There’s no question that companies need to get a better handle on data—how to get it, how to mine it and how to use it to make better decisions internally, engage employees, excite investors and offer innovative, customized solutions to clients. “But that is not sufficient unless each one of your stakeholders actually trusts the data you’re providing and what you’re doing with it,” says IBM Managing Partner Jesus Mantas.

There’s no question that companies need to get a better handle on data—how to get it, how to mine it and how to use it to make better decisions internally, engage employees, excite investors and offer innovative, customized solutions to clients. “But that is not sufficient unless each one of your stakeholders actually trusts the data you’re providing and what you’re doing with it,” says IBM Managing Partner Jesus Mantas.

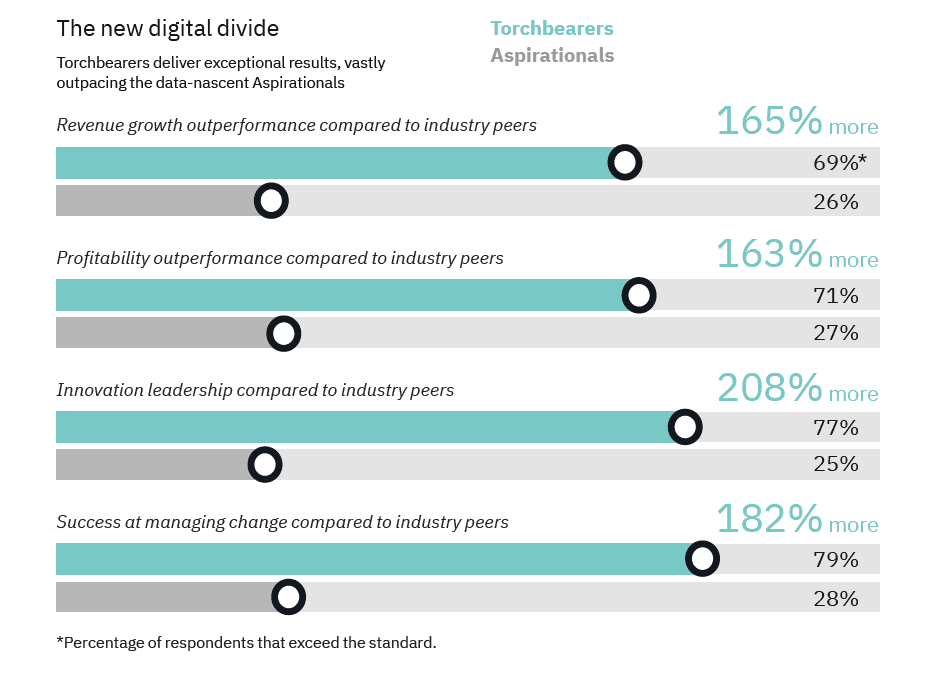

Mantas is one of the coauthors of a new study, conducted by IBM Institute for Business Value (IBV) in cooperation with Oxford Economics; the study found trust to be at the heart of what divides the leaders, or “Torchbearer” companies, which make up just 9% of the companies, and the laggards, or “Aspirationals.” Mantas’s team collected data from more than 13,000 C-suite executives who oversee leading brands across 98 countries and 20 industries and found big differences between the two categories:

• Torchbearers have identified customer trust as their defining issue: 82% say they have turned to data to strengthen the trust they earn from customers, compared with 43% of Aspirationals;

• Torchbearers have created a culture of “data-believers”: 78% say their C-suite executives rely heavily on data for quality and speed of decisions, compared with just 34% of Aspirationals;

• Torchbearer C-suites trust their data: 69% say the C-suite “has extensive access to accurate and actionable 360-degree customer data” vs. just 22% of Aspirationals.

• Torchbearers are using that data more often to develop new business models (70% vs. 33%) and to enter new markets (66% vs. 31%), and are planning significant investments in AI or machine learning (72% vs. 40%).

Perhaps most importantly, the Torchbearers outperform their peers in revenue growth and profitability:

Mantas sat down with Chief Executive to discuss the findings and how CEOs can use them to move their companies from aspirational to torchbearer.

So the world is becoming more and more regulated. In Europe already, now you have regulation about what data you get to keep based on the transparency you provide your customers. Your customers now get to decide if all that data—whether you’re trying to collect or you already have it—can be used by you to help them. So the Torchbearers use their data with a specific purpose to increase trust on the part of their clients, through transparency or making it very clear how they’re using the data. As a result, those companies get to keep that data and use it and so, because of that customer trust, they get to outperform others. Conversely, organizations that don’t have that trust, even if they have collected the data, in a world that is becoming more regulated, if your clients don’t trust you, they may not let you keep the data. In our study, the difference between the Torchbearers and the Aspirational companies is almost double—91% more Torchbearers use data to strengthen customer trust.

Well, Europe is the more visible example because they have already created a now well-known regulation, [General Data Protection Regulation (GDPR)], but that is probably going to come to every country in the world in some shape or form. But even without the regulation, when you ask consumers, “Are you concerned with what companies are going to do with the data they collect?”—that level of concern has almost doubled in the last year. The same can be said of the use of algorithms. Some states and cities are now regulating whether you can or cannot use visual identification algorithms and for what purpose. I think CEOs in the U.S. know that most companies are global in nature anyway so most of the U.S. companies also operate in Europe.

