In February 2019, Institutional Shareholder Services (ISS) announced it would add Economic Value Added (EVA) metrics to its quantitative Pay for Performance methodology, correctly stating that these metrics are key indicators of corporate performance. Simply put, EVA measures economic profit (EP), or earnings after a charge for the capital used to generate those earnings. While these are not yet a part of ISS’s quantitative CEO Pay for Performance test, this development will certainly help raise awareness of economic profit in the boardroom, and for good cause.

In February 2019, Institutional Shareholder Services (ISS) announced it would add Economic Value Added (EVA) metrics to its quantitative Pay for Performance methodology, correctly stating that these metrics are key indicators of corporate performance. Simply put, EVA measures economic profit (EP), or earnings after a charge for the capital used to generate those earnings. While these are not yet a part of ISS’s quantitative CEO Pay for Performance test, this development will certainly help raise awareness of economic profit in the boardroom, and for good cause.

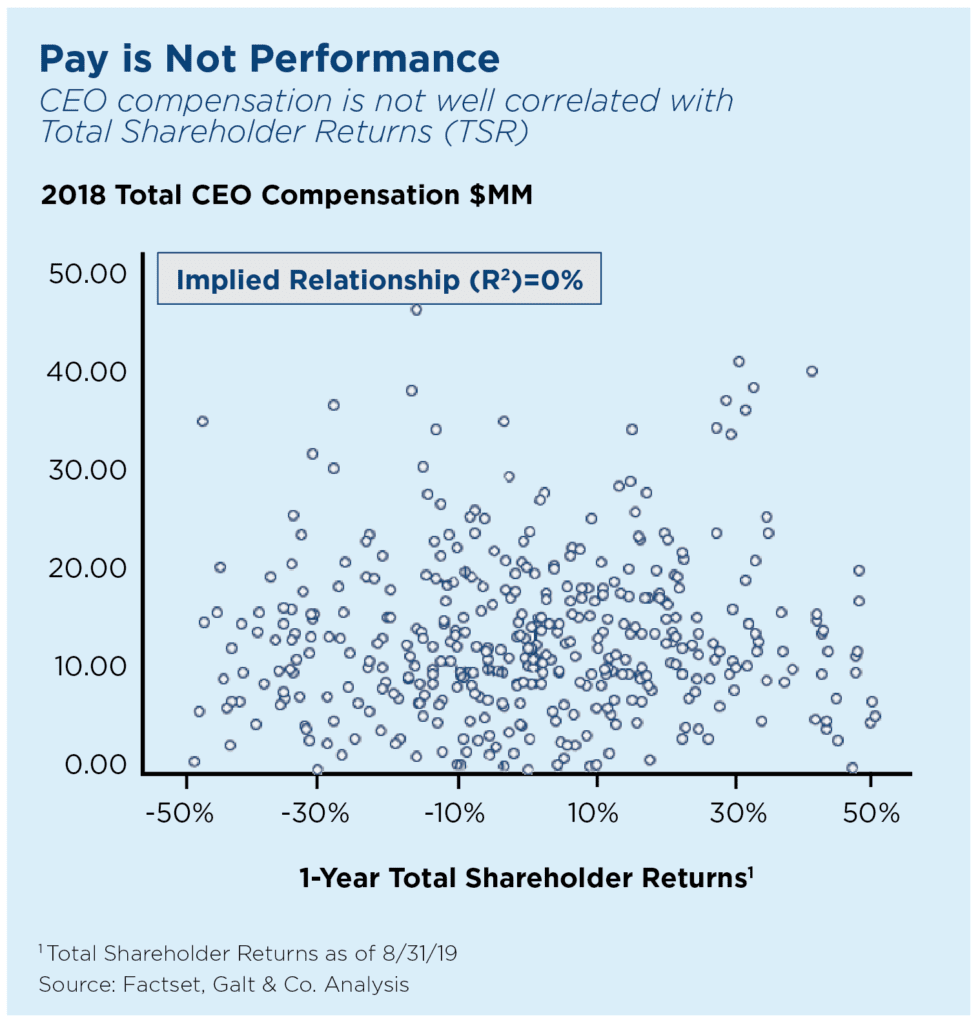

It is well documented that the shareholder returns of publicly traded companies are driven by investors’ expectations of future economic profit growth. (See “What Investors Want,” below) It is also well documented that higher levels of executive compensation are not generally correlated with superior total shareholder return (TSR) performance. (See “Pay is Not Performance,” below.) So, introducing a new measure like EVA or economic profit and linking it to compensation may seem like a logical step in the right direction.

