It’s been a whirlwind, to say the least. From a global pandemic to record-high inflation to conflicts breaking out around the world, the past few years have been marked by turbulence, uncertainty and volatility. But our latest survey of America’s CEOs shows business leaders believe they may now have a chance to breathe—at least a little.

Regardless of political preference, Chief Executive’s November CEO Confidence Index shows the overall sentiment for business has turned positive since the presidential election, as CEOs say that no matter who is in the White House in January, the mere fact of being past the uncertainty and friction of this presidential election cycle is enough to propel businesses forward.

Two-thirds of the 206 CEOs polled November 6-9 say they now expect business conditions to improve in 2025, up 21 percentage points from 43 percent in October. That jump is the highest on record since the Covid-19 vaccine was announced, giving hope that life—and commerce—would soon return to normal.

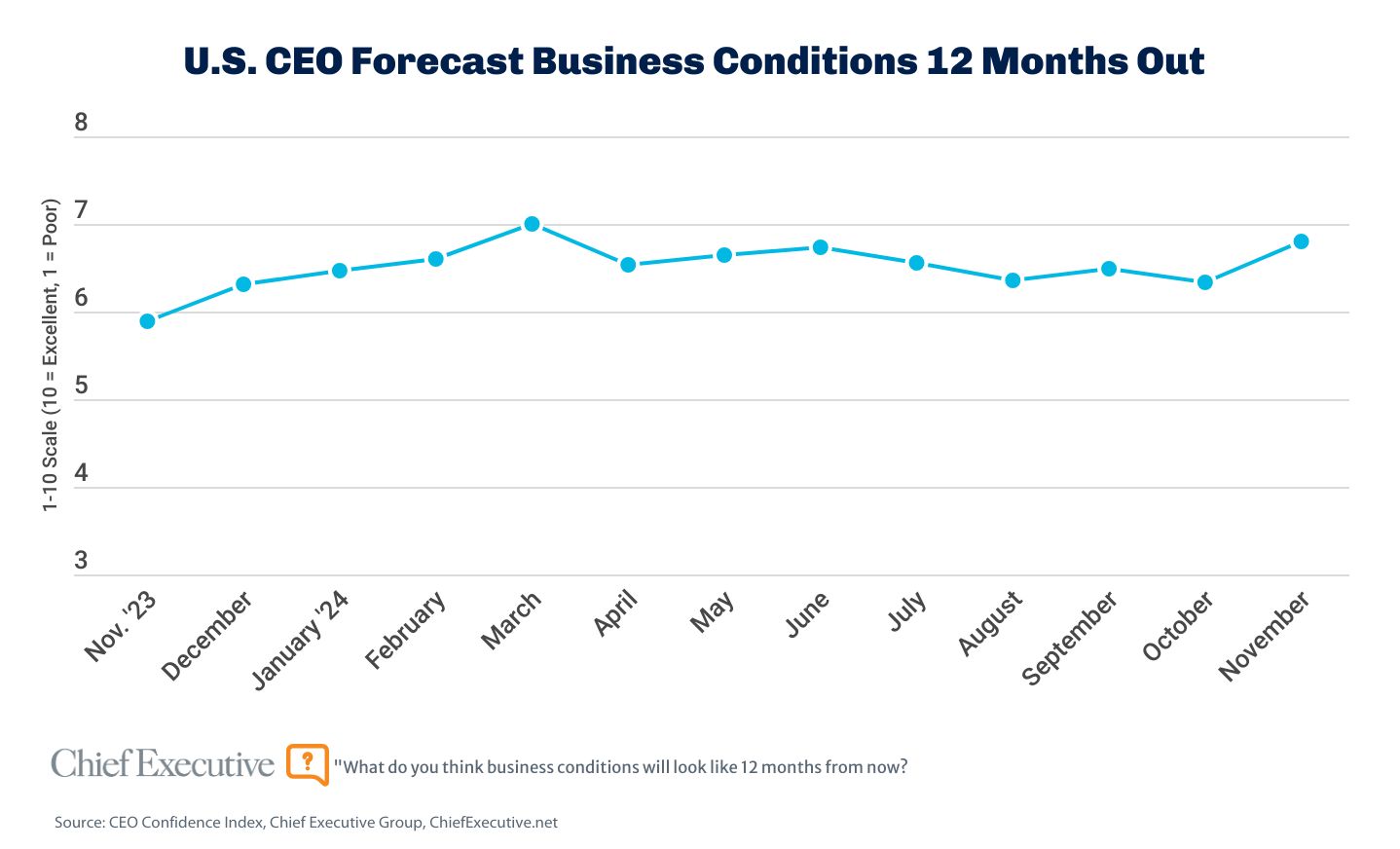

CEOs now forecast business conditions in the U.S. to reach 6.8 on a 10-point scale where 1 is Poor and 10 is Excellent. That’s a 7.7 percent improvement from what they forecasted just one month ago (6.3/10) and the second-highest forecast since January 2022—only eclipsed by the Fed’s rosy economic speech in March, which drove forecasts to a 7 out of 10.

But when asked about what’s driving this optimism, the answer is more nuanced. While 91 percent of the CEOs polled say the outcome of the presidential election influenced their forecast, to varying degrees, several say it’s not so much the party that won that matters to them, but rather the idea that the outcome has been determined and business leaders can now plan for what comes next.

“People’s sense of ‘now things are settled’ will allow more business-as-usual actions to be taken, rather than just wait,” said Go! Foton’s Simin Cai, one of the CEOs participating in the poll.

Of course, for many, there is hope that the newly elected administration’s pro-business policies will reduce both the fiscal and regulatory burden for U.S. businesses, thus clearing the path to stronger growth in the years ahead. More than three-quarters also say the effect of the incoming administration should help boost equity markets, though almost half of those say gains will be limited.

As can be expected (especially with this election cycle), not everyone agrees, and some CEOs voiced concern over the incoming administration’s proposed policies, particularly on tariffs.

“Tariffs and chaos are coming, and they will be bad for the economy and business,” said one of those CEOs.

