculum, a common language around what we call big-picture marketing training. We’ve become a much more sophisticated marketing company, better price discipline, better price management, better segmentation of customers.

What difference does that make, the idea of marketing, with all of the different things you make? Stretchers have nothing to do with knees.

No, they don’t.

So how does the brand work with that?

It’s an umbrella. Mako is the brand for robotic in orthopedics. We have a knee called Triathlon, we have the Big Wheel bed. The products have their own name. But underneath that, we have this umbrella called Stryker, which has a common look and feel. Frankly, it’s just as powerful inside the company as it is with our customers. It creates a lot more power. And it’s very unifying for the organization.

And the sales specialization, is it by product type or by customer type?

By call point. If the call point is a nurse, we wrap the products around that OR nurse. If the call point is a neurosurgeon, how do we bring everything we can to the neurosurgeon?

I say the term “call point” very intentionally because it’s different than what you’ll hear other CEOs or companies say. We use that term very intentionally. The example I’ll give you is when we bought Physio-Control, which is the defibrillator company, which Medtronic used to own and sold because it was not a good performing business. They sold to private equity, and we bought it from private equity. When we did that deal, investors said, “Medtronic said this wasn’t a good business.” I said, “Well, it’s not good for them because it’s not a cardiovascular product. It’s an emergency medical technology.”

If you open the back of an ambulance, the two most expensive items in the back of that ambulance are the powered cot—the Stryker—and the defibrillator. It’s an EMT product, not a heart product.

And guess what? We have a division that’s laser-focused on that call point. Now I just put another product in their bag, focused on the call point. We know how to innovate and create new cycles of this innovation. That thing’s been growing double digits for us since we bought it. When Medtronic had it, it was growing 2 percent, 3 percent—that’s why they sold it.

So we think of things in terms of call point. And as soon as the bag starts to get too big, or we have some division or a sales rep that selling to two or three call points, as soon as we can fill it in with extra products, then we split.

So instead of operating like Jim Collins’s flywheel, you’re running hundreds of little flywheels all over the place?

That’s exactly right. Call-point driven. How do we become really excellent in that call point and solve their problems in the call point? How do we become indispensable to them? It gives us new ideas. We try all kinds of crazy things inside the call points.

Obviously, the Amazon effect is impacting everybody. So maybe can you address that point?

Sure. Most of the products we sell are acute intervention products. If you have a car accident and your leg has to be repaired, consumerism isn’t going to help. No one’s gonna say, “[Make] sure that rod is a Stryker rod,” because they’re under anesthetic. They’re asleep.

So it is irrelevant for certain portions of our business. But not for anything elective. Knee replacement is a great example. Patients care a lot now. They want to know, “Hey, is it being done with robotic surgery, and what’s the implant?”

I would say we’re in the very early stages of consumerism. It is an undeniable trend in the future. People are going to care much more. They’re going to want to know more. We’re in its infancy right now.

But it will accelerate, and we’re already talking to our teams about how we start telling our story. We’re even doing patient stories on our website, so people [can] go on the website and say, “Hey, if I have a need for this procedure, let me see a patient describing what they went through.” It has to be real and authentic.

And so those are things we’re starting to do even getting, you know, more patient advocacy. But it’s a great question. It’s coming.