But why doesn’t tying CEO compensation to economic profit growth lead to greater shareholder returns?

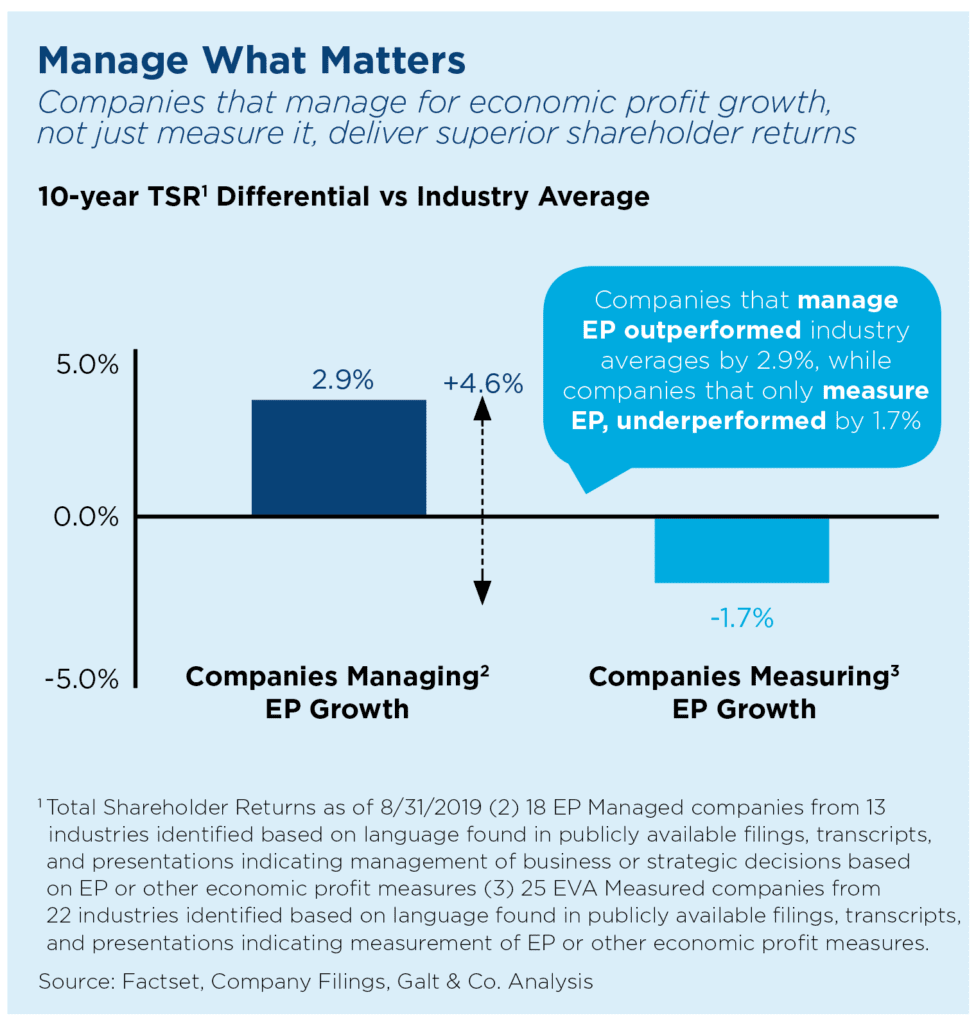

Ensuring CEOs and managers focus on and achieve the economic profit growth needed to sustain superior shareholder returns takes more than just introducing a new measure and linking it to compensation. The 2 percent of Fortune 500 companies that have been able to deliver top quartile shareholder returns, within respective peer groups, for five consecutive years go beyond measurement alone, as co-authors Scott Gillis, Lee Mergy, Joe Shalleck wrote in Beliefs, Behaviors, & Results. They are managing for economic profit growth. A study by INSEAD, “Are You (Really) Managing for Value?”, evaluated performance of EVA-centric companies in 2000 and found two-thirds of those that managed EVA outperformed the total shareholder returns (TSRs) of their industry peers. In contrast, companies that only adopted an economic profit measure and perhaps linked it to compensation, lagged their peer TSRs, because they likely did little else to change the way their company is managed.

