Ever since the economy began to bounce back, with unemployment at an all-time low, the familiar refrain from pundits has been that growth, particularly of the higher wage variety, would head to the tech-oriented elite cities along the coasts. Yet, today, despite the headlines about Amazon’s expansions in New York and Washington, D.C., the real story is the aggressive growth taking place on a changing stage, both in terms of geography and changing labor demands.

Ever since the economy began to bounce back, with unemployment at an all-time low, the familiar refrain from pundits has been that growth, particularly of the higher wage variety, would head to the tech-oriented elite cities along the coasts. Yet, today, despite the headlines about Amazon’s expansions in New York and Washington, D.C., the real story is the aggressive growth taking place on a changing stage, both in terms of geography and changing labor demands.

While tech is still among the fastest-growing job categories, up 29 percent since 2010, that’s not where the biggest shortfalls are now. Instead, jobs in food preparation, personal service, production and construction have the highest job-opening rates. In skilled blue-collar fields, there’s also the issue of a substantially older workforce—average age 45—than the general level.

An exclusive analysis of job trends for Chief Executive finds serious changes in the locale of economic growth. Although the Silicon Valley, and, to a lesser extent, its urban annex of San Francisco, continues to create higher-wage jobs, the momentum there has shifted primarily to lower-cost, less-heavily-regulated economies. Similarly, some of the “super-star cities,” such as New York, Los Angeles, Chicago and Boston, are seeing only modest job growth, often at or below the national average.

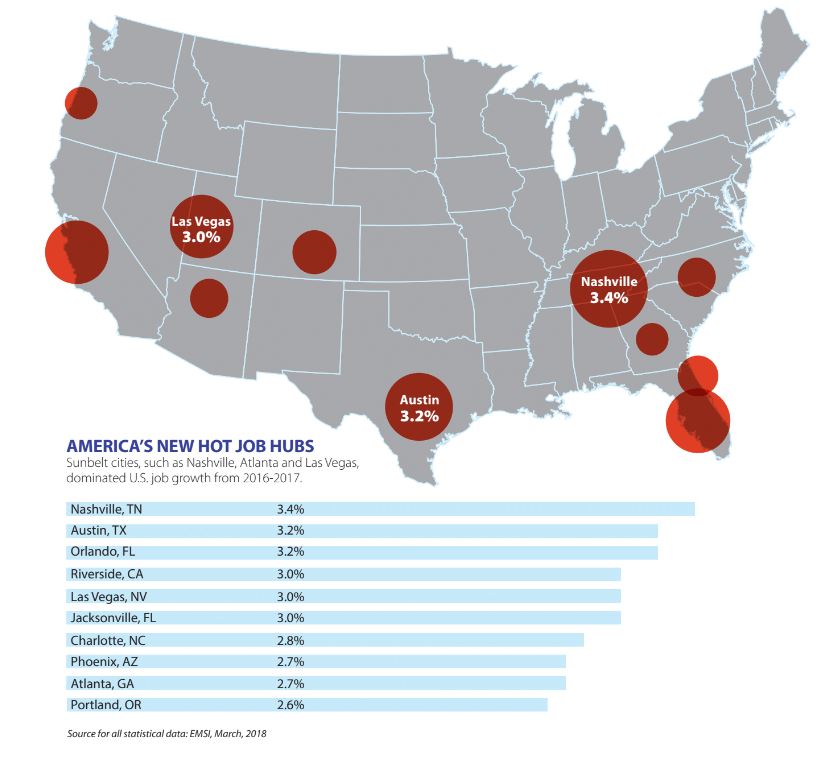

This can be seen most clearly by comparing job growth over the past seven years to growth over the last year. Metropolitan job growth from 2010 to 2017 looks like a hip, high-tech central casting. Top five metros include Austin, San Jose-Sunnyvale and San Francisco. Last year’s numbers, however, show a distinct trend towards Sun Belt cities, which accounted for all eight top-growing economies, including Nashville, Las Vegas, Jacksonville, Atlanta, Phoenix and Riverside-San Bernardino, an exurb east of Los Angeles.

The Bay Area metro area job picture remains robust, growing well above the national average, yet no longer outperforming all comers in tech growth. San Jose-Sunnyvale ranked second, with 25 percent growth since 2010, but last year notched a respectable, but not overwhelming 15th, with San Francisco right behind at 16th. This reflects an ongoing shift of work in technology and business services to other markets.

We looked at the growth in computer and math-related jobs. Since 2010, the field, which includes 4.6 million workers, has been led by the Bay Area, which took two of the three fastest expansions of this critical sector. Last year, the San Jose area still ranked No. 2, but San Francisco, third since 2010, fell below 25 and slightly below the national average. The big gainers were first place Orlando, which added 7.3 percent to its employment in this field. Other rising Sun Belt upstarts include Las Vegas and Atlanta. Perhaps more surprising, places like Cleveland and Kansas City are growing up to twice the national average in this critical field and far more than self-described “tech hubs” Washington, Los Angeles, Boston and San Diego, all of which are producing new tech jobs at or below the national average.

Much of the geographic widening of tech work is made possible by the growth of high-tech business services, which tends to be more integrated with the economy and works often with non-high-tech sectors. The professional, scientific and technical services sector employs 1.7 million (36 percent) of computer and math workers, compared to just under 600,000 employed by the more celebrated software and Internet industries. More importantly, business services sectors generated 2.5 times more jobs for computer and mathematics workers than IT sector businesses since 2010.

Much of the geographic widening of tech work is made possible by the growth of high-tech business services, which tends to be more integrated with the economy and works often with non-high-tech sectors. The professional, scientific and technical services sector employs 1.7 million (36 percent) of computer and math workers, compared to just under 600,000 employed by the more celebrated software and Internet industries. More importantly, business services sectors generated 2.5 times more jobs for computer and mathematics workers than IT sector businesses since 2010.

The big issue behind this change may be costs, notably housing, as is widely admitted by tech industry leaders. Once wages are normalized, Bay Area workers’ relative salary plummets. Overall, the average salary in San Jose turns out to be less, in real terms, than places like Minneapolis, Washington D.C., Raleigh, Kansas City or Austin. Migration patterns from the Bay Area have changed radically over the past five years, with more people leaving than coming. Nearly half of millennials and more than half of all current residents say they are considering a move out.

Employing more than 10 million workers, the biggest sector of high-wage jobs—paying $87,000 on average—comes from the business services sector. The dynamics here differ from what is traditionally considered high-tech in that this is a field that may not be as amenable to the urban phenomena of single, young people sharing small, overpriced apartments. Along with its 1.7 million IT workers, the professional and technical services sector employs more than 900,000 in management occupations.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.