“I expect him to drive the economy into the ground,” said another.

When asked more specifically which of the Trump administration’s policies would have the biggest implications for their business—good or bad—CEOs cited “corporate taxes,” “industry regulation,” “labor” and “trade” as the top answers.

Looking at forecasts by sector, all but the government/nonprofit space are showing increasing optimism compared to October, though the extent of those improvements varies significantly. Healthcare, travel/leisure and tech are posting the largest month-over-month gains in confidence for business in 2025, while construction, wholesale/distribution and professional services are showing a slower rise.

As one tech CEO participating in the poll put it: “We’ll have to see. Facta non verba.”

For now, CEOs rate current conditions at 6.0 on a 1-10 scale where 1 is Poor and 10 is Excellent, relatively unchanged since July. And a big part of that, they say, is the state of the economy, which they hope the Trump administration will prioritize in 2025, ahead of immigration, foreign relations, energy and, yes, even taxes.

THE YEAR AHEAD

The optimism recorded by our leading indicator in November also translates to individual company forecasts, with sizeable jumps across metrics.

Three-quarters of CEOs (74 percent) expect revenues to increase in 2025, vs. 69 percent who felt the same in October (+7 percent). That number is the highest it’s been since June, when it reached 76 percent—the highest level of the year.

Sixty-eight percent expect profits to climb over the next 12 months, up from 60 percent in October (+14 percent)—also the highest level recorded since June (71 percent).

Fifty-five percent plan to increase capital expenditures over the next 12 months, up from 37 percent last month (+46 percent). That is the highest level since March 2022—a testament to the renewed sense of clarity CEOs say they now have over the near term.

Finally, 59 percent plan to add to their headcount in 2025, up from 41 percent in October (+43 percent)—also the highest level since the spring of 2022.

About the CEO Confidence Index

The CEO Confidence Index is America’s largest monthly survey of chief executives. Each month, Chief Executive surveys CEOs across America, at organizations of all types and sizes, to compile our CEO Confidence Index data. The Index tracks confidence in current and future business environments, based on CEOs’ observations of various economic and business components. For additional information about the Index and prior months data, visit ChiefExecutive.net/category/CEO-Confidence-Index/