With President Trump’s trade deadline approaching and “Big Beautiful Bill” clearing Congress on Friday, CEOs are breathing a sigh of relief, perhaps not about the details, but the hope that they can finally get back to business.

Chief Executive’s latest CEO Confidence Index, conducted July 1-2 among 216 U.S. CEOs across sectors and companies of all sizes, finds America’s business chiefs increasingly optimistic that the turmoil experienced in March and April is finally behind us and that they will now have more clarity to move forward.

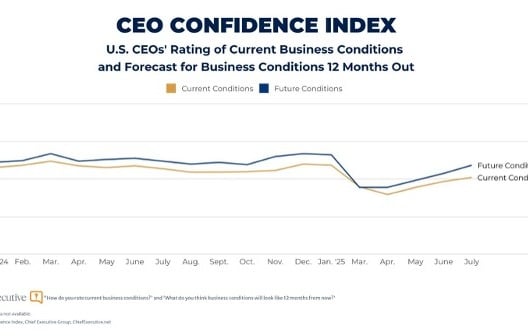

When asked to rate current conditions on a 1-10 scale, where 1 is Poor and 10 is Excellent, CEOs graded the current U.S. business environment a 5.6, up 4 percent from June (5.3/10). This is the third consecutive month-over-month increase in their rating of business conditions since the 30 percent tariffs-driven drop in March and April. The Index has yet to return to January levels but is now 12 percent off its 2025 high.

CEOs are also optimistic that business conditions will continue to improve in the year ahead, forecasting a 13 percent improvement by this time next year, to 6.3 out of 10 on that same 10-point scale. This is a gain of 8 percent since June (5.8/10) and the fourth consecutive increase since the 28-percent abrupt drop in March. This indicator is now 9 percent shy of where it was in January (6.9/10).

CEOs attribute their optimism to robust economic indicators and sustained consumer demand amid all the volatility and disruption.

“I believe that the tariff disagreements will pass, and we will enter a general growth period,” said one CEO participating in the poll, joining 58 percent of CEOs who forecast improving conditions in the year ahead. This is the highest proportion of optimistic CEOs since November 2024, when the presidential election results fueled optimism for growth.

Only 19 percent of CEOs anticipate an economic downturn in the year ahead, the lowest level since the first quarter of 2021.

“The economy will get past the tariff issues and significantly pick up,” echoed Triad B2B Agency’s Tom Prikryl, who anticipates business conditions to reach 8 out of 10 by this time next year. “I believe we are in for an amazing time of growth and prosperity.”

“Small business depends on big business, and I see a lot of big business investment coming to America,” said Vance Patterson at industrial manufacturer Patterson Fan Company in South Carolina, adding the “improved trading parameters will strengthen manufacturing in the U.S.”

Of course, not every CEO shares this sunny outlook—though that minority is getting smaller every month. Among those who are not as optimistic about business conditions over the coming months, many say they are concerned the U.S. hasn’t yet felt the full effect of the tariffs and that there will likely be more backlash as developments take hold.

“Input cost pressures are squeezing our margins severely. We are pushing through price increases to partially account for our increased costs. This has caused some of our products to be sourced offshore by our customers,” said Tim Zimmerman, CEO of Mitchell Metal Products. “It is a difficult market for first and second tier suppliers to domestic, Canadian and Mexican OEMs.”

There are also certain sectors where CEOs are more concerned over the effects of the current federal budget and policies. Healthcare CEOs, in particular, are not as optimistic about the short term.

“Hospitals will be further weakened by Medicaid cuts, coupled with continuance of exorbitant costs of pharmaceuticals, supplies, equipment and high labor costs,” said Peggy L. Abbott, CEO/President of Ouachita County Medical Center. “As inflation continues, people triage the payment for household expenses and hospitals are often at the bottom of their lists.”

TriRx Chair and CEO Tim Tyson shared a similar outlook: “I am very concerned about the current administration’s focus on tariffs and attitude towards Russia and China and the impact on pricing and the global supply chain,” he said, forecasting a slight deterioration in business conditions in the near term but an overall flat economy.

Overall, 51 percent of CEOs now forecast a growing economy for the second half of the year—a sharp turnaround from Q1, when 62 percent expected a recession in the U.S. Today, fewer than a quarter continue to forecast a recession by year end.

The Year Ahead

Despite the optimism, when asked how these factors will impact their respective companies, CEOs’ forecasts have remained relatively unchanged since June:

- 66 percent anticipate revenue to grow in 2025, vs. 67 percent in June and 84 percent at the start of the year

- 55 percent expect profits to increase vs. 54 percent in June, 76 percent in January

- 33 percent plan to increase capex vs. 36 percent in June, 56 percent in January

- 42 percent plan to hire vs. 41 percent in June, 60 percent in January

About the CEO Confidence Index

Since 2002, Chief Executive Group has been polling hundreds of U.S. CEOs at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. See additional information about the Index and prior months data.