President Trump has been flooding the zone with tariff threats, blustery tweets and generally distressing and confusing signals on America’s relationships with China, Mexico, Canada, Germany, Italy – every major trading partner or adversary the United States has.

Caught in the middle with little clear idea of how it’ll all pan out are literally thousands of CEOs of U.S. companies that are trying to take advantage of the strong global economy, plan their capital investments by type and geography, and train and hire workers to keep up with them.

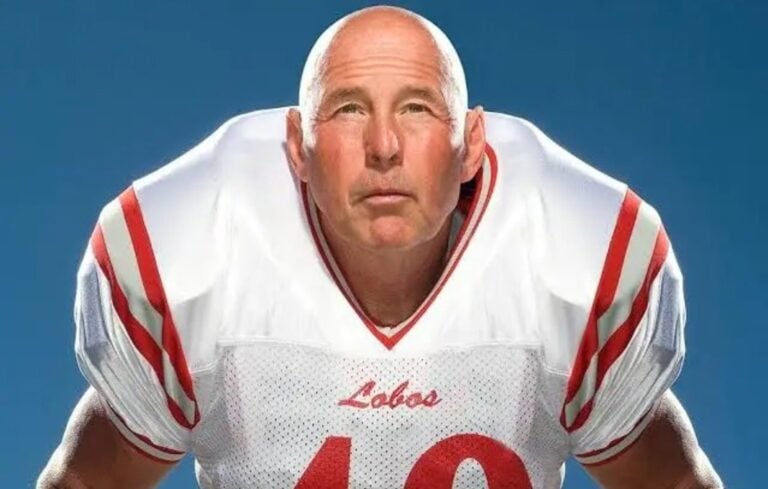

Dan Sandberg is one of those CEOs, and he may be caught in the middle more than most. He’s CEO of Brembo North America, the U.S. arm of Italy-based Brembo SpA, one of the world’s leading automotive-brake suppliers, which has huge markets around the globe, significant manufacturing operations in several countries, and about 9,000 employees spread around a dozen or more nations.

“We’re operating in a global market and we’re somewhat distressed that the [Trump] administration doesn’t realize how global it is right now in the automotive sector,” Sandberg told Chief Executive. “This is a very large shift that he’s trying to accomplish, and there will be disruptions in some of the supply chains if the tariffs he imposes are spectacularly high.”

Sandberg’s concerns about Trump’s fulminations and machinations on trade are both short- and long-term. For one thing, he worries that the potential for punitive tariffs, and even just the uncertainties created by the prospect, “could throw cold water on a very hot economy. That’s the big worry.”

And second, Sandberg worries that Trump’s bluster on trade could end up being solidified in significant tariffs or other restrictions that impede global supply chains and upset a system that has functioned well, by understood rules, for decades. Brembo, for instance, relies on a highly integrated supply chain within NAFTA that encompasses its U.S. facilities in Michigan and plants in Mexico.

“ If customers decide they can’t do business in the US anymore and move out, we’ll have to move our production. That’s the part that President Trump needs to understand.”

“So I don’t understand [Trump’s] most recent attacks on auto-industry globalization, and I don’t feel it’s realistic to re-shore everything back to the United States,” Sandberg said. “It’s not feasible. We’re not talking about components that are easily re-sourced. Commodity-like items without value aren’t easy to bring back, and why would you want to do that anyway? We want to make things in the U.S. with heavier value-add.”

Sandberg understands that Trump relies heavily on his accomplishments and reputation as a negotiator and that posturing is a huge part of what the president is doing right now. The Brembo North American chief also said that minor new tariffs such as the ones currently being contemplated in a restructuring of NAFTA wouldn’t knock his company off-plan. And he maintained that Trump’s ultimate largest target is Chinese trade practices. “That doesn’t affect our business much,” he said.

“Right now, the choice for us is where are our customers, and where do they build cars?” Sandberg said. “That’s where we’re going to go regardless of what the administration does and what the tariffs are like. If customers decide they can’t do business in the US anymore and move out, we’ll have to move our production. That’s the part that President Trump needs to understand.”

Read more: TrumpTrade: How Trump’s Trade Policies Divide CEOs

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.