Imagine two different companies, each funding the same innovation program. They are both pursuing a technology that shows disruptive potential in their industry, but that faces an uncertain path to market viability. Each company has poured millions of dollars into upstream R&D. After three years, neither firm has reached a breakthrough.

The Directors of company A, let’s call it Alpha Corporation, have seen enough. They shut down the program, convinced that it is under-performing and has become a drain on the company’s balance sheet. They hunker down and wait for the right opportunity to re-engage. If and when the technology matures, they’ll buy one of the startups that did manage to crack the code. The premium they pay in M&A will have been worth the reduction in uncertainty.

The directors of company B, let’s call it Beta Corporation, decide to double-down. They conclude that the technology’s potential to disrupt the industry is too potent to ignore; they can’t afford not to invest. They launch an innovation center devoted to the technology; they buy several prominent startups in the space; and they become active in promoting the company’s “leap into the future.” They view these efforts not as a sunk cost, but rather as the price of admission for first-mover advantage.

In boardroom and leadership discussions, it’s possible to muster evidence-based arguments for either approach. Alpha’s leaders can cite case after case of errant companies throwing good money after bad. Beta can counter with their own studies of companies that invested aggressively and came to dominate their respective industries. Both can offer structural and economic analyses to support their viewpoints.

They’re both wrong.

The two types of innovation capital

Over the past few decades, there’s been a tendency to reduce innovation to a capital investment analogous to any other aspect of a company’s operations. Either you make innovation as predictable as the factory floor, or you re-invest the money elsewhere, where it can be more productive. Special cases may persist, but they become exceptions to the rule, driven by CEO intuition or me-too panic. In this view, any substantial innovation effort either delivers value to the balance sheet on a predictable schedule, or it exists in extended purgatory—its own special snowflake.

Before we get into the nitty-gritty, let’s get a handle on the relevant distinction. There are two types of innovation with very different investment requirements: core innovation and strategic innovation.

Core innovation is what most companies are already reasonably good at pursuing. Sometimes it is referred to as “incremental” innovation—although that’s not really fair, as some core innovations can be game-changers for the company’s immediate fortunes. What all core innovations share in common is that they seek to extend or expand the value of the current business.

Strategic innovation is where most companies tend to invest haphazardly, or not at all. You may hear it called “breakthrough” or “disruptive” or “transformative” innovation, although such labels are not always apt. The defining characteristic is that strategic innovations generate novel growth options for the company’s future.

Over and over, we’ve found that companies have not internalized what it takes to do strategic innovation well. Instead, they have applied enough window dressing for core innovation to masquerade as something else.

That’s a real shame, because our research has shown that companies with well-developed strategic innovation practices consistently outperform their industry peers. Indeed, those in the top quintile of revenue growth (compared to peers) are twice as likely to have a dedicated Tech Scouting team (62% vs 32%), and also twice as likely to fund new innovations through a dedicated Corporate Ventures team (41% vs 22%). Although these are key ingredients for strategic innovation success, thus far only a select few companies have learned to connect the dots.

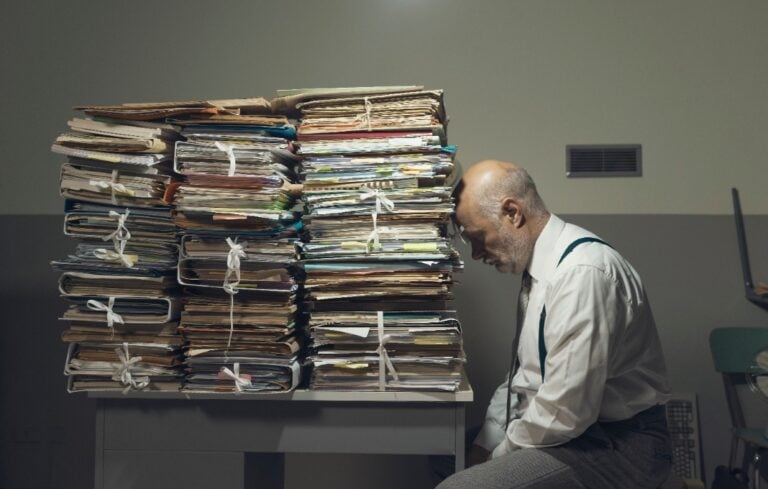

Consistently, we’ve observed that most corporate R&D and innovation leaders instinctively understand the value of strategic innovation. But they are handicapped from following their instincts. They’re stuck trying to prove the wrong kind of ROI to the CEO and/or the board.

Different expectations for different innovations

Let’s go back to Alpha and Beta Corporations. How do we know both are misguided? It’s because they are applying the logic of the core business toward decisions about a strategic innovation program.

Core innovations are advances that can help the business win now—such as product extensions and refinements, process improvements and better internal systems. Typically, at the outset of a core innovation effort, the expectations are reasonably clear. You can measure the expected value through conventional methods—IRR, NPV, ROI. If the investment fails to pan out, it’s a straightforward decision to cancel the effort and deploy the operating capital elsewhere.

Strategic innovations are different. Measures like NPV, while useful in many parts of the business, are meaningless for strategic innovation, because there are too many unknowns. If you try to force conventional predictive measurements onto strategic innovation programs, managers will conjure forward-looking assumptions out of thin air, and you won’t be able to trust the numbers. Instead, the investment thesis needs to focus on generating new growth options for the business.

As an example, consider the rise of electric vehicles (EVs) in the automotive industry. Ten years ago, the only car Tesla sold was the roadster. The notion that the world would pivot en masse to EVs was considered quaint. No self-respecting car company was putting serious effort into next-gen battery technologies or charging stations. Fast forward to today, and everyone is scrambling to catch up—not just OEMs but all the firms in the automotive supply chain. Tesla’s valuation dwarfs every other car company on earth.

Critically, your company doesn’t need to be the next Tesla. Strategic innovations create novel growth opportunities, but they also protect downside risk. If your corporate goal is to be a fast follower, then a strategic innovation program is critical for building absorptive capacity—ensuring you’re ready to play the game when Tesla arrives. Too many companies pay huge premiums for high-flying startups, only to have the acquired companies flame out once integrated. Others start too late on key R&D programs, playing catch-up on unrealistic timelines. When it comes to innovation, absorptive capacity significantly mitigates the risk of costly—and sometimes existential—mistakes.

More generally, strategic innovation’s mission is to explore a disruptive technology or market trend until the company has gained a sufficiently well-developed sense of its potential applications (or lack thereof). Then, at any point going forward, you have the option to invest larger sums in scale-up, engineering and launch—if and when commercial opportunities (or competitive threats) appear on the horizon.

It’s even possible to quantify the expected future value from your strategic innovation bets. But instead of framing payback in terms of ROI and discounted cash flows, focus on a real options analysis of the strategic portfolio. The crux is to develop a scenario-based view of the big-picture threats and opportunities lurking in the middle-distance. Investments serve the purpose of de-mystifying the likeliest paths to viability, which in the process serves to generate (or rule out) strategic options for the business.

This is what the best VCs and entrepreneurs do—venturing into the unknown with a strategic thesis in mind, and then steadily working to clarify the playing field as efficiently as possible. We’ve seen that leading companies such as Land O’Lakes have already started following suit. There’s no reason your company can’t do it too. But strategic innovation won’t stand a chance unless you allocate capital with proper expectations from the outset.