After months of promising that once deals were in place there would be more certainty about the economy, clearing the path for businesses to move forward, it turns out that things aren’t so clear after all. The tariffs going into effect on August 7 did little to calm markets—or CEOs.

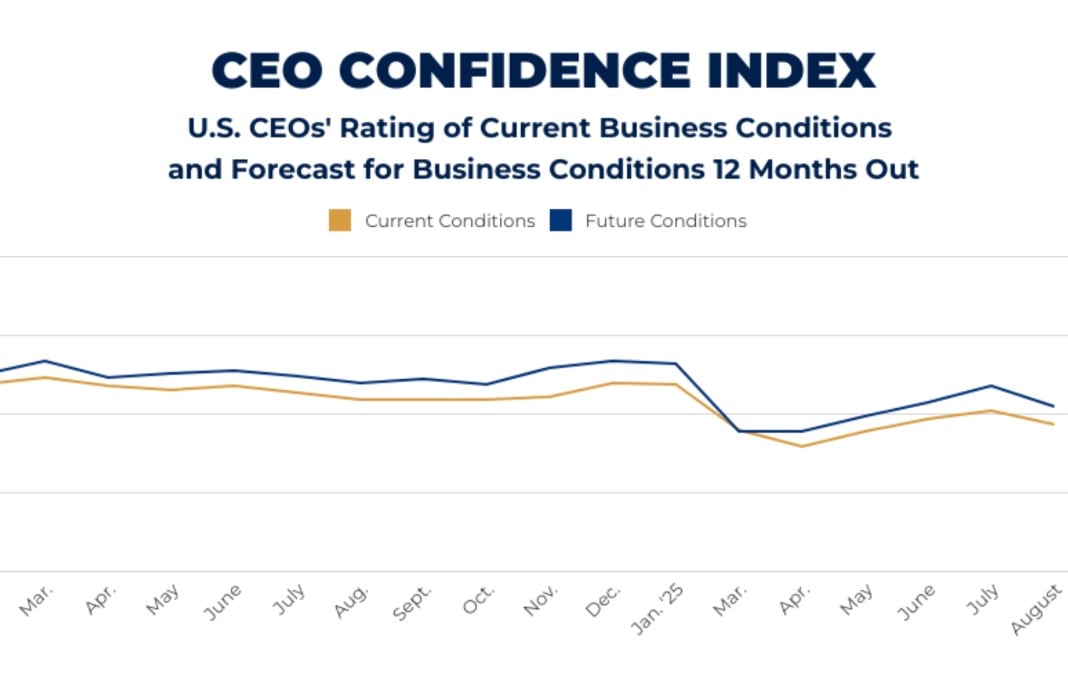

That’s at least according to our latest reading of CEO confidence, conducted among 359 U.S. CEOs August 5-6. We find CEOs downgrading their view of both current business conditions (to 5.2 out of 10 from 5.6 in July, measured on a scale where 1 is Poor and 10 is Excellent) and business conditions will look like 12 months from now (5.7 out of 10 by this time in 2026—nearly 10 percent lower than the 6.3 forecast they shared in July.)

The proportion of CEOs forecasting improvements in the business environment over the next 12 months declined to 49 percent in August, from 58 percent in July, while those expecting conditions to deteriorate increased from 19 percent to 27 percent—the worst we’ve seen since May.

Nearly half of all CEOs polled cited tariffs as a reason for their weakening outlook. “Uncertainty surrounding domestic policy and tariff frameworks has undermined organizational confidence, causing investment activity to stall across sectors,” said one CEO echoing many others.

“Not knowing future costs for raw materials is challenging,” agreed the CEO of a PE-backed medical device manufacturer. “Combined with customer management of pricing expectations that are also uncertain… Major disconnect with the business community.”

Anger is growing, too. As one CEO put it: “The current administration is conducting an economic goat rodeo, and we have somehow managed to derail what appeared to be the fabled soft landing in favor of chaos.”

Recession worries grew in August as well: 30 percent forecast a recession or slowdown, up from 22 percent in July and 48 percent of CEOs now forecast economic growth by 2026, down from 51 percent in July.

But while the numbers suggest a pullback in CEO confidence, there remain 48 percent who expect growth by 2026—and 49 percent who anticipate conditions for business will continue to improve over the next 12 months.

“I believe the conclusion of trade agreement negotiations should create a boom in investment, spending and business confidence,” said one CEO who forecasts business conditions one year out will reach 9 out of 10 (or “Excellent” on our 10-point scale). “Capital is waiting to be invested at both the consumer and institutional levels.”

“Inflation has slowed, interest rates should begin to fall, and the consumer is still spending,” added another CEO.

“Assuming interest rates go down where they should be, we will be entering a new Golden Age of America,” said the CEO of a talent consultancy.

The Year Ahead

Several of the CEOs polled—and particularly those with upbeat forecasts—cite healthy pipelines and order logs, alongside headways in AI adoption and thus, efficiency gains, as reasons for their positive outlook. This is perhaps why, when looking at how the current business and economic environments are expected to impact individual companies, CEO forecasts remain relatively upbeat: 64 percent anticipate revenue to grow in 2025 vs. 66 percent in July, and 53 percent expect profits to increase, vs. 55 percent in July.

Data also shows companies may be starting to deploy more capital: 37 percent plan to increase capex over the coming months, vs. 33 percent in July, and 43 percent plan to add to their workforce, vs. 42 percent in July.

Of course, those numbers remain well off where they were in January. For instance, 84 percent of CEOs at the start of the year had projected increasing revenues in 2025, and 76 percent also expected higher profitability this year. A silver lining may be that operational expenditures, while high, appear to be slowing: 68 percent of CEOs surveyed forecast growing opex in the coming year, down from 71 percent in July and from a high of 81 percent in April.

About the CEO Confidence Index

Since 2002, Chief Executive Group has been polling hundreds of U.S. CEOs at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. See additional information about the Index and prior months data.