A recent Wall Street Journal article about ousted CEO John Flannery’s replacement from within the GE board of directors misrepresents the dynamic of the boardroom by making the succession plan look like the corporate version of a second string quarterback lying in wait for the star to be injured.

Nothing could be more preposterous.

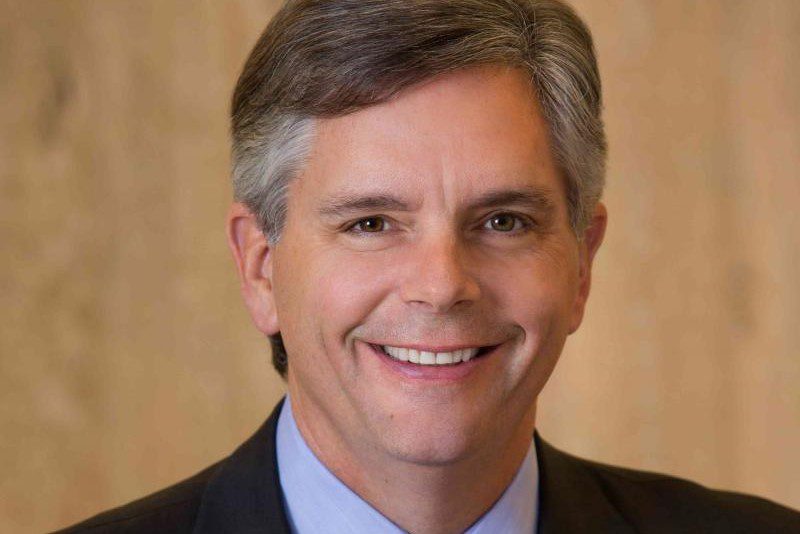

In naming Larry Culp, a former chief executive of Danaher, as Flannery’s replacement, the article makes it seem board directors are a fifth column, waiting to jump-start their careers as a chief executive. It goes so far as to suggest that chief executives are calling headhunters and professors for advice on whether they should be worried about their replacement. It does not ring true, however.

The odds of a director taking over the top position from inside the boardroom are about as long as finding oneself on a board where the chief is fired only after a year on the job, as Culp did. He had left Danaher and the chief executive world to start a new chapter in his life and to offer some useful experience to someone running the show. He didn’t need another job and never needed to sign off on another option pool for the rest of his life. It is the very nature of the collegiality that makes someone like him willing to take on the role after a full career behind him.

The independent directors of the board choose the incoming chief executive. The CEO has little say over succession since Sarbanes Oxley was passed in 2002, and the old adage of someone anointing their chosen successor is bunk these days. Only in dime store novels do chief executives hold sway over the board.

Great executives running large, complex global organizations rely on savvy board directors to understand the challenges because they need patience to get them through the turmoil of the times. In Flannery’s case, GE is more of a country than a company, and one that is falling behind in every possible measurement. Flannery was counting on help from the board in crafting a turnaround vision. While the crafting was going on, no one was thinking of replacing him. Culp was brought on because of his experience not because he could be a replacement. Who else to help the company than someone that has been in the trenches and now retired.

The boardroom deliberation dynamic is where the decision first began. What happens inside the boardroom is a test of one’s mettle and caliber of thought. As discussion takes place, each board member weighs in on specific areas, and it is possible that a board director begins to sound smarter than the chief executive. Or it may be just as likely that a glitch in temperament is visible, with a chief executive showing signs of strain and frustration.

Once the decision to terminate has been taken, the person most surprised to be the board’s first choice is the fellow director. He or she has already retired and spending promised time with family or pursuing foundation activities, has no time nor need for any more fireworks. But it is these dark horses who stand out during times of great angst as safe harbors in the storm tossed seas. When they are asked, the first thing they ask, is it the right thing for the company? Personal issues are put aside, and often, even compensation and the like are discussed as an afterthought. Their job is to see the course through until a more permanent solution can be found.

I have spent most of my career either as a horse whisperer as publisher of Forbes or as a CEO or board director of a dozen public companies.

Everyone in the top job knows that being replaced is a potential fate, and the idea that they are more worried about someone on the board than the hundreds of candidates inside and out is ridiculous. While job insecurity isn’t unique to chief executives, premature terminations for performance are so rare as to be not among the top 100 things they worry most about.

Related: The Two People That Could Help Elon Musk Save Tesla (If He Can Get Them)