I think the simplest way to describe it is to basically replace the natural habit of making decisions based on experience with a new learned habit of making decisions based on the data first and the experience second. What’s interesting is you see that behavior very well in the new generation of millennials. If you or I were asked, “what is the capital of France?” we’d say Paris because we’ve learned that. But if you ask a millennial, the first thing they’ll do is Google it to get the data. It’s a very simple habit, but you have to learn that in the corporate world, to first query the data and then impose opinion and experience. There are many ways to do that—it all comes back to what you do with the data and how you present it, and how do you modify workflows to make sure that data-based truth is presented before a decision is made. The GPS is actually the perfect example of a data-driven tool that, as consumers, we have accepted without any problem. So the C-suite needs to embed more GPS-like interfaces in every one of their processes.

The other thing that has to happen is a change in culture. That also correlates more with cultures that are more flat, where leadership moves more to the edges, because at the end of the day, you have to distribute the decisions to the places where all that data can be taken into account in a better way to make decisions. It’s interesting, because all of these different trends collide in the sense that organizations that are more agile tend to be more “data first.”

Most CEOs would tell you they do that by definition. It’s just the magnitude to which they do it and magnitude to which they implement transparency. So if you were to ask a CEO, “Do you make data-driven decisions?” they would say, “Of course.” But if you asked a different question—”is the data you make decisions with transparently shared across the entire company?”—very few have actually implemented that level of transparency. The problem with many C-suites is they do make decisions based on data, but that data is almost created for the purpose of that decision and it’s then not transparently shared. So it may represent an alternative reality.

Yes, all the way to your front-line people, whether it’s a budget, status of a project, stats of an order, NPS data, you want to make sure you have a foundational data platform, so whether you’re a person in front of the client or you’re the CEO, you’re looking at the same data.

The economics of that have changed a lot because of the cloud. One of the trends that really is democratizing the data is the hybrid cloud. You can have the data and algorithms programmed once and it can be run publicly, very inexpensively, or it can be run privately, secured, with permissions. Hybrid cloud makes that a lot more portable, so whether you’re a startup, a midsize, a large corporation, you can access these. Because of cloud, the economics of using data, using AI and being able to implement it in processes have massively changed.

The Torchbearers really have discipline around data ownership, it’s very clear. They manage that data like a resource, as they would any other resource. The good news is that technologies like blockchain, when you strip down the hype, blockchain is just a distributed database that can be permissioned. So even though you have transparency, that doesn’t mean everybody sees everything; you can have transparency but permissioned differently for every person, so you can basically have your cake and eat it, too. Everyone sharing the data knows that no other party can manipulate it so there is trust there.

I think we’re going to see in the next two years an evolution on that. We’re going to see data that, in the past, companies were reluctant to share that they will now start sharing because the transparency will give them more benefit than not sharing. Like pricing data—that’s something that almost every company would say is pretty confidential—or employee compensation data. You can see platforms springing up, like Glassdoor intermediaries aggregating the data and sharing it. So some companies are saying, let’s remove the intermediary and just be more transparent. The interesting thing is, if you’re a really great employer, then it’s to your advantage to share it. If you’re a really bad employer, it’s not to your advantage. So I think we’re moving to a world where, if you don’t share the data, then maybe you’re not that good at it.

There’s actually an interesting dilemma between companies and consumers—as consumers, we are all demanding better protection and privacy of our data but at the same time, we’re all demanding more information from companies. when you look at the torchbearers, they seem to be managing that balance better.

My expectation is that over the next two years, the role of brands as the proxy of trust is going to shift to the data you share. the more you share, the more you’ll be trusted.

Chief Executive Group exists to improve the performance of U.S. CEOs, senior executives and public-company directors, helping you grow your companies, build your communities and strengthen society. Learn more at chiefexecutivegroup.com.

0

1:00 - 5:00 pm

Over 70% of Executives Surveyed Agree: Many Strategic Planning Efforts Lack Systematic Approach Tips for Enhancing Your Strategic Planning Process

Executives expressed frustration with their current strategic planning process. Issues include:

Steve Rutan and Denise Harrison have put together an afternoon workshop that will provide the tools you need to address these concerns. They have worked with hundreds of executives to develop a systematic approach that will enable your team to make better decisions during strategic planning. Steve and Denise will walk you through exercises for prioritizing your lists and steps that will reset and reinvigorate your process. This will be a hands-on workshop that will enable you to think about your business as you use the tools that are being presented. If you are ready for a Strategic Planning tune-up, select this workshop in your registration form. The additional fee of $695 will be added to your total.

2:00 - 5:00 pm

Female leaders face the same issues all leaders do, but they often face additional challenges too. In this peer session, we will facilitate a discussion of best practices and how to overcome common barriers to help women leaders be more effective within and outside their organizations.

Limited space available.

10:30 - 5:00 pm

General’s Retreat at Hermitage Golf Course

Sponsored by UBS

General’s Retreat, built in 1986 with architect Gary Roger Baird, has been voted the “Best Golf Course in Nashville” and is a “must play” when visiting the Nashville, Tennessee area. With the beautiful setting along the Cumberland River, golfers of all capabilities will thoroughly enjoy the golf, scenery and hospitality.

The golf outing fee includes transportation to and from the hotel, greens/cart fees, use of practice facilities, and boxed lunch. The bus will leave the hotel at 10:30 am for a noon shotgun start and return to the hotel after the cocktail reception following the completion of the round.