In 1859 Swiss financier Henri Dunant witnessed the tragic aftermath of the Battle of Solferino, where thousands of wounded French and Italian soldiers died for lack of medical care. The tragedy moved him to create the International Red Cross and the Geneva Convention, saving the lives of millions and earning Mr. Dunant the first-ever Nobel Peace prize.

As we pass the third anniversary of Covid, a variety of global statistics show elevated rates of death, disability and other adverse health outcomes, indicating a global tragedy at a scale far greater than Solferino.

Recent U.S. government reports show that even with the direct effects of Covid waning, mortality in the fourth quarter of 2022 continued to remain elevated at 15% above 2019’s pre-Covid levels. Worse, recent actuarial reports show elevated mortality shifted to younger ages beginning in 2021.

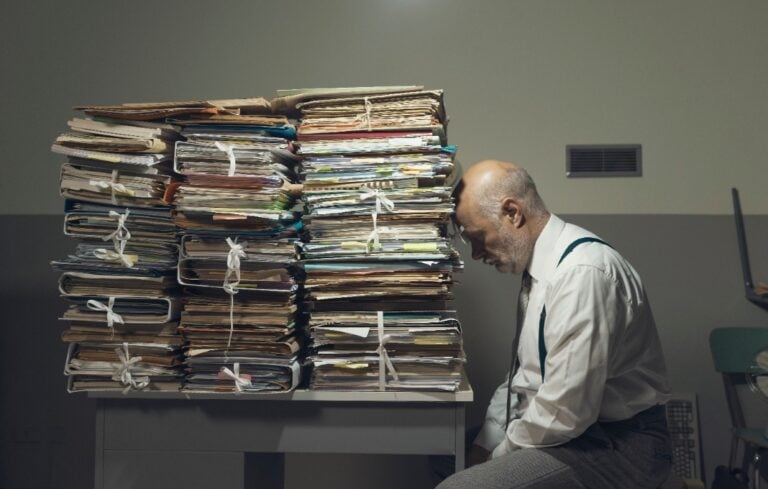

It’s not just deaths. Disability reports set new records last fall, and recently, hospitals have reported notable increases in emergency visits. Similar adverse health trends can be seen in data from other countries. The exact causes of these problems are unknown, but may be an unfortunate after-effect of Covid and related policy. Post-Covid health has deteriorated at a scale that suggests profound tragedy and presents a new challenge for society.

Life insurers can take concrete steps to solve this problem. Our industry has vast actuarial, underwriting and medical expertise, which today its uses primarily to underwrite the health of prospective new customers. We can re-purpose these capabilities to screen, test insured members, to triage those who present high risk for sudden death or other calamity to proactive medical and lifestyle intervention.

By offering currently insured members voluntary health screenings and targeted panel of blood tests, life insurers can help their members identify and reduce risk factors for both chronic and catastrophic outcomes, such as sudden adult death syndrome, cardiac arrest, stroke, pulmonary embolism or blood clots.

Helping high-risk members to identify and begin targeted interventions will prevent catastrophe, help members live longer and healthier lives, reduce untold tragedy, and greatly reduce the cost of these health events, for insurers and society.

This solution is within the industry’s grasp and requires no new technology—only leadership to deploy it.

Though this level of proactive engagement would be a bold step for life insurers, insurers already deploy similar strategies to help policyholders reduce risk in other lines, including property, casualty, title and health. A life insurer which leverages screening, testing and triage to reduce mortality, rather than merely underwriting it, will save lives and reduce loss.

Even as Covid recedes, society faces new health challenges. Unlike Mr. Dunant, who had to forge a new approach to address the horrors of war, life insurers already have the tools and capabilities they can use to identify and mitigate the risks faced by members most exposed to health catastrophe.

Life insurance companies can help address these new challenges, while benefiting their members and shareholders. Collective industry action holds the potential to change history and ensure broad-based health benefits for years to come.