It was welcome news when the U.S. Department of Labor announced the latest jobless claims numbers—and markets reacted in kind. Is the labor market finally turning in favor of employers?

At this time, it’s nearly impossible to tell. And if you ask CEOs, as we did the first week of June as part of our monthly CEO Confidence Index tracker, they’ll likely tell you they are not taking any chances.

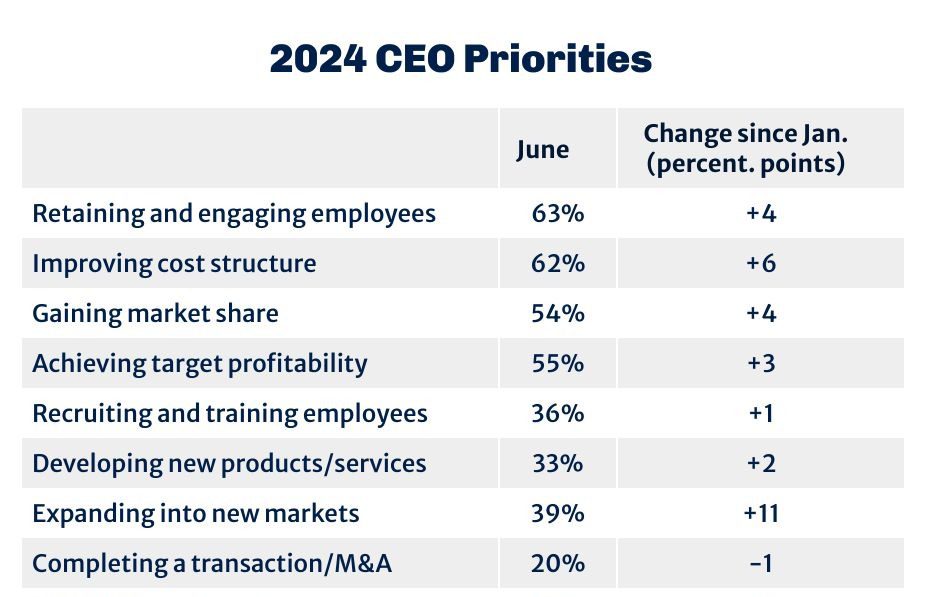

Nearly two-thirds of the hundreds of business chiefs participating in our survey said they will continue prioritizing retaining and engaging employees in the months ahead—that is up four percentage points since we asked them about their priorities for the year back in January.

This is also a marked increase from the 57 percent who had listed employee retention as a priority the year prior, indicating that the talent issue has only but intensified despite encouraging reports.

“While funding is adequate and conditions are favorable, the continued lack of qualified staff is a pressure that will not go away anytime soon,” said one of the CEOs polled, echoing many others.

Next on the list of priorities for the second half of the year: improving cost structure and gaining market share. Those two agenda items are up 6 and 4 percentage points, respectively, since our January poll—an indication that despite cooling inflation data, CEOs remain concerned about the high cost of capital to compete in today’s economy.

One of the largest shifts noted from January to June, however, is the increasing focus placed on expanding into new markets: 39 percent of CEOs surveyed in June listed it as a priority for the coming months–an 11 percentage point increase since January.

ROADBLOCKS AHEAD

With a presidential election looming, continued turmoil on the global scene and slowing consumer demand, there are several potential bumps in the road ahead, but when asked what could impede their ability to meet targets by year end, the great majority of CEOs polled pointed toward one thing: inflation data.

It’s likely no surprise to anyone that inflation pressure remains the top concern among business chiefs. While markets jumped earlier this week as a result of the latest report and the increasing probability of a rate cut by the Fed in 2024, CEOs we surveyed say the cost of doing business remains high, and they have little room left to pass price increases to consumers.

After a surge of price increases in 2022, when 83 percent of companies reported having raised their prices, according to our annual Financial Performance Benchmarks report for U.S. companies, the trend is now slowing. The latest data collected earlier this year indicates that while three-quarters of companies still plan to raise their prices in 2024, the size of the increase is now concentrated below 5 percent, lower than in prior years.

Of course, CEOs also listed the upcoming presidential election in the U.S., the regulatory environment and geopolitical events as potential obstacles to their business goals over the next six months—though all of those ranked much lower on the list compared to the impact of worsening fundamentals.