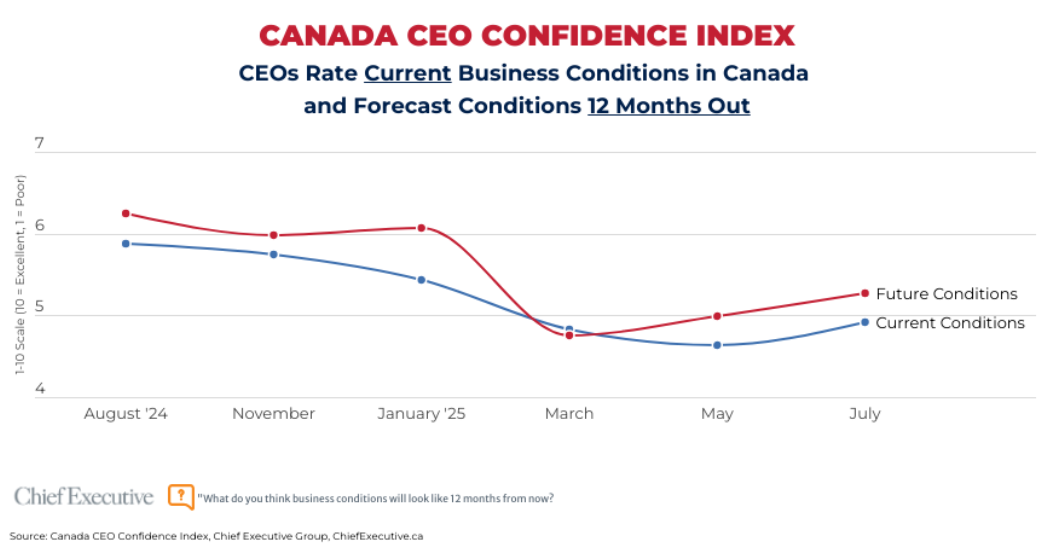

Chief Executive’s July reading of CEO confidence, taken on July 15–16 among 152 CEOs and business leaders across the country, finds improving sentiment toward the business environment, rating current conditions 4.9 out of 10, on a scale where 1 is Poor and 10 is Excellent.

That is far from a robust rating, and it remains well below where it started the year (at 5.4), but it nonetheless represents an improvement of 6 percent since our Q2 reading in May (4.6).

CEOs also forecast this improvement to continue over the coming months. Overall, 43 percent of those polled expect the business landscape to improve to a rating of 5.3 by this time next year—an increase of 7 percent from what they rate conditions today and 8 percent better than what they had anticipated in May.

Driving the improvement is the idea that there should soon be more clarity on the Canada-U.S. trade agreement, though many remain doubtful the outcome will be mutually beneficial. Only 11 percent of the CEOs polled say they anticipate a mutually beneficial deal with the U.S. will be reached before the end of the year. Instead, 54 percent expect a partial resolution that will be specific to the most critical or harshly impacted sectors in Canada.

“I believe the U.S. will hold us ransom to their needs and not our needs, and the current Canadian government will cave,” said Rod Malloy, CEO of Canadian IPG Corporation in Ontario.

He’s not alone in expecting a less-than-optimal outcome for Canadian businesses. Many of those participating in the survey said they believe the deal—if a deal is reached—is likely to benefit certain sectors over others. Others hinted at the unpredictability of the current U.S. administration to explain why they believe that even if a deal is reached, it will be difficult for Canadian businesses to move forward with confidence.

“An agreement will be struck, and then within a couple of months, the U.S. will decide to change things and reimpose different tariffs and find different excuses,” said one CEO echoing others on the level of uncertainty they are facing.

CEOs also seem divided as to whether Canada’s economic discussions with other nations will succeed in providing new markets to those impacted by the situation with the U.S.: 48 percent said strengthening partnerships with other allies will help, to various degrees, counter the impact of the U.S. tariffs, but 40 percent say it will make no difference for their company or sector.

“The UK is not a country to substitute for the U.S.” said one CEO. Added another: “EU rules are far more onerous than any tariffs. So Canadian companies won’t succeed in large part. Pretending the EU can replace the U.S. is delusional.”

All of this uncertainty has CEOs doubling down on the importance for Canada to remove internal barriers to commerce. A full third of the CEOs polled say doing so is, in fact, more important than achieving any outside agreement, even with the U.S., with nearly half (47 percent) pointing to the overall cost of doing business in Canada as their biggest challenge today. “We need Government to get out of our way,” said one CEO.

“There is far too much bureaucracy and red tape that holds business back, and taxes are punitive,” added Mike Chisholm, CEO of Chisholm Consulting Group, a Vancouver-based consultancy that helps leadership teams with their growth strategies. “Small business struggles to break even in most cases, and the government seems to think the best way to raise revenue is to tax business more.”

Peter Baran, founder of Blueneck Consulting, says the government is simply not focusing on the things that can truly make an impact for businesses: “Rather than the government strengthening the social safety net for unemployment and continuing the difficulty and slowness of the regulatory process, they should create strong incentives for skills acquisition, mobility, job retention and regulatory efficiency (speed and ease of approvals rather regulatory removal that could reduce safety and environment concerns).”

Toronto-based Awerix CPA’s Sangeeta Kashyap says if Canada wants to reduce its reliance on U.S. goods, it needs to get serious about removing interprovincial trade barriers. “We also need to start giving grants incentives to exporters and innovators, so we have more tech companies in Canada. We need to bring in skilled tech force, which is crucial for IT companies to set up their offices here,” she added.

THE YEAR AHEAD

When asked to forecast how all of this is impacting their respective companies, our data finds an increase in optimism compared to earlier in the year, when the U.S. announced its tariffs demand.

“Canadians have a way of adapting to everything, whether it is natural disasters, change in government, tariffs, higher prices, we always just plod along. We are the fulfilment of persistence is 90 percent of success,” said one CEO.

Overall:

- 60 percent of CEOs expect revenue to increase in 2025, compared to 2024. That proportion is up significantly since May (49 percent) and nearing January levels (67 percent).

- Perhaps a better barometer is the fact that 30 percent forecast declining revenues this year, relative to 2024—down from 42 percent when polled in March.

- Similarly, 49 percent forecast increasing profitability this year, vs. 37 percent in May and 58 percent in January.

- 36 percent forecast declining profits in 2025, compared to 46 percent who had expected profits to fall y/y back in March.

Despite their improving forecasts for 2025, CEOs remain cautious with their investments:

- 33 percent plan to increase capital expenditures this year—slightly up from May (27 percent) but still far from the 51 percent who intended to raise capex back in January. At this time, 26 percent said they are instead pulling back on capex.

- Hiring plans point to a similar trend: 39 percent plan to increase their workforce by year end, vs. 35 percent in May and 43 percent in January. Fewer than a quarter (22 percent) plan to cut jobs before the year ends, up from 13 percent who had planned to do so back in January.

Interestingly, we do not find much variance in forecasts between businesses with no exposure outside of Canada and those who also operate in the U.S. In fact, Canada-only businesses appear less optimistic in their ability to grow this year, compared to their peers who also have exposure to the U.S. This perhaps has to do with the size of the company or the sector in which they operate.

About Chief Executive Group’s Canada CEO Confidence Index

Chief Executive Group polls hundreds of C-Suite and board members throughout the year to build our CxO Confidence Index series. The Index provides insightful data into business trends and what will likely shape strategies for the year ahead. In August 2024, we expanded the series to Canada. Our July (Q3) 2025 edition of the Canada CEO survey received 152 responses.