Ensuring CEOs and managers focus on and achieve the economic profit growth needed to sustain superior shareholder returns takes more than just introducing a new measure and linking it to compensation. The 2 percent of Fortune 500 companies that have been able to deliver top quartile shareholder returns, within respective peer groups, for five consecutive years go beyond measurement alone, as co-authors Scott Gillis, Lee Mergy, Joe Shalleck wrote in Beliefs, Behaviors, & Results. They are managing for economic profit growth. A study by INSEAD, “Are You (Really) Managing for Value?”, evaluated performance of EVA-centric companies in 2000 and found two-thirds of those that managed EVA outperformed the total shareholder returns (TSRs) of their industry peers. In contrast, companies that only adopted an economic profit measure and perhaps linked it to compensation, lagged their peer TSRs, because they likely did little else to change the way their company is managed.

The companies that deliver superior shareholder returns and sustain these over time relentlessly apply five core principles to manage economic profit growth:

1. Establish the Right Definition of Winning: The ultimate objective of a publicly traded company is to deliver superior returns over time for its stockholders. While revenue, earnings and return on capital are important measures of performance, it is ultimately the economic profit and cash flow growth that drives shareholder value. Leaders of successful organizations establish this as an unambiguous and singular definition of winning. As a result, their organizations are absolutely clear on what they are trying to achieve and how they will ultimately measure success.

1. Establish the Right Definition of Winning: The ultimate objective of a publicly traded company is to deliver superior returns over time for its stockholders. While revenue, earnings and return on capital are important measures of performance, it is ultimately the economic profit and cash flow growth that drives shareholder value. Leaders of successful organizations establish this as an unambiguous and singular definition of winning. As a result, their organizations are absolutely clear on what they are trying to achieve and how they will ultimately measure success.

2. Capitalize on Concentrations of Value: Economic profits, shareholder value contribution and, most importantly, economically profitable growth potential are always concentrated by market, company, business and business segment (i.e., by product, customer, channel, etc.). In fact, in many Fortune 500 companies, less than 40 percent of the capital employed is generating over 100 percent of the company’s shareholder value, while 25 to 35 percent of the capital employed is destroying shareholder value. If a company can understand where and why economic profits are concentrated and how that concentration is likely to change in the future, management will have a tremendous competitive advantage in deciding where investing time, effort and capital is most likely to drive shareholder value growth.

3. Manage to a Focused and Prioritized Value Growth Agenda: Just as economic profits are concentrated, so too are the opportunities a company has to drive economic profit growth. Jim Kilts (who, as CEO, turned around the performance of three of the world’s most notable consumer brand companies: Kraft Foods, Nabisco and Gillette) calls it staying focused on “doing what matters.” As he describes, “It takes guts to say these are the things that really matter and I’ll pay absolutely no attention to the rest.” Successful leaders know that nothing gets done when their organizations try to do too much.

3. Manage to a Focused and Prioritized Value Growth Agenda: Just as economic profits are concentrated, so too are the opportunities a company has to drive economic profit growth. Jim Kilts (who, as CEO, turned around the performance of three of the world’s most notable consumer brand companies: Kraft Foods, Nabisco and Gillette) calls it staying focused on “doing what matters.” As he describes, “It takes guts to say these are the things that really matter and I’ll pay absolutely no attention to the rest.” Successful leaders know that nothing gets done when their organizations try to do too much.

4. Differentiate Strategies and Allocate Resources Differentially: CEOs who delivered superior customer and shareholder value emphasize that strategies must define how a business will differentiate itself from the competition in order to capture a leading share of the economic profits. However, many businesses simply try to optimize performance of the existing business model. We call this “optimizing a sub-optimal business model.” Instead, businesses should ask themselves if they are pursuing the value-maximizing business strategy in the first place—that is, one that results in growing the highest possible share of the market’s economic profit pool.

5. Build the Organizational Conditions and Capabilities to Manage Value: Executives face two key challenges in delivering and sustaining superior shareholder value growth. First, they need to ensure the strategies and resources are in place to maximize the economic profit growth of each business unit and the entire corporation. Second, they must establish the organizational beliefs and conditions that increase the odds that the daily decisions and actions of hundreds of managers across the company are aligned with shareholder interests.

Getting a business to focus on and sustain superior economic profit growth takes more than just introducing a new measure of profitability and linking it to compensation; i.e., “measuring value will not maximize value.” It requires the CEO and all leaders within the company to adopt a common definition of winning and align their strategies, resource allocation and performance management decisions to that objective. Only then can a company be confident in its ability to sustain superior shareholder returns over